Question: Debit Credit Cosh $ 9 5 3 , 1 8 4 Short term investments 1 6 7 , 0 0 0 Fair value adjustment (

Debit Credit Cosh $ Short term investments Fair value adjustment Trading Accounte receivable Allowance for doubtful accounts Inventory Purchases Prepaid insurance LT Debt investments HTM Land Building Accumulated deprecistion: building Equipment Accumulated deprecistion: equipment Potent Accounte paysble Notes paysble Income toxes poysble Unesmed rent revenue Bonds Paysble Premium on Bonds Payable Common stock PIC In Excess of ParCommon Stock Retained earningz Treasury toock Dividends Soles Revenue Advertising expense woges expense Office expense Amortization Expense Deprecistion expense Utilities expense Insurance expense Income toxes expense

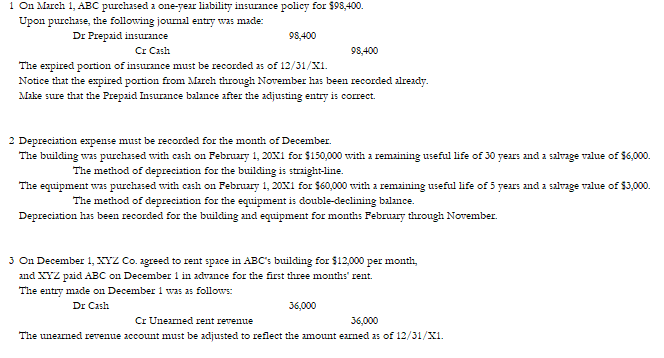

On March ABC purchased a oneyear liability insurance policy for $

Upon purchase, the following journal entry was made:

Dr Prepaid insurance

Cr Cash

The expired portion of insurance must be recorded as of X

Notice that the expired portion from March through November has been recorded already.

Make sure that the Prepaid Insurance balance after the adjusting entry is correct.

Depreciation expense must be recorded for the month of December.

The building was purchased with cash on February X for $ with a remaining useful life of years and a salvage value of $

The method of depreciation for the building is straightline.

The equipment was purchased with cash on February X for $ with a remaining useful life of years and a salvage value of $

The method of depreciation for the equipment is doubledeclining balance.

Depreciation has been recorded for the building and equipment for months February through November.

On December XYZ Co agreed to rent space in ABC s building for $ per month,

and XYZ paid ABC on December in advance for the first three months' rent.

The entry made on December was as follows:

Dr Cash

Cr Unearned rent revenue

The unearned revenue account must be adjusted to reflect the amount earned as of X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock