Question: DBG Company has just added a new division in to manufacture specially designed classroom desk to facilitate the use technological devices in schools. It

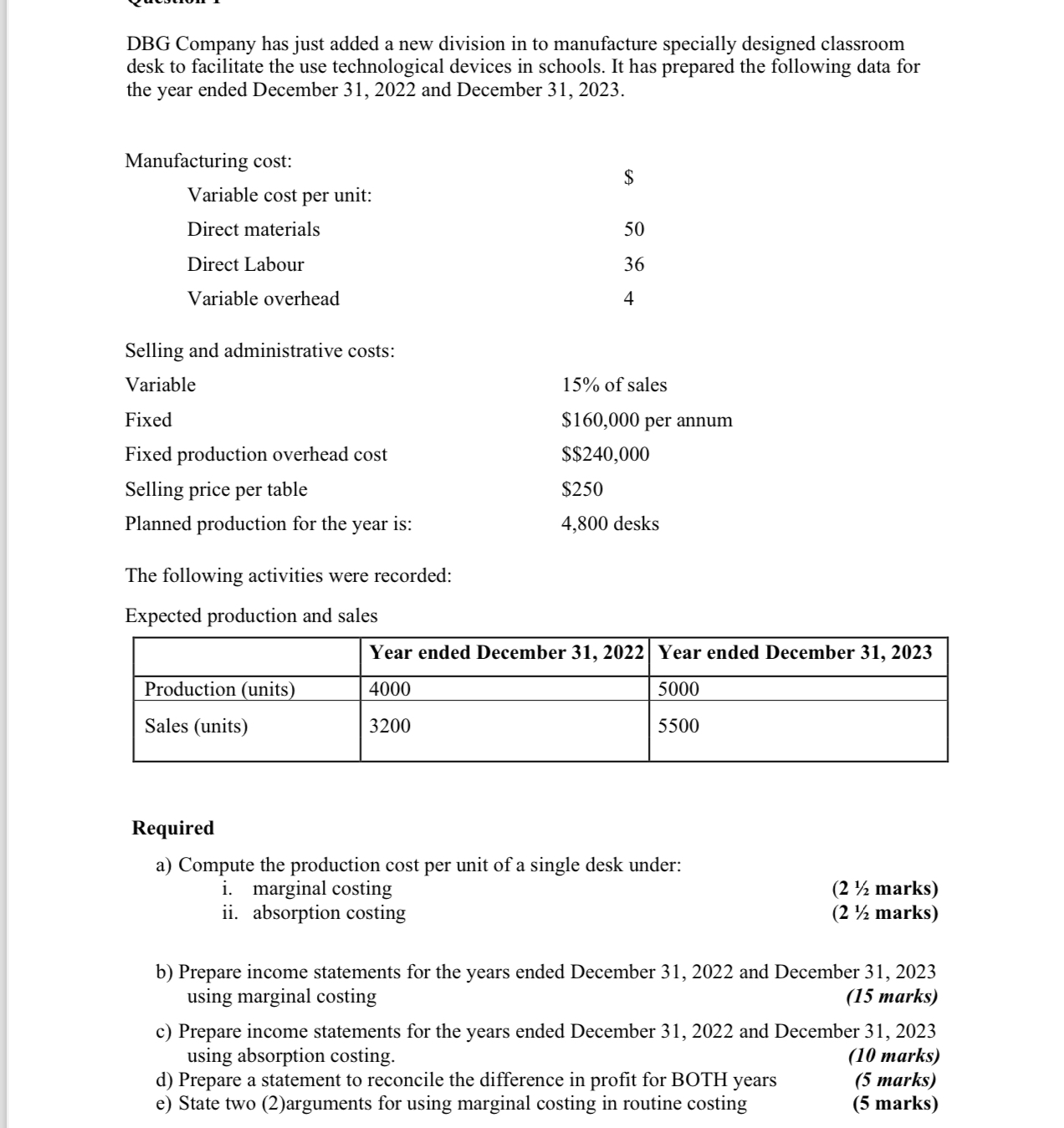

DBG Company has just added a new division in to manufacture specially designed classroom desk to facilitate the use technological devices in schools. It has prepared the following data for the year ended December 31, 2022 and December 31, 2023. Manufacturing cost: Variable cost per unit: Direct materials Direct Labour Variable overhead Selling and administrative costs: Variable Fixed Fixed production overhead cost Selling price per table Planned production for the year is: The following activities were recorded: Expected production and sales $ 50 36 4 15% of sales $160,000 per annum $$240,000 $250 4,800 desks Year ended December 31, 2022 Year ended December 31, 2023 Production (units) Sales (units) 4000 5000 3200 5500 Required a) Compute the production cost per unit of a single desk under: i. marginal costing ii. absorption costing (2 marks) (2 marks) b) Prepare income statements for the years ended December 31, 2022 and December 31, 2023 using marginal costing (15 marks) c) Prepare income statements for the years ended December 31, 2022 and December 31, 2023 using absorption costing. d) Prepare a statement to reconcile the difference in profit for BOTH years e) State two (2)arguments for using marginal costing in routine costing (10 marks) (5 marks) (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Understanding the Problem and Data Problem Calculate production cost per unit under marginal and absorption costing Prepare income statements for both years using both costing methods Reconcile the di... View full answer

Get step-by-step solutions from verified subject matter experts