Question: Dear Sir, please double check the answer before submitting. Thanks Question: 4 Assume that two securities. A and B, constitute the market portfolio, their proportions

Dear Sir, please double check the answer before submitting. Thanks

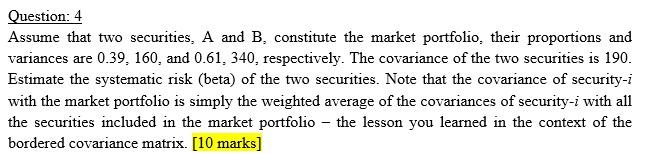

Question: 4 Assume that two securities. A and B, constitute the market portfolio, their proportions and variances are 0.39, 160, and 0.61, 340, respectively. The covariance of the two securities is 190. Estimate the systematic risk (beta) of the two securities. Note that the covariance of security-i with the market portfolio is simply the weighted average of the covariances of security-i with all the securities included in the market portfolio - the lesson you learned in the context of the bordered covariance matrix. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts