Question: Davids Nice Beans (DNB) was started by David Parker who developed a love of fine coffee while attending Purdue University. DNB processes and distributes luxury

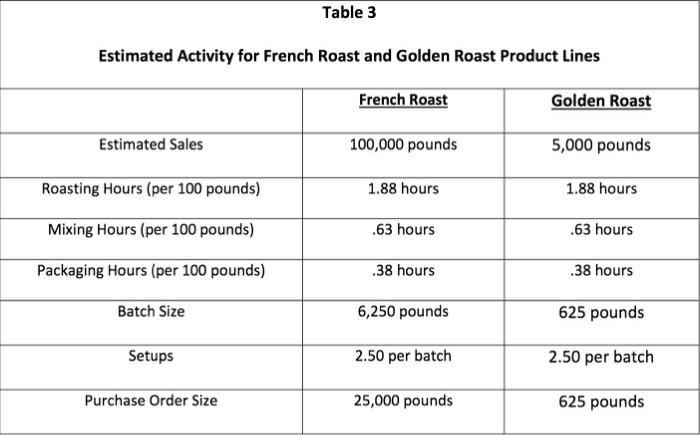

Davids Nice Beans (DNB) was started by David Parker who developed a love of fine coffee while attending Purdue University. DNB processes and distributes luxury coffee beans in a production facility in Chicago. DNB sources the finest beans globally and then roasts, mixes and packages them for resale to specialty coffee shops. When David initially established his operations, the manufacturing process relied heavily on labor. However, overtime, David has automated the production process so that he could expand his product lines. David thinks that his product lines appear to use different amounts of roasting and mixing processes. However, he is the first to admit that he focuses more time on developing unique blends and less time on understanding his costs. David competes in the very competitive market-place by creating distinctive luxury coffee blends. The coffee industry is dominated by large companies like Dunkin Donuts and Starbucks that sell a variety of beans. David knows that, as a smaller company, he must balance selling his popular blends in larger volumes with his more distinct blends in lower volumes. David uses a cost-plus pricing strategy with a 25% markup. However, his coffee shop customers are very price sensitive and David is sometimes forced to adjust his pricing to remain competitive. David is trying to create her master budget for the upcoming year, and he is worried. His French Roast bean is a popular bean that competes directly with dark beans of other competitors.

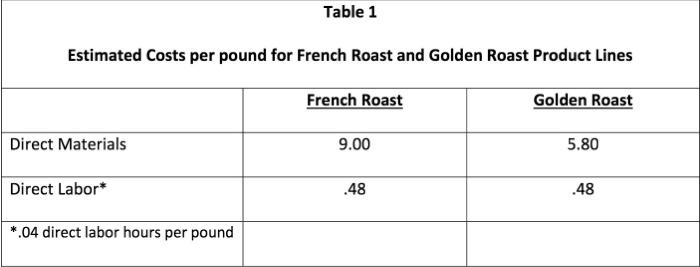

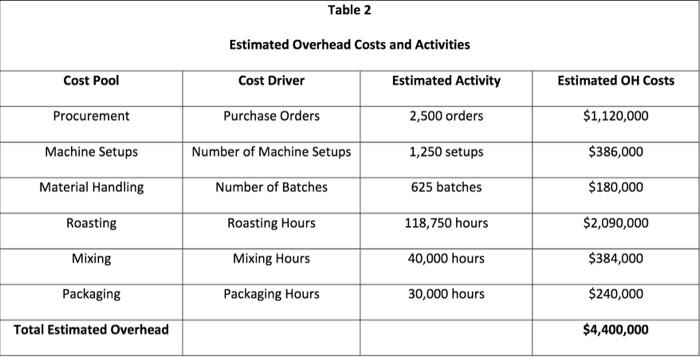

He has noticed that his competitors have been dropping their prices of these dark beans. The average market price of the dark beans is around $12.50 per pound, almost 4 percent less than her current price. David does not believe that he can afford to drop the price anymore on her French Roast bean and is now considering whether he should even keep this product line. His production facility is close to capacity. David is considering dropping the French Roast product line and using the capacity to produce his more unique blends like his Golden Roast which has little direct competition in the market. For the upcoming year, David estimates his overhead cost will be $4,400,000. Currently, David keeps things simple and allocates overhead to his product lines using direct labor hours. He expects direct labor costs to be $1,200,000 based on 100,000 direct labor hours. He also anticipates material costs made up mostly of coffee beans to be $10,000,000. David has reached out to you for your help. You both took managerial accounting together, but David did not focus on the material as well as you did. He is hoping that you can advise him on his business. You think that this is a great opportunity for you to put your managerial accounting skills to work in an advisory role. Knowing the power of managerial accounting data, you have asked David to put together some sales and cost data. David has provided you the data in Tables 1 - 3. David is anxious to meet with you to get your insight. In preparation for the meeting with David, you should prepare cogent answers to the following questions, draw relevant insights and provide any supporting exhibits and/or graphs that you believe will illuminate your analysis. You should use Excel for your analyses. In your advisory role, you need to prepare for your meeting with David by providing a professional analysis.

1. Describe the industry and the competitors which DNB is operating. Discuss DNB's strategy to compete in this market. (aim for a 1 page answer)

Table 1 Estimated Costs per pound for French Roast and Golden Roast Product Lines French Roast Golden Roast Direct Materials 9.00 5.80 Direct Labor* .48 .48 *.04 direct labor hours per pound Table 1 Estimated Costs per pound for French Roast and Golden Roast Product Lines French Roast Golden Roast Direct Materials 9.00 5.80 Direct Labor* .48 .48 *.04 direct labor hours per pound

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock