Question: dear tutor, Please help to solve this problem along with explaination. best, On January 1, 2024, a company adopted the dollar-value LIFO inventory method. The

dear tutor,

Please help to solve this problem along with explaination.

best,

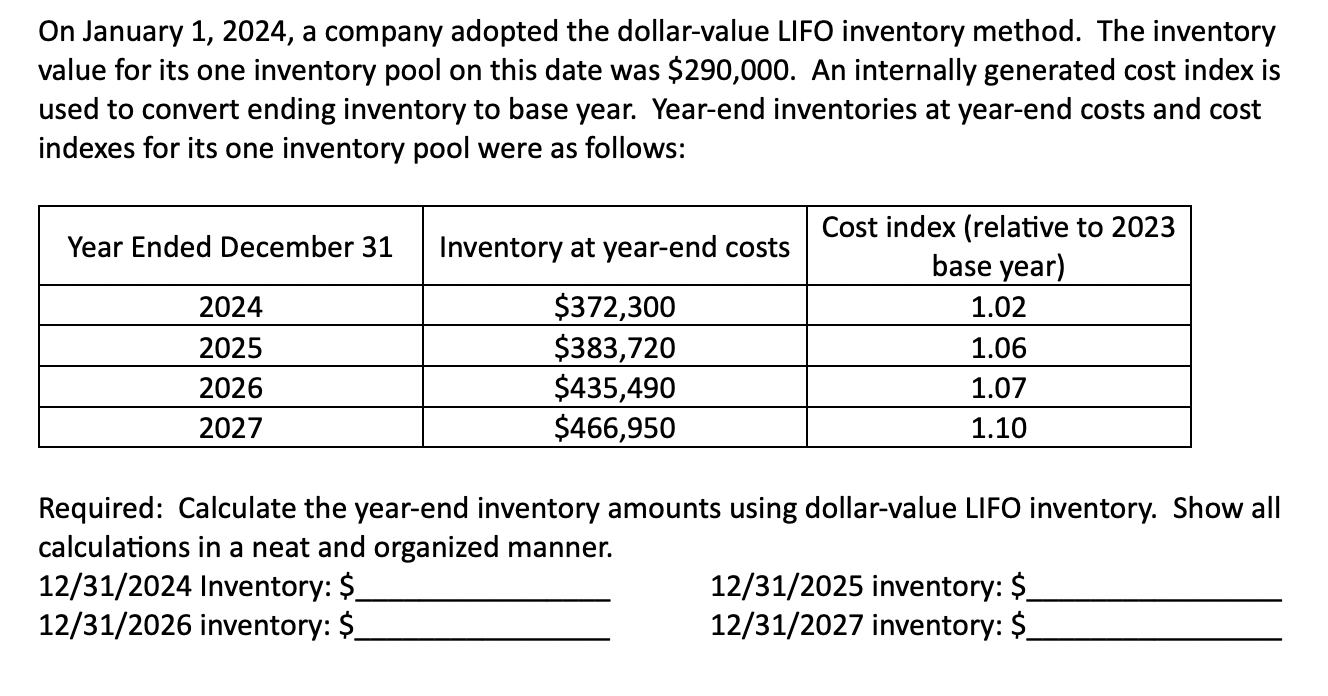

On January 1, 2024, a company adopted the dollar-value LIFO inventory method. The inventory value for its one inventory pool on this date was $290,000. An internally generated cost index is used to convert ending inventory to base year. Yea rend inventories at yearend costs and cost indexes for its one inventory pool were as follows: Cost index (relative to 2023 base year) 2024 $372,300 1.02 Year Ended December 31 Inventory at yea rend costs 2025 $383,720 1.06 2026 $435,490 1.07 2027 $466,950 1.10 Required: Calculate the year-end inventory amounts using dollar-value LIFO inventory. Show all calculations in a neat and organized manner. 12/31/2024 Inventory: 5 12/31/2025 inventory: 5 12/31/2026 inventory: 5 12/31/2027 inventory: 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts