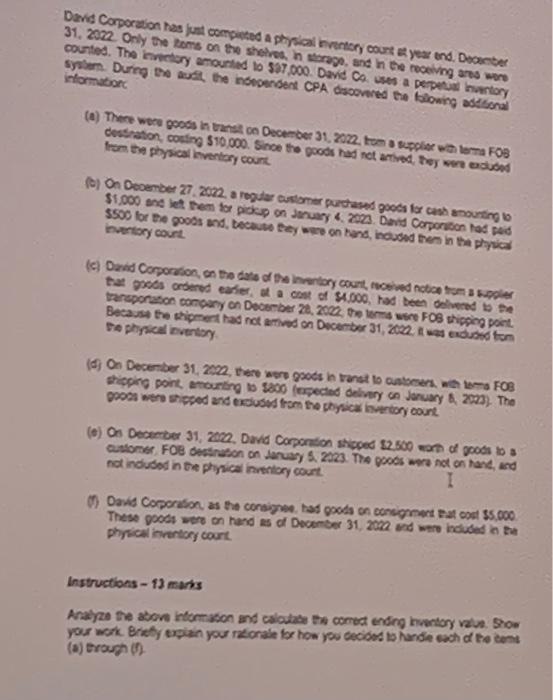

Question: David Corporation has just completed a physical inventory count st year end, December 31, 2022. Only the items on the shelves, in storage, and in

David Corporation has just competed a physical entory court a year end. December 31, 2022. Only the tems on the shelves in storage, and in the receiving area were counted. The intory amounted to $97.000. David Causes a perpen hertory system. During the suit the independent CPA discovered the following additional information (a) There were goots in an on December 31, 2022. to a supplies with loma FOS coration, couting $10.000. Since the goods had not atved, they would from the physical inventory court foy on December 27 2022. a regular customer purchased goods for cush mounting to $1,000 and let them for pickup on January 4, 2023. David Corporition had ped $500 for the goods and because tey wonten inguted them in the physica Inventory court c) David Corporation on the date of the inventory court, ved not om die that gets ordered easier, o act of $4.000 had been delivered to the transporation company on December 20, 2022. The term we FOS shipping point Because the shipment had notarived on December 31, 2022. It was add ton te physical overtory e On December 31, 2022, there were goods in varst to customerswe FOB srieping point amounting to $800 fpeclied delivery CA January 8, 2923). The roots senseped and ton to phyica avertory court (c) On December 31, 2022. David Corporation sliced $2.500 or oppos os customer FOB decination on January 52023. The goods were not on hand, and natinduded in the physical entory court I 1 David Corporation as the consigo had goods on consent that cost 35.000 These goods were on hand as of December 31, 2022 wd was included in the physical inventory court Instructions - 1) marts Anaryze the stone intematon and calculate the corned ending Inventory vauro yous work. Brety explain your rationalets how you cecio 15 hande och d to come (a) through

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts