Question: Dear tutors, please help to answer the question below based on MFRS123 Tutorial - Chapter 2 You are a senior accountant of Twinkle Bhd. The

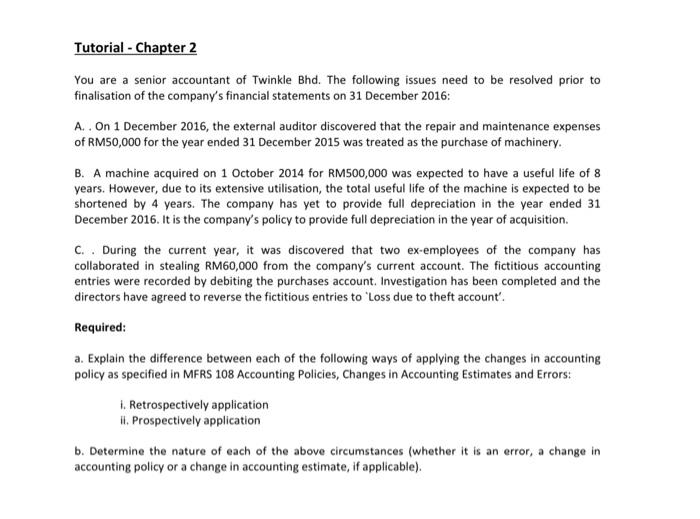

Tutorial - Chapter 2 You are a senior accountant of Twinkle Bhd. The following issues need to be resolved prior to finalisation of the company's financial statements on 31 December 2016: A. . On 1 December 2016, the external auditor discovered that the repair and maintenance expenses of RMS0,000 for the year ended 31 December 2015 was treated as the purchase of machinery. B. A machine acquired on 1 October 2014 for RM500,000 was expected to have a useful life of 8 years. However, due to its extensive utilisation, the total useful life of the machine is expected to be shortened by 4 years. The company has yet to provide full depreciation in the year ended 31 December 2016. It is the company's policy to provide full depreciation in the year of acquisition. C. During the current year, it was discovered that two ex-employees of the company has collaborated in stealing RM60,000 from the company's current account. The fictitious accounting entries were recorded by debiting the purchases account. Investigation has been completed and the directors have agreed to reverse the fictitious entries to 'Loss due to theft account'. Required: a. Explain the difference between each of the following ways of applying the changes in accounting policy as specified in MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors: i. Retrospectively application ii. Prospectively application b. Determine the nature of each of the above circumstances (whether it is an error, a change in accounting policy or a change in accounting estimate, if applicable)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts