Question: DBF borrows 55.788 by issuing 10 year bonds. ECB's cost of debt is 5 41%, so it will need to pay interest each year for

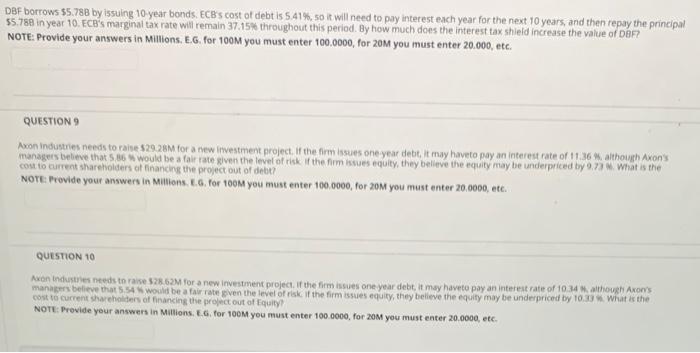

DBF borrows 55.788 by issuing 10 year bonds. ECB's cost of debt is 5 41%, so it will need to pay interest each year for the next 10 years, and then repay the principal $5.788 in year 10. ECB's marginal tax rate will remain 37.15% throughout this period. By how much does the interest tax shield increase the value of DF? NOTE: Provide your answers in Millions, E.G. for 100M you must enter 100.0000, for 20M you must enter 20.000, etc. QUESTION 9 Axon industries needs to raise 529 28M for a new investment project. If the firm issues one year debt, it may haveto pay an interest rate of 11.36% although Axon's managers believe that 5.86 would be a fait rate given the level of risk of the misses equity, they believe the equity may be underpriced by 9.77 What is the cost to current shareholders of financing the project out of debt? NOTE: Provide your answers in Millions. L. for 100M you must enter 100.0000, for 20M you must enter 20.0000, etc. QUESTION 10 Axon Industries needs to raise 528 62M for a new investment project. If the firm issues one year debt, it may haveto pay an interest rate of 1034 although Axony's managers believe that 54 would be a fair rate oven the level of risk if the firm issues equity, they believe the equity may be underpriced by 10.30 What the cost to current shareholders of financing the project out of Equity NOTE: Provide your answers in Millions EG for 100M you must enter 100.0000, for 20M you must enter 20.0000, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts