Question: Dear Tutor, Please solve the below mentioned question and provide answers along with proper workings and explanations (pls do not use excel format or excel

Dear Tutor,

Please solve the below mentioned question and provide answers along with proper workings and explanations

(pls do not use excel format or excel formulas to answers the below questions)

THANKS!!

Q1) Ramsay Health Care Ltd has recently paid a dividend of $6 and the dividend payments are expected to grow at a constant rate of 11% per year for the next 12 years. The required rate of return for the same class of shares is 15%. What should be the price of the share in 12 years?

Q2) Walmart Ltd has recently paid a dividend of $4 and the dividend payments are expected to grow at a constant rate of 8% per year for the next 5 years. The required rate of return for the same class of shares is 16%. What is the market value of Walmart Ltd.'s share?

Q3) Suppose that the current cash dividend of PayPal Ltd is $0.70. Financial analysts expect the dividends to grow at a constant rate of 5 per cent per year, and investors require a 12 per cent return on this class of shares. What should be the current share price of PayPal Ltd?

Q4) Suppose that the current cash dividend of XYZ Ltd is $0.80. Financial analysts expect the dividends to grow at a constant rate of 9 per cent per year, and investors require a 10 per cent return on this class of shares. What should XYZ Ltd's price be in 15 years?

Q5) A 7 year bond with a face value of $100,000 and having a coupon rate of 7%. Coupon payments are made semi-annually. What's the present value of the first coupon payment?

Q6) A change in interest rates for two 11-year bonds with coupon rates of 6% and 9% respectively will:

Q7) Telstra Corp expects its dividend pay-outs to increase by the following amounts for 3 years: 12%, 14% and 17% respectively. Calculate the present value of all those dividend payments assuming a required rate of return of 20% and that the last year, the company made a dividend payment of $5.

Q8) UltraTech Cement's preference shares have an annual dividend of $14 (paid quarterly), a par value of $1000, and an effective maturity of 9 years. If similar preference shares issues have market yields of 9%. Calculate the value of UltraTech Cement's share price.

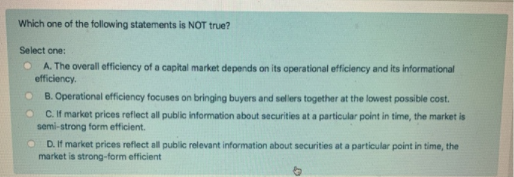

Q9) Please answer the below shown MCQ.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts