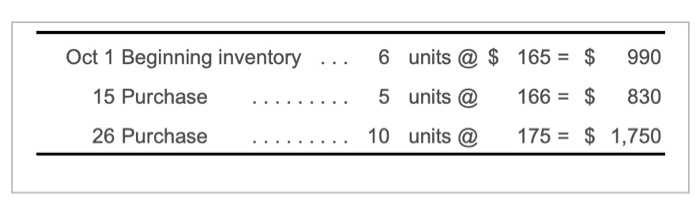

Question: Dave D a v e Company's inventory records for its retail division show the following at October O c t o b e r 31:

1. | Total OctoberOctober purchases in one summary entry. All purchases were on credit. |

2. | Total OctoberOctober sales and cost of goods sold in two summary entries. The selling price was $ 530$530 per unit, and all sales were on credit. Assume that DaveDave uses the FIFO inventory method. |

3. | Under FIFO, how much gross profit would DaveDave earn on for the month ending OctoberOctober 31? What is the FIFO cost of DaveDave Company's ending inventory? |

Oct 1 Beginning inventory 6 units @ $ 165 = $ 990 15 Purchase 5 units @ 166 = $ 830 26 Purchase 10 units @ 175 = $ 1,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts