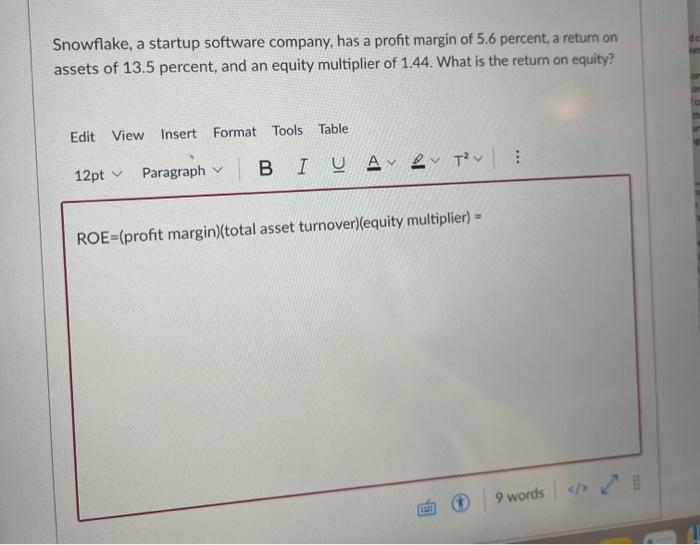

Question: de Snowflake, a startup software company, has a profit margin of 5.6 percent, a return on assets of 13.5 percent, and an equity multiplier of

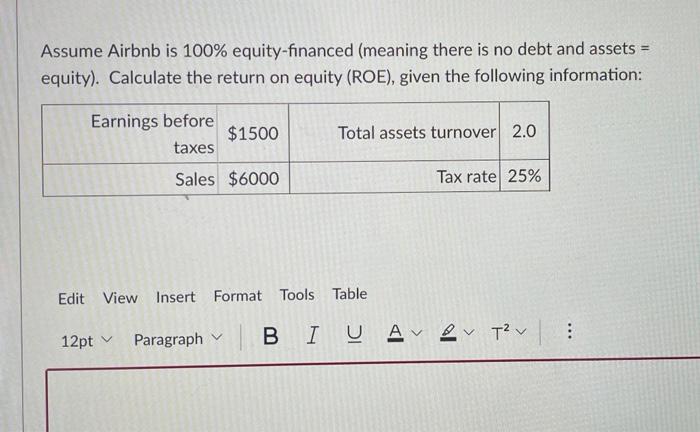

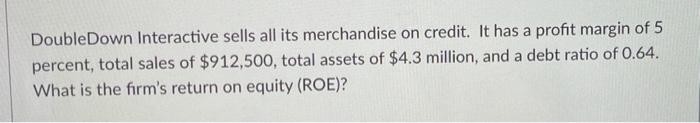

de Snowflake, a startup software company, has a profit margin of 5.6 percent, a return on assets of 13.5 percent, and an equity multiplier of 1.44. What is the return on equity? Edit View Insert Format Tools Table : 12pt Paragraph ROE=(profit margin}(total asset turnover)(equity multiplier) = 9 words Assume Airbnb is 100% equity-financed (meaning there is no debt and assets = equity). Calculate the return on equity (ROE), given the following information: Earnings before taxes $1500 Total assets turnover 2.0 Sales $6000 Tax rate 25% Edit View Insert Format Tools Table 12pt Paragraph B I U Ave Tv : Robinhood has an equity multiplier of 5.0. The company will have a debt ratio of what? If Snowflake, a startup software company has a debt-equity ratio of 2.0, then its total debt ratio must be which one of the following? DoubleDown Interactive sells all its merchandise on credit. It has a profit margin of 5 percent, total sales of $912,500, total assets of $4.3 million, and a debt ratio of 0.64. What is the firm's return on equity (ROE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts