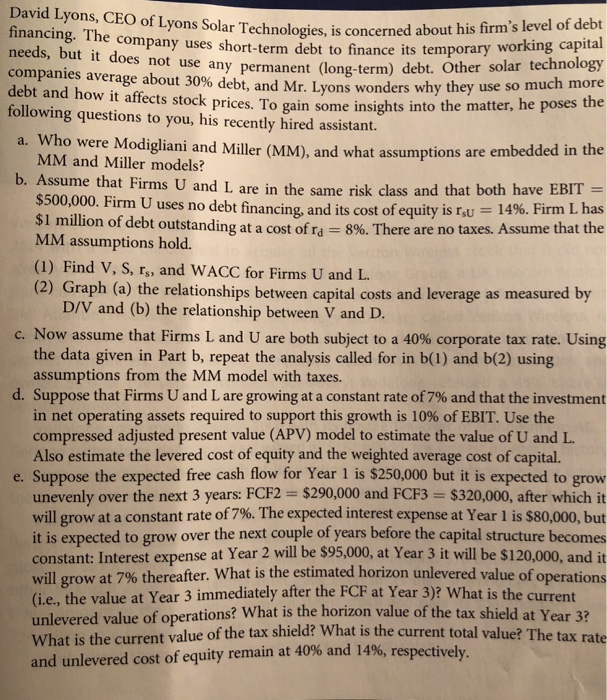

Question: David Lyons, CEO financing. The needs, but it does not use any permanent (long-term) debt. companies average about 30% debt, and Mr. Lyons wonders why

David Lyons, CEO financing. The needs, but it does not use any permanent (long-term) debt. companies average about 30% debt, and Mr. Lyons wonders why they use so debt and how it affects stock prices. To gain some insights into the ma following questions to you, his recently hired assistant. of Lyons Solar Technologies, is concerned about his firm's level of debt company uses short-term debt to finance its temporary working capital Other solar technology much more tter, he poses the Wh o were Modigliani and Miller (MM), and what assumptions are embedded in the MM and Miller models? Assume that Firms U and L are in the same risk class and that both have EBIT $500,000. Firm U uses no debt financing, and its cost of equity is rsU $1 million of debt outstanding at a cost of rd 8%. There are no taxes MM assumptions hold. b. -1496. Firm L has Assume t (1) Find V, S, r, and WACC for Firms U and L. (2) Graph (a) the relationships between capital costs and leverage as measured by D/V and (b) the relationship between V and D c. Now assume that Firms L and U are both subject to a 40% corporate tax rate. Using the data given in Part b, repeat the analysis called for in b(1) and b(2) using assumptions from the MM model with taxes d. Suppose that Firms U and L are growing at a constant rate of 7% and that the investment in net operating assets required to support this growth is 10% of EBIT. Use the compressed adjusted present value (APV) model to estimate the value of U and L Also estimate the levered cost of equity and the weighted average cost of capital e. Suppose the expected free cash flow for Year 1 is $250,000 but it is expected to grow unevenly over the next 3 years FCF2 = $290,000 and FCF3s $320,000, after which it will grow at a constant rate of 7%. The expected interest expense at Year 1 is $80,000, but it is expected to grow over the next couple of years before the capital structure becomes constant: Interest expense at Year 2 will be $95,000, at Year 3 it will be $120,000, and it will grow at 7% thereafter. What is the estimated horizon unlevered value of operations (ie, the value at Year 3 immediately after the FCF at Year 3)? What is the current nlevered value of operations? What is the horizon value of the tax shield at Year 32 What is the current value of the tax shield? What is the and unlevered cost of equity remain at 40% and 14%, respective! rent total value? The tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts