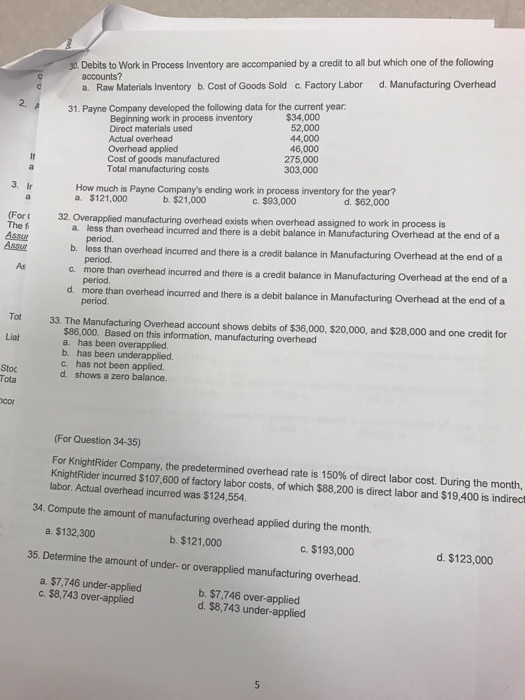

Question: Debits to work in process inventory are accompanied by a credit to all but which one of the following accounts? a. Raw Materials Inventory b.

Debits to work in process inventory are accompanied by a credit to all but which one of the following accounts? a. Raw Materials Inventory b. costs of Goods Sold C. Factory Labor d. Manufacturing Overhead Payne Company developed the following data for the current year: How much is payne company's ending work in process inventory for the year? a. $121,000 b. $21,000 c. $93,000 d. $62,000 Overapplied manufacturing overhead exists when overhead assigned to work in process is a. Less than overhead incurred and there is a debit balance in Manufacturing Overhead at the end of a period. b. less than overhead incurred and there is a credit balance in manufacturing overhead at the end of a period c. more than overhead incurred and there is a credit balance in Manufacturing Overhead at the end of a period. d. more than overhead incurred and there is a debit balance in Manufacturing Overhead at the end of a period. The manufacturing Overhead account shows debits of $36,000, $20,000, and $28,000 and one credit for $86,000. Based on this information, manufacturing Overhead a. has been over applied. b. has been underapplied. c. has not been applied d. shows a zero balance. For knightRider company, the predetermined overhead rate is 150% of direct labor cost. During the month, KnightRider incurred $107, 600 of factory labor costs of which $88, 200 is direct labor and $19, 400 is indirect labor Actual overhead incurred was $124, 554. Compute the amount of manufacturing overhead applied during the month. a. $132, 300 b. $121,000 c. $193,000 d. $123,000 Determine the amount of under or overapplied manufacturing overhead. a.$7.746 under-applied b. $7, 746 over-applied c. $8, 743 over-applied d. $8, 743 under-applied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts