Question: DC 12-5 Inventory Count Observation: Planning and Substantive Audit Procedures. Cindy Li is the partner in charge of the audit of Blue Distributing Corporation, a

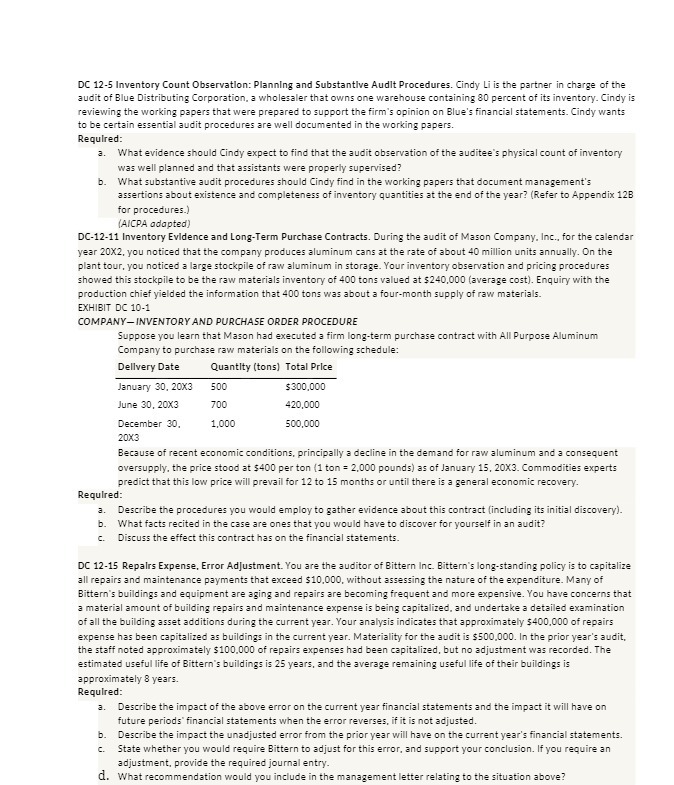

DC 12-5 Inventory Count Observation: Planning and Substantive Audit Procedures. Cindy Li is the partner in charge of the audit of Blue Distributing Corporation, a wholesaler that owns one warehouse containing 80 percent of its inventory. Cindy is reviewing the working papers that were prepared to support the firm's opinion on Blue's financial statements. Cindy wants to be certain essential audit procedures are well documented in the working papers. Required: 3. What evidence should Cindy expect to find that the audit observation of the auditee's physical count of inventory was well planned and that assistants were properly supervised? b. What substantive audit procedures should Cindy find in the working papers that document management's assertions about existence and completeness of inventory quantities at the end of the year? (Refer to Appendix 12B for procedures.) (AICPA adapted DC-12-11 Inventory Evidence and Long-Term Purchase Contracts. During the audit of Mason Company. Inc., for the calendar year 20X2, you noticed that the company produces aluminum cans at the rate of about 40 million units annually. On the plant tour, you noticed a large stockpile of raw aluminum in storage. Your inventory observation and pricing procedures showed this stockpile to be the raw materials inventory of 400 tons valued at $240,000 (average cost). Enquiry with the production chief yielded the information that 400 tons was about a four-month supply of raw materials. EXHIBIT DC 10-1 COMPANY-INVENTORY AND PURCHASE ORDER PROCEDURE Suppose you learn that Mason had executed a firm long-term purchase contract with All Purpose Aluminum Company to purchase raw materials on the following schedule: Dellvery Date Quantity (tons] Total Price January 30, 20X3 500 $300.000 June 30, 20X3 700 420,000 December 30, 1,000 500,000 20X3 Because of recent economic conditions, principally a decline in the demand for raw aluminum and a consequent oversupply, the price stood at $400 per ton (1 ton = 2,000 pounds) as of January 15, 20X3. Commodities experts predict that this low price will prevail for 12 to 15 months or until there is a general economic recovery. Required: a. Describe the procedures you would employ to gather evidence about this contract (including its initial discovery). b. What facts recited in the case are ones that you would have to discover for yourself in an audit? Discuss the effect this contract has on the financial statements. DC 12-15 Repairs Expense, Error Adjustment. You are the auditor of Bittern Inc. Bittern's long-standing policy is to capitalize all repairs and maintenance payments that exceed $10,000, without assessing the nature of the expenditure. Many of Bittern's buildings and equipment are aging and repairs are becoming frequent and more expensive. You have concerns that a material amount of building repairs and maintenance expense is being capitalized, and undertake a detailed examination of all the building asset additions during the current year. Your analysis indicates that approximately $400,000 of repairs expense has been capitalized as buildings in the current year. Materiality for the audit is $500.000. In the prior year's audit, the staff noted approximately $100.000 of repairs expenses had been capitalized, but no adjustment was recorded. The estimated useful life of Bittern's buildings is 25 years, and the average remaining useful life of their buildings is approximately 8 years. Required: 3. Describe the impact of the above error on the current year financial statements and the impact it will have on future periods' financial statements when the error reverses, if it is not adjusted. b. Describe the impact the unadjusted error from the prior year will have on the current year's financial statements. C. State whether you would require Bittern to adjust for this error, and support your conclusion. If you require an adjustment, provide the required journal entry. d. What recommendation would you include in the management letter relating to the situation above