Deb Bishop Health and Beauty Products has developed a new shampoo and you need to develop...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

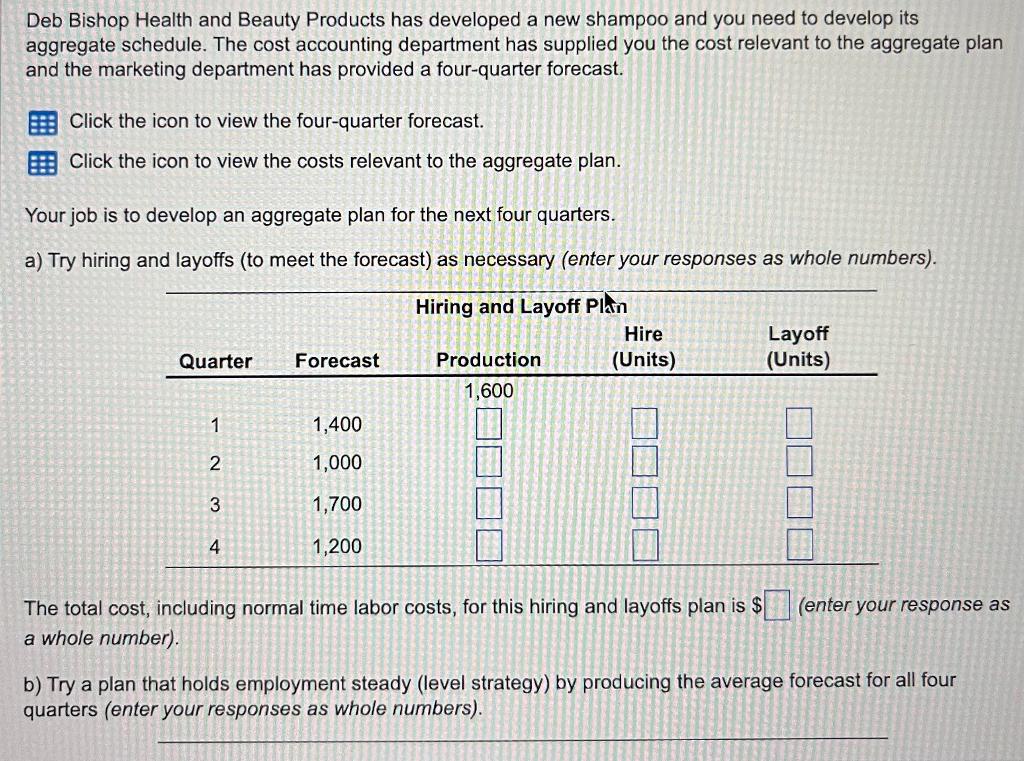

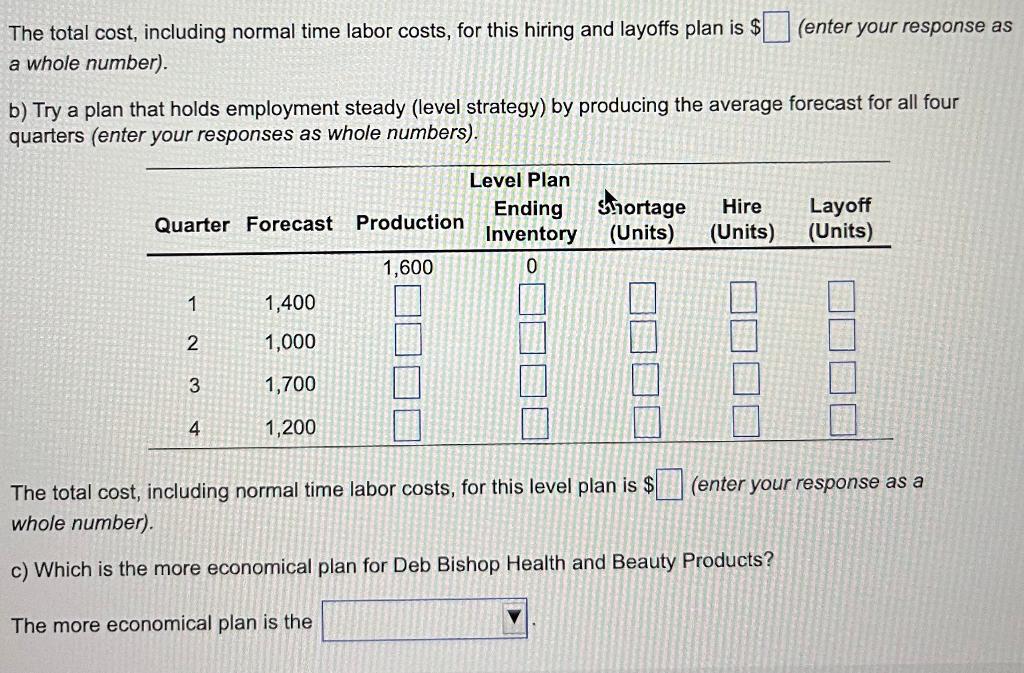

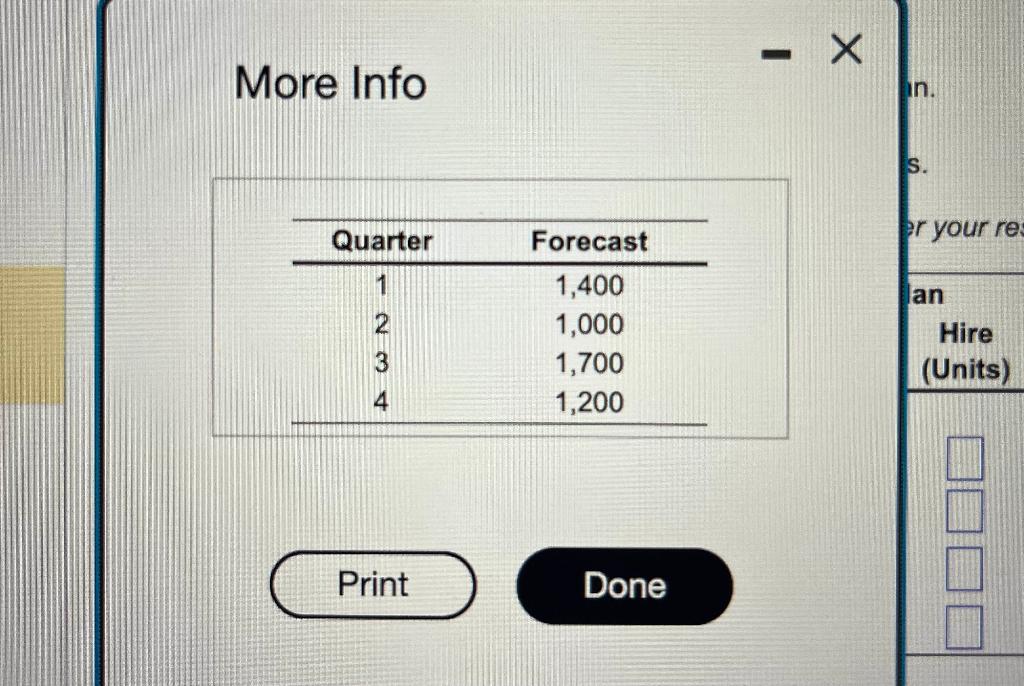

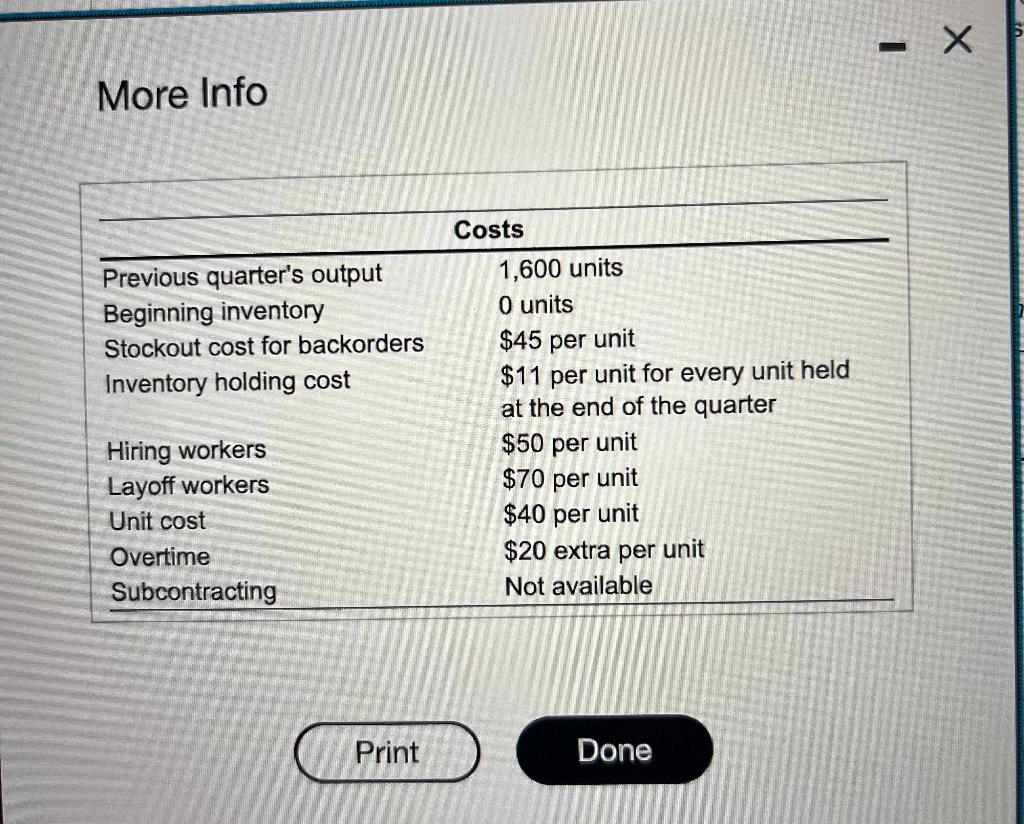

Deb Bishop Health and Beauty Products has developed a new shampoo and you need to develop its aggregate schedule. The cost accounting department has supplied you the cost relevant to the aggregate plan and the marketing department has provided a four-quarter forecast. Click the icon to view the four-quarter forecast. Click the icon to view the costs relevant to the aggregate plan. Your job is to develop an aggregate plan for the next four quarters. a) Try hiring and layoffs (to meet the forecast) as necessary (enter your responses as whole numbers). Hiring and Layoff Plan Quarter 1 2 3 4 Forecast 1,400 1,000 1,700 1,200 Production 1,600 Hire (Units) The total cost, including normal time labor costs, for this hiring and layoffs plan is $ a whole number). Layoff (Units) (enter your response as b) Try a plan that holds employment steady (level strategy) by producing the average forecast for all four quarters (enter your responses as whole numbers). The total cost, including normal time labor costs, for this hiring and layoffs plan is $ a whole number). b) Try a plan that holds employment steady (level strategy) by producing the average forecast for all four quarters (enter your responses as whole numbers). Quarter Forecast Production 1,600 1 2 3 4 1,400 1,000 1,700 1,200 Level Plan Ending Shortage Hire Inventory (Units) (Units) 0 (enter your response as The total cost, including normal time labor costs, for this level plan is $ whole number). c) Which is the more economical plan for Deb Bishop Health and Beauty Products? The more economical plan is the Layoff (Units) (enter your response as a More Info Quarter 1 Print Forecast 1,400 1,000 1,700 1,200 Done - X in. S. er your res lan Hire (Units) More Info Previous quarter's output Beginning inventory Stockout cost for backorders Inventory holding cost Hiring workers Layoff workers Unit cost Overtime Subcontracting Print Costs 1,600 units 0 units $45 per unit $11 per unit for every unit held at the end of the quarter $50 per unit $70 per unit $40 per unit $20 extra per unit Not available Done I X Deb Bishop Health and Beauty Products has developed a new shampoo and you need to develop its aggregate schedule. The cost accounting department has supplied you the cost relevant to the aggregate plan and the marketing department has provided a four-quarter forecast. Click the icon to view the four-quarter forecast. Click the icon to view the costs relevant to the aggregate plan. Your job is to develop an aggregate plan for the next four quarters. a) Try hiring and layoffs (to meet the forecast) as necessary (enter your responses as whole numbers). Hiring and Layoff Plan Quarter 1 2 3 4 Forecast 1,400 1,000 1,700 1,200 Production 1,600 Hire (Units) The total cost, including normal time labor costs, for this hiring and layoffs plan is $ a whole number). Layoff (Units) (enter your response as b) Try a plan that holds employment steady (level strategy) by producing the average forecast for all four quarters (enter your responses as whole numbers). The total cost, including normal time labor costs, for this hiring and layoffs plan is $ a whole number). b) Try a plan that holds employment steady (level strategy) by producing the average forecast for all four quarters (enter your responses as whole numbers). Quarter Forecast Production 1,600 1 2 3 4 1,400 1,000 1,700 1,200 Level Plan Ending Shortage Hire Inventory (Units) (Units) 0 (enter your response as The total cost, including normal time labor costs, for this level plan is $ whole number). c) Which is the more economical plan for Deb Bishop Health and Beauty Products? The more economical plan is the Layoff (Units) (enter your response as a More Info Quarter 1 Print Forecast 1,400 1,000 1,700 1,200 Done - X in. S. er your res lan Hire (Units) More Info Previous quarter's output Beginning inventory Stockout cost for backorders Inventory holding cost Hiring workers Layoff workers Unit cost Overtime Subcontracting Print Costs 1,600 units 0 units $45 per unit $11 per unit for every unit held at the end of the quarter $50 per unit $70 per unit $40 per unit $20 extra per unit Not available Done I X

Expert Answer:

Answer rating: 100% (QA)

Lets begin by creating an aggregate plan for quarters 1 through 4 using hiring and layoff strategies to meet the forecast demand The forecast demand is given for each quarter To calculate the hiring a... View the full answer

Related Book For

Posted Date:

Students also viewed these general management questions

-

Deb Bishop Health and Beauty Products has developed a new shampoo, and you need to develop its aggregate schedule. The cost accounting department has supplied you the costs relevant to the aggregate...

-

Liz Perry Health and Beauty Products has developed a new shampoo and you need to develop its aggregate schedule. The cost accounting department has supplied you the cost relevant to the aggregate...

-

Deb Bishop Health and Beauty Products has devel- oped a new shampoo, and you need to develop its aggregate sched- ule. The cost accounting department has supplied you the costs relevant to the...

-

Inventory Ratio Calculations Dell Technologies reported the following data for 2018 and 2019 (in millions): Inventory February 3, 2017 $ 2,538 February 2, 2018 2,678 February 1, 2019 3,649 Cost of...

-

A glass plate 3.50cm thick, with an index of refraction of 1.55 and plane parallel faces, is held with its faces horizontal and its lower face 6.00cm above a printed page. Find the position of the...

-

What is the effect of centrifugal tension on power transmission?

-

Which item(s) appears as a reconciling item(s) to the book balance in a bank reconciliation? a. Outstanding checks b. Deposits in transit C. Both a and b d. None of the above

-

Kelly Foods has two plants and ships canned vegetables to customers in four cities. The cost of shipping one case from a plant to a customer is given in the following table. The plant in Akron has a...

-

question 1 There is negative publicity about the products that McDonald's sells are fast food and contains a high amount of fat, carbohydrate, salt, and sugar. Due to this, there is a trend of...

-

Devon Bishop, age 45, is single. He lives at 1507 Rose Lane, Albuquerque, NM 87131. His Social Security number is 111-11-1117. Devon does not want $3 to go to the Presidential Election Campaign Fund....

-

Read the two news articles "Indo-Pacific plan..." and "Trudeau to attend.....summits", recently published in the GLOBE AND MAIL newspaper, following the attachments below: Apparently, Canada is...

-

Explain why goal trees are so useful to artificial intelligence research. Give illustrations of how they are used.

-

What classes of transactions are included in the expenditure cycle?

-

Explain the Chinese Room argument, and present some of the arguments against it, and the counter-arguments. Which do you find most convincing? How does this affect your view on the overall worth of...

-

Identify six types of invalid data that you might use in testing cash disbursements.

-

What aspects of the EDP system are subject to testing by the use of (a) test data and (b) generalized audit software?

-

Consider the following database tables. Based on the given tables, Write an SQL query to retrieve the average rating for each author. Include the author's name and the average rating in the view, and...

-

Show that if A is any m n matrix, then Im A = A and AIn = A.

-

Richard Dulskis firm is about to bid on a new radar system. Although the product uses new technology, Dulski believes that a learning rate of 75% is appropriate. The first unit is expected to take...

-

The defect rate for data entry of insurance claims has historically been about 1.5%. (a) What are the upper and lower control chart limits if you wish to use a sample size of 100 and 3-sigma limits?...

-

Research and briefly describe the Delphi technique. How would it be used by an employer you have worked for?

-

Name four disruptive business models and describe what they offer to their customers.

-

How is IT contributing to the success of the on-demand and shared economies?

-

What are the key strategic and tactical questions that determine an organizations profitability and management performance?

Study smarter with the SolutionInn App