Question: de: WPP 10 Saved Help Save & Exit Submit Check my work On March 31, 2018, Susquehanna Insurance purchased an office building for $12,600,000. Based

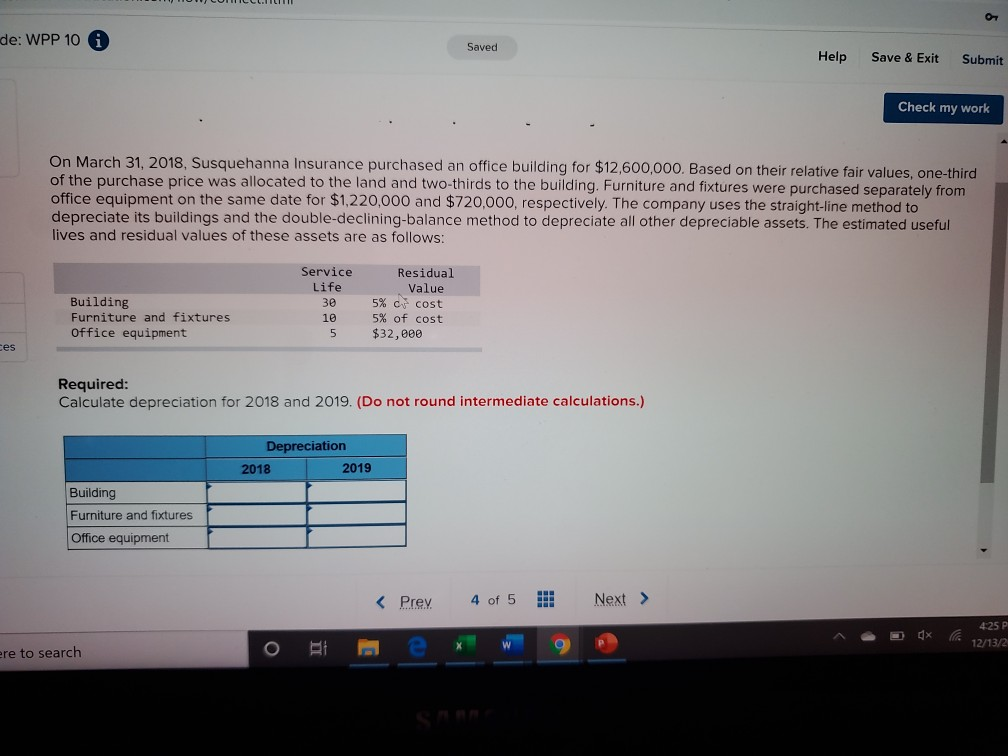

de: WPP 10 Saved Help Save & Exit Submit Check my work On March 31, 2018, Susquehanna Insurance purchased an office building for $12,600,000. Based on their relative fair values, one-third of the purchase price was allocated to the land and two-thirds to the building. Furniture and fixtures were purchased separately from office equipment on the same date for $1,220,000 and $720,000, respectively. The company uses the straight-line method to depreciate its buildings and the double-declining-balance method to depreciate all other depreciable assets. The estimated useful lives and residual values of these assets are as follows: Building Furniture and fixtures Office equipment Service Life 30 10 5 Residual Value 5% cv cost 5% of cost $32,000 ces Required: Calculate depreciation for 2018 and 2019. (Do not round intermedia Depreciation 2018 2019 Building Furniture and fixtures Office equipment 3 x 4:25 P la 12/13/2 ere to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts