Question: Dear all Do you know how to solve it ,please share the light please,that is all question and information from Sir. Thanks The following table

Thanks

Thanks

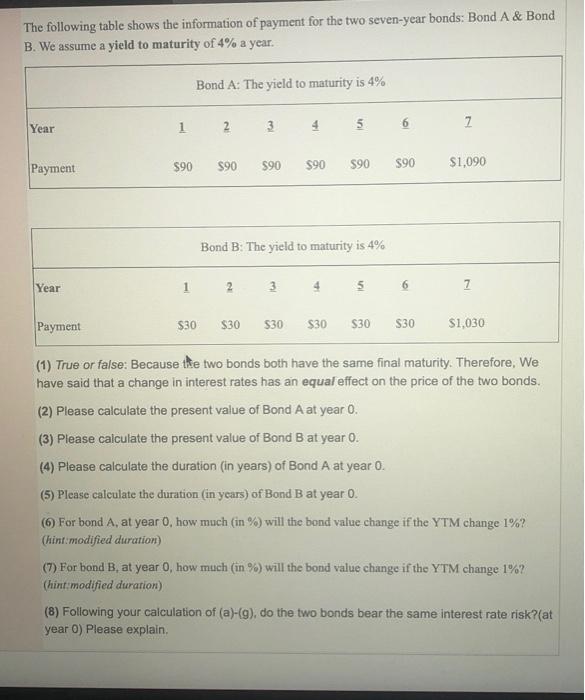

The following table shows the information of payment for the two seven-year bonds: Bond A & Bond B. We assume a yield to maturity of 4% a year. Bond A: The yield to maturity is 4% Year 1 2 3 3 4 5 6 7 S90 Payment $90 $90 $90 $90 590 $1,090 Bond B: The yield to maturity is 4% Year 1 2 3 4 5 6 7 Payment $30 $30 $30 $30 $30 S30 $1,030 (1) True or false: Because the two bonds both have the same final maturity. Therefore, we have said that a change in interest rates has an equal effect on the price of the two bonds. (2) Please calculate the present value of Bond A at year 0. (3) Please calculate the present value of Bond B at year 0. (4) Please calculate the duration (in years) of Bond A at year 0. (5) Please calculate the duration (in ycars) of Bond B at year 0. For bond A, at year o, how much (in %) will the bond value change if the YTM change 1%? (hint modified duration) (7) For bond B. at year 0, how much (in %) will the bond value change if the YTM change t%? (hint modified duration) (8) Following your calculation of (a)-(9), do the two bonds bear the same interest rate risk?(at year 0) Please explain. Checkpoint 2 Worked-out solution available at LarsonAppliec Determine the open intervals on which the graph of f(x) = x 12 x + 4 is concave upward or concave downward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts