Question: DEAR EXPERT, PLEASE GIVE A DETAILED ANSWER FOR THIS QUESTION. REGARDS, TEAM CHEGG The following information is available: Depreciation for Plant & equipment is to

DEAR EXPERT, PLEASE GIVE A DETAILED ANSWER FOR THIS QUESTION.

REGARDS, TEAM CHEGG

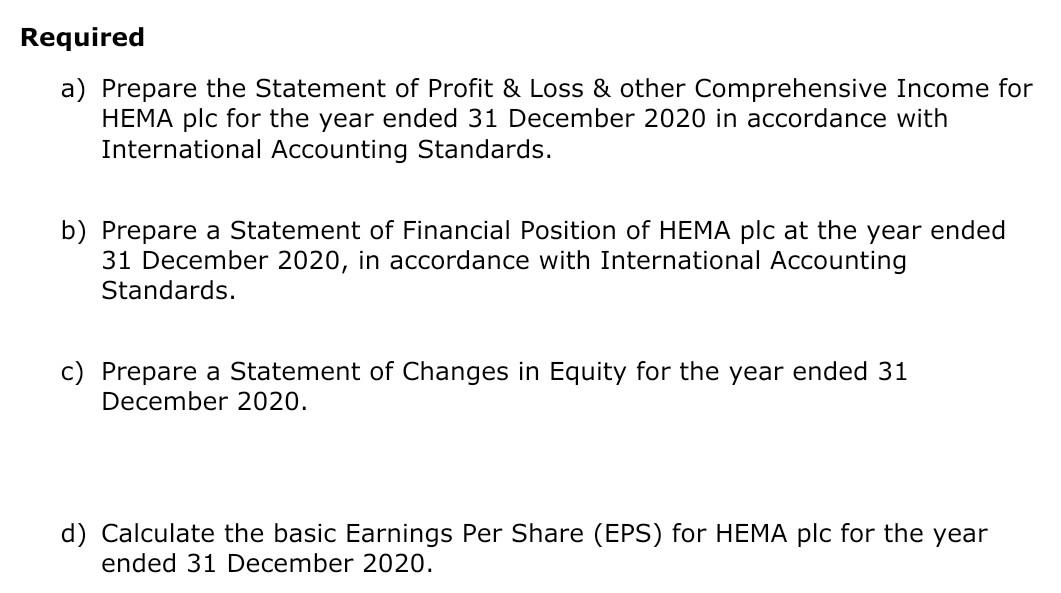

The following information is available:

Depreciation for Plant & equipment is to be providing for the year on a straight line basis at 15% per annum

Depreciation for Plant & equipment is to be allocated to cost of sales 80%, distribution costs 20%.

The land was revalued on 1 January 2020 at 15,000,000. This revaluation is not yet included in the trial balance figures but is required for the financial statements.

Inventory on 31st December 2020 was valued at 24,186,000

The corporation tax charge for the year has been calculated as 1,537,000

A transfer from deferred tax of 100,000 is required to be made.

The loan was taken out on the 1st January 2020. The interest rate to be paid is at 7%, payable annually.

Required Prepare the Statement of Profit & Loss & other Comprehensive Income for HEMA plc for the year ended 31 December 2020 in accordance with International Accounting Standards. Prepare a Statement of Financial Position of HEMA plc at the year ended 31 December 2020, in accordance with International Accounting Standards. Prepare a Statement of Changes in Equity for the year ended 31 December 2020.

Calculate the basic Earnings Per Share (EPS) for HEMA plc for the year ended 31 December 2020.

PLEASE ANSWER AND PLEASE GIVE CORRECT ANSWER!

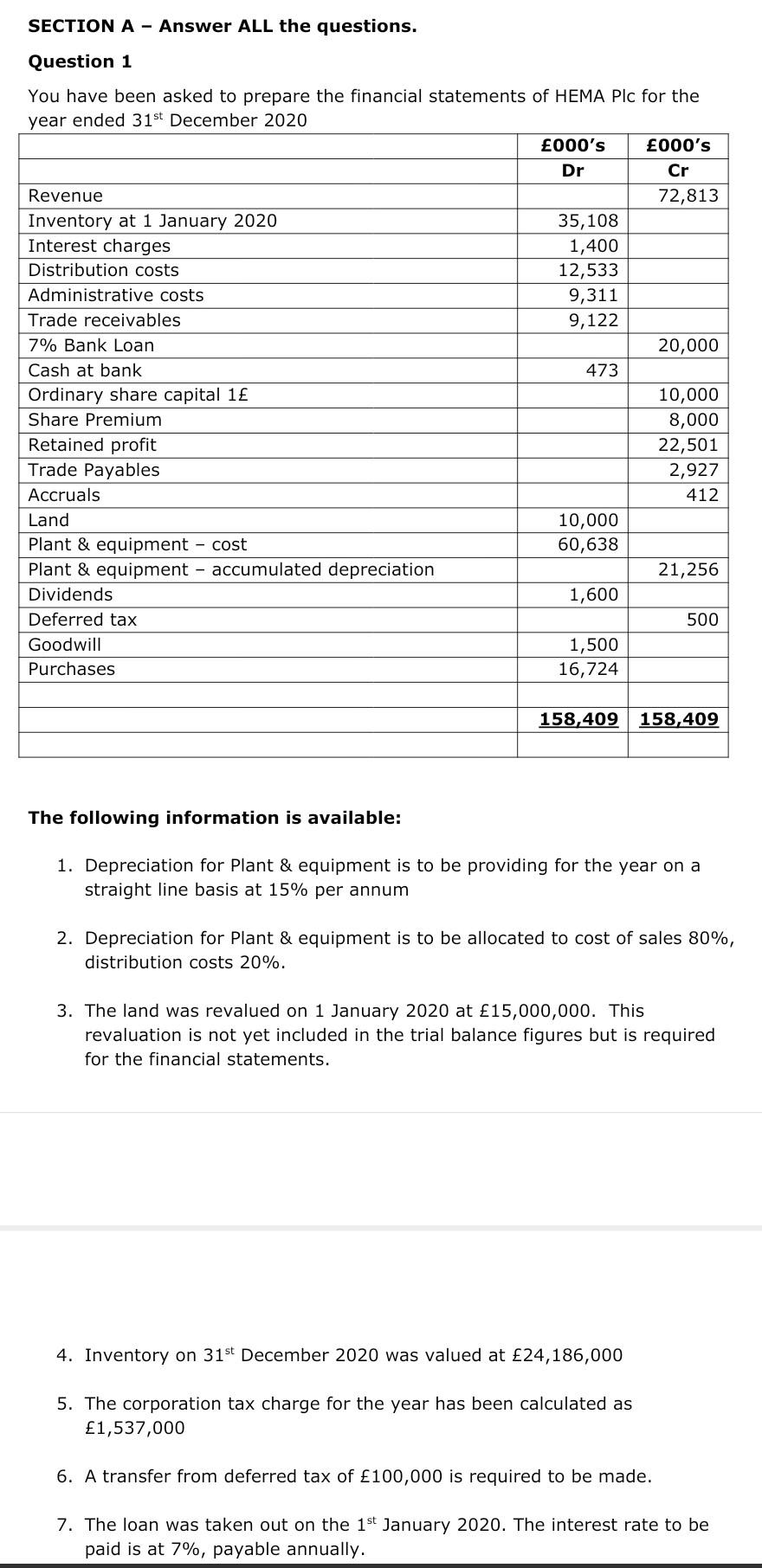

SECTION A - Answer ALL the questions. Question 1 You have been asked to prepare the financial statements of HEMA Plc for the year ended 31st December 2020 000's 000's Dr Cr Revenue 72,813 Inventory at 1 January 2020 35,108 Interest charges 1,400 Distribution costs 12,533 Administrative costs 9,311 Trade receivables 9,122 7% Bank Loan 20,000 Cash at bank 473 Ordinary share capital 1 10,000 Share Premium 8,000 Retained profit 22,501 Trade Payables 2,927 Accruals 412 Land 10,000 Plant & equipment - cost 60,638 Plant & equipment - accumulated depreciation 21,256 Dividends 1,600 Deferred tax 500 Goodwill 1,500 Purchases 16,724 158,409 158,409 The following information is available: 1. Depreciation for Plant & equipment is to be providing for the year on a straight line basis at 15% per annum 2. Depreciation for Plant & equipment is to be allocated to cost of sales 80%, distribution costs 20%. 3. The land was revalued on 1 January 2020 at 15,000,000. This revaluation is not yet included in the trial balance figures but is required for the financial statements. 4. Inventory on 31st December 2020 was valued at 24,186,000 5. The corporation tax charge for the year has been calculated as 1,537,000 6. A transfer from deferred tax of 100,000 is required to be made. 7. The loan was taken out on the 1st January 2020. The interest rate to be paid is at 7%, payable annually. Required a) Prepare the Statement of Profit & Loss & other Comprehensive Income for HEMA plc for the year ended 31 December 2020 in accordance with International Accounting Standards. b) Prepare a Statement of Financial Position of HEMA plc at the year ended 31 December 2020, in accordance with International Accounting Standards. c) Prepare a Statement of Changes in Equity for the year ended 31 December 2020. d) Calculate the basic Earnings Per Share (EPS) for HEMA plc for the year ended 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts