Question: David sold securities for a ( $ 7 5 , 0 0 0 ) short - term capital loss during the current

David sold securities for a $ shortterm capital loss during the current year, but he has no personal capital gains to recognize The D&M General Parnership, in which David has a capital, profits, and loss interest, reported a $ shortterm capital gain this year. In addition, the partnership earned $ of ordinary income David's only partner, Maria, agrees to divide the year's incame as follows.

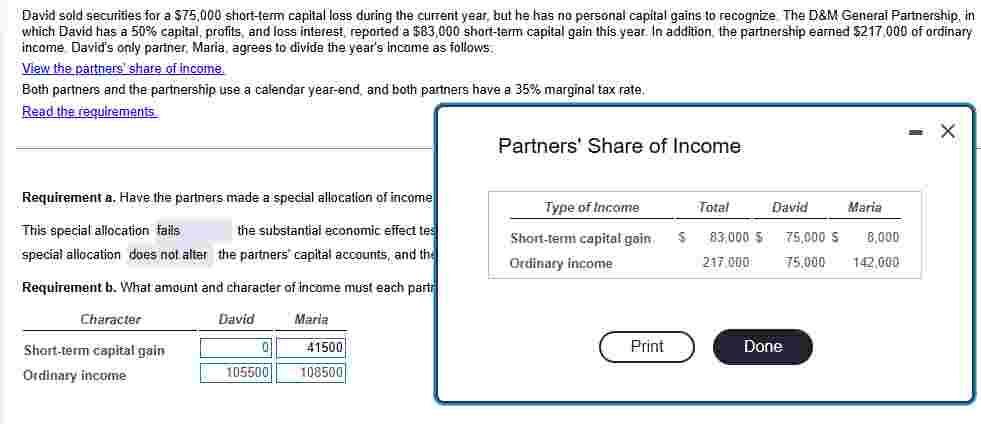

View the pattherg' share of income.

Both partners and the partnership use a calendar yearend, and both partners have a marginal tax rate.

Read the requirements

Requirement a Have the partiers made a spectal allocation of income

This special allocation falls the substantial economic effect tes special allocation does not alter the partners' eapital accounts, and the

Requirement b What amount and character of income must each partr

Partners' Share of Income David sold securities for a $ shortterm capital loss during the current year, but he has no personal capital gains to recognize. The D&M General Partnership, in which David has a capital, profits, and loss interest, reported a $ shortterm capital gain this year. In addition, the partnership earned $ of ordinary income. David's only partner, Maria, agrees to divide the year's income as follows:

Tiew the Dartners' share of income.

Both partners and the partnership use a calendar yearend, and both partners have a marginal tax rate.

Read the requirements.

Requirement a Have the partners made a special allocation of income that has substantial economic effect?

This special allocatiol the substantial economic effect test and be acceptable to the IRS. In particular, shifting because the special allocation does not alter the partners' capital accounts, and the special allocation the partners' total tax liability.

Requirement mathbfb What amount and character of income must each partner report on his or her tax return?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock