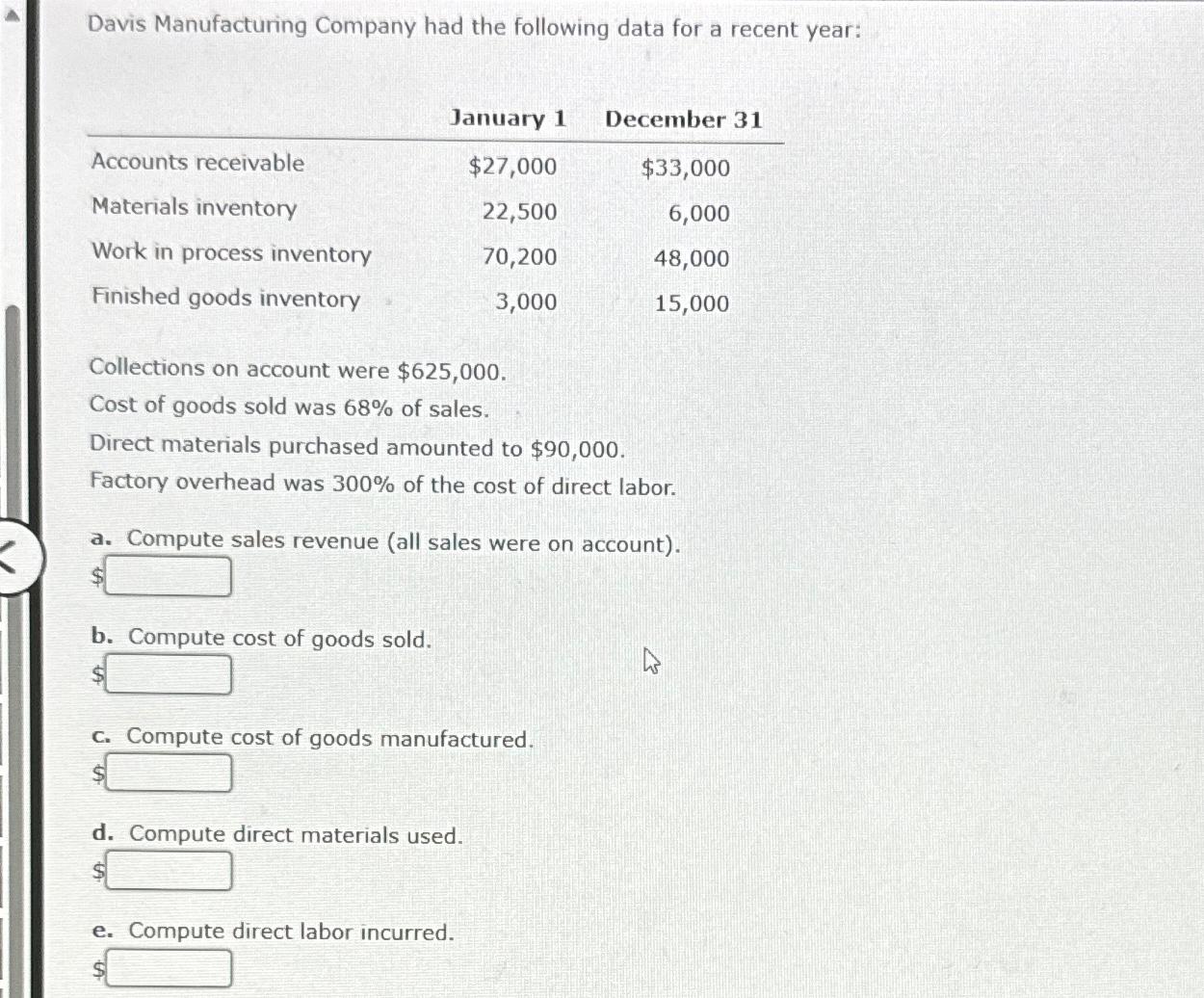

Davis Manufacturing Company had the following data for a recent year: January 1 December 31 Accounts...

Fantastic news! We've Found the answer you've been seeking!

Question:

Related Book For

Posted Date: