Question: Dear Tutor, Kindly help me with below attached, I tried to solve but I got stuck. As the cash flows are in thousands. Task: A.

Dear Tutor,

Kindly help me with below attached, I tried to solve but I got stuck.

As the cash flows are in thousands.

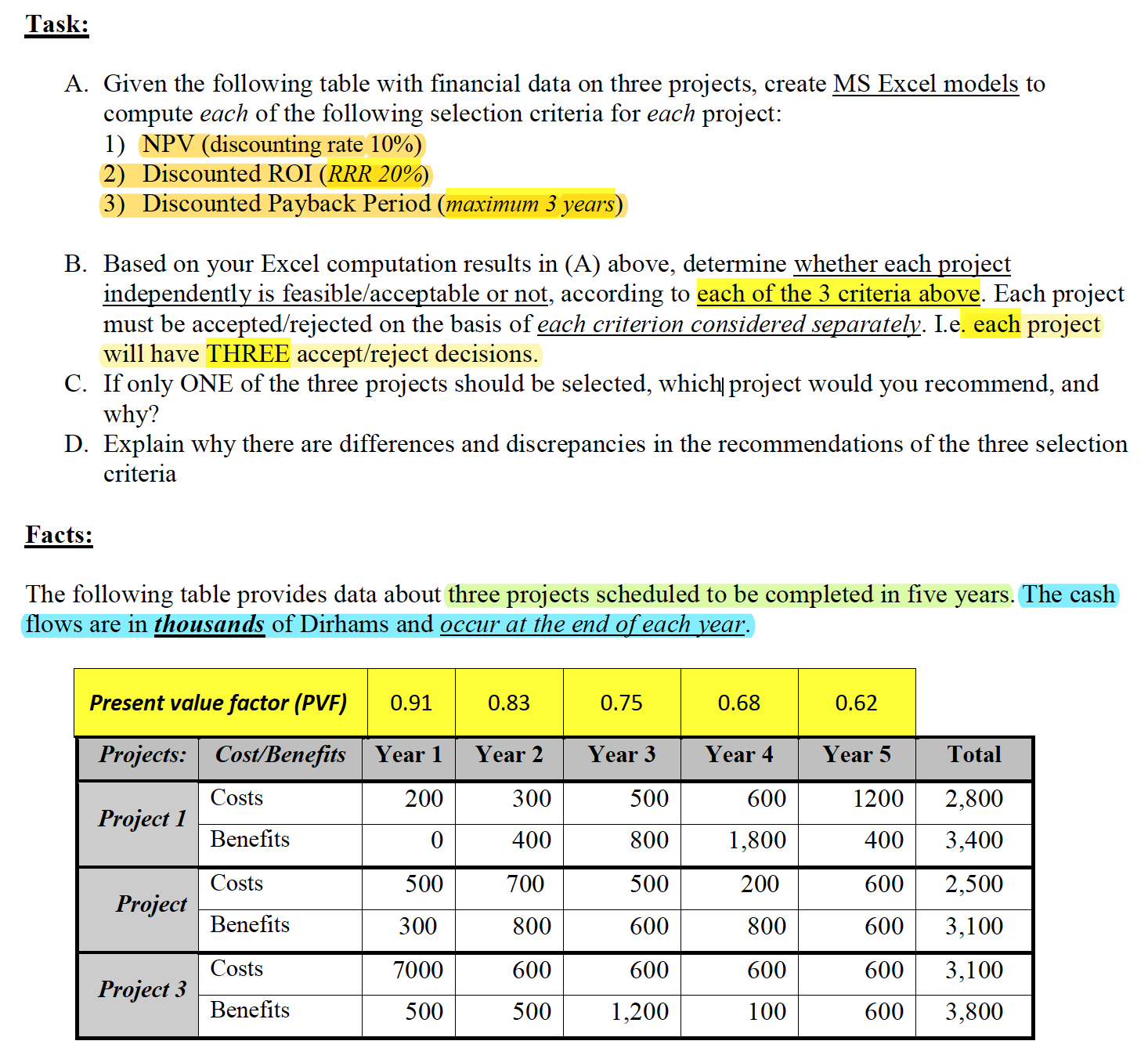

Task: A. Given the following table with nancial data on three projects, create MS Excel models to compute each of the following selection criteria for each project: 1) NPV (discounting rate 10%) 2) Discounted ROI (RRR 20%) 3) Discounted Payback Period (maximum 3 years) Based on your Excel computation results in (A) above, determine whether each project independently is feasible/acceptable or not, according to each of the 3 criteria above. Each project must be accepted/rejected on the basis of each criterion considered separately. I.e. each project will have THREE accept/reject decisions. If only ONE of the three projects should be selected, which| project would you recommend, and why? Explain why there are differences and discrepancies in the recommendations of the three selection criteria Facts: The following table provides data about three projects scheduled to be completed in five years. The cash ows are in thousands of Dirhams and occur at the end 0 each ear. Present value factor (PVF) 0.91 0.83 0.75 0.68 0.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts