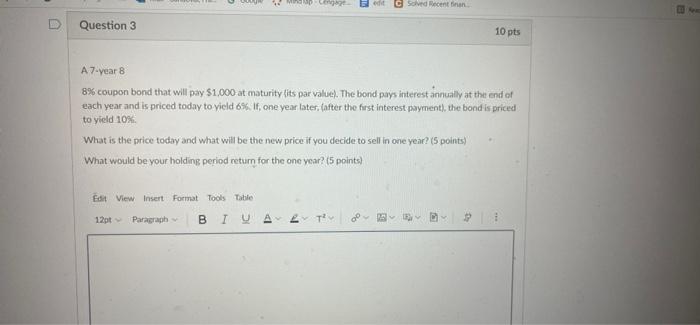

Question: DC C Solved Recent finan Question 3 10 pts A 7-year 8 8% coupon bond that will pay $1,000 at maturity lits par value. The

DC C Solved Recent finan Question 3 10 pts A 7-year 8 8% coupon bond that will pay $1,000 at maturity lits par value. The bond pays interest annually at the end of each year and is priced today to yield 69. If one year later, after the first interest payment), the bond is priced to yield 10% What is the price today and what will be the new price if you decide to sell in one year? (5 points) What would be your holding period return for the one year? (5 points) Edit View Insert Format Tools Table 12pt Paragraph B T U ALT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts