Question: Dear Chegg Tutor: Here it is again. From the picture, please help with Exercise 19.9. I got the solution (Please see the second picture attached);

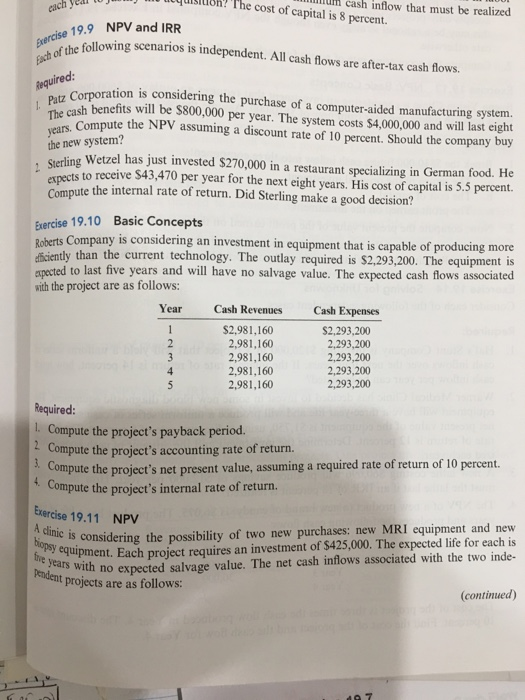

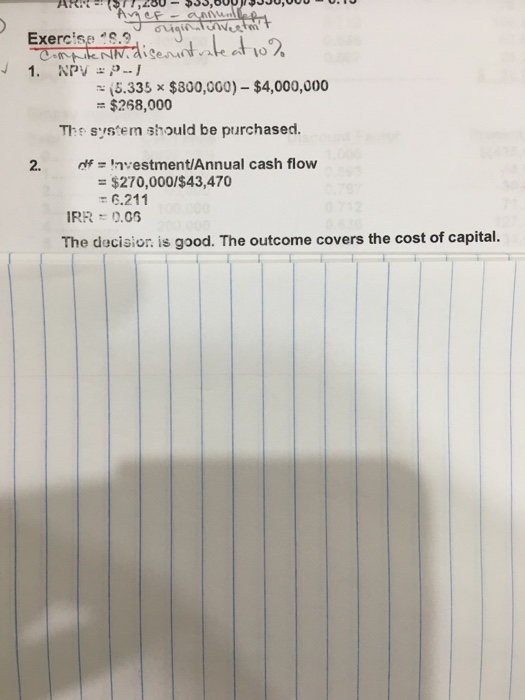

un cash inflow that must be realized Lucquisition? The cost of capital is 8 percent. sich year to ise 19.9 NPV and IRR Bercise 19.9 following scenarios is independent. All cash flows are after-tax cash flows. Fach of the follow Required: Patz Corporation The cash benefits will Corporation is considering the purchase of a computer-aided manufacturing system. sh benefits will be $800,000 per year. The system costs $4,000,000 and will last eight Compute the NPV assuming a discount rate of 10 percent. Should the company buy the new system? Starling Wetzel has just invested $270,000 in a restaurant specializing in German food. He nects to receive 543,470 per year for the next eight years. His cost of capital is 5.5 percent. Compute the internal rate of return. Did Sterling make a good decision? Exercise 19.10 Basic Concepts Roberts Company is considering an investment in equipment that is capable of producing more fficiently than the current technology. The outlay required is $2,293,200. The equipment is wnected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Year Cash Revenues Cash Expenses $2.981,160 $2,293,200 2,981,160 2,293,200 2,981,160 2,293,200 2,981,160 2,293,200 2,981,160 2,293,200 ut WN Required: 1. Compute the project's payback period. Compute the project's accounting rate of return. compute the project's net present value, assuming a required rate of return of 10 percent. Compute the project's internal rate of return. Exercise 19.11 NPV A clinic is consideri tiopsy equipo free years with no is considering the possibility of two new purchases: new MRI equipment and new wuipment. Each project requires an investment of $425,000. The expected life for each is with no expected salvage value. The net cash inflows associated with the two inde- Pendent projects are as follows: (continued) 07 ARIS77,200 - $35,BUUWJJU,UUUU.TU "Arief annuallery Exercise o cuiqin Westent computer.diseruntrate at 10% 1. NPV = "-- (5.335 * $800,000) $4,000,000 -- $268,000 The system should be purchased. of Investment/Annual cash flow = $270,000/$43,470 = 6.211 IRR = 0.06 The decision is good. The outcome covers the cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts