Question: Dear Teacher, Our Prof did not explain this to us thoroughly, we are still having online asynchronous classes, meaning we just listen to a taped

Dear Teacher,

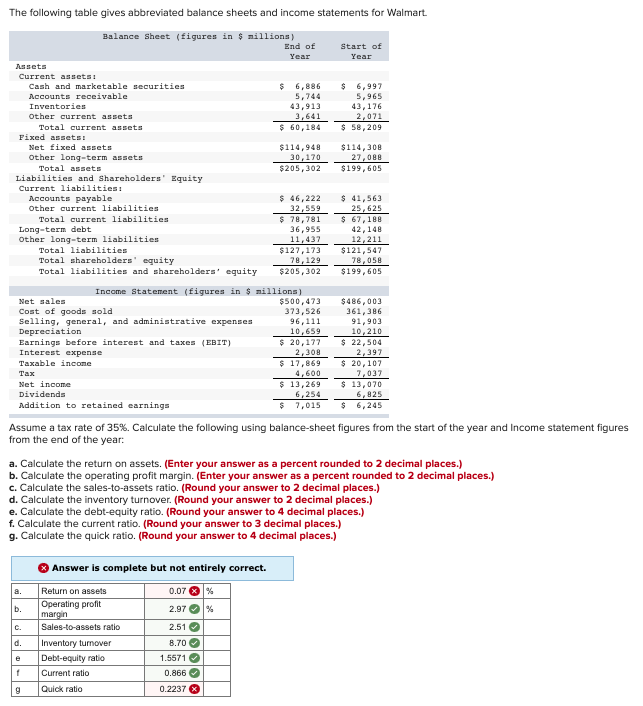

Our Prof did not explain this to us thoroughly, we are still having online asynchronous classes, meaning we just listen to a taped lecture and couldn't really ask questions. This is Basic Finance subject. The HW is already due tomorrow. My mistakes are only letters a and g. Please help with a little explanation. Thank you.

The following table gives abbreviated balance sheets and income statements for Walmart Balance sheet (figures in $ millions) End of Year Start of Year $ 6,886 5,744 43,913 3,641 $ 60,184 $ 6,997 5,965 43,176 2,071 $ 58,209 Assets Current assets: Cash and marketable securities Accounts receivable Inventorien Other current assets Total current assets Fixed assets: Net fixed assets other long-term assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity Total liabilities and shareholders' equity $114,948 30,170 $205,302 $114,308 27,088 $199, 605 $ 46,222 32,559 $ 78, 781 36,955 11,437 $127.173 78,129 $205,302 $ 41,563 25, 625 $ 67,188 42,148 12,211 $121, 547 78, 058 $199, 605 Income Statement (figures in $ millions) Net sales $500,473 $486,003 Cost of goods sold 373,526 361, 386 Selling, general, and administrative expenses 96,111 91,903 Depreciation 10,659 10,210 Earnings before interest and taxes (EBIT) $ 20,177 $ 22,504 Interest expense 2,308 2,397 Taxable income $ 17,869 $ 20,107 Tax 4,600 7,037 Net income $ 13,269 $ 13,070 Dividends 6,254 6,825 Addition to retained earnings $ 7,015 $ 6,245 Assume a tax rate of 35%. Calculate the following using balance sheet figures from the start of the year and Income statement figures from the end of the year: a. Calculate the return on assets. (Enter your answer as a percent rounded to 2 decimal places.) b. Calculate the operating profit margin. (Enter your answer as a percent rounded to 2 decimal places.) c. Calculate the sales-to-assets ratio. (Round your answer to 2 decimal places.) d. Calculate the inventory turnover. (Round your answer to 2 decimal places.) e. Calculate the debt-equity ratio. (Round your answer to 4 decimal places.) f. Calculate the current ratio. (Round your answer to 3 decimal places.) 9. Calculate the quick ratio. (Round your answer to 4 decimal places.) a. b. C. Answer is complete but not entirely correct. Return on assets 0.07% Operating profit 2.97 % margin Sales-to-assets ratio 2.51 Inventory turnove 8.70 Debt-equity ratio 1.5571 Current ratio 0.866 Quick ratio 0.2237 X d. e 1 g

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts