Question: Debra and Merina sell electronic equipment and supplies through their partnership. They wish to expand their computer Ines and decide to admit Wayne to the

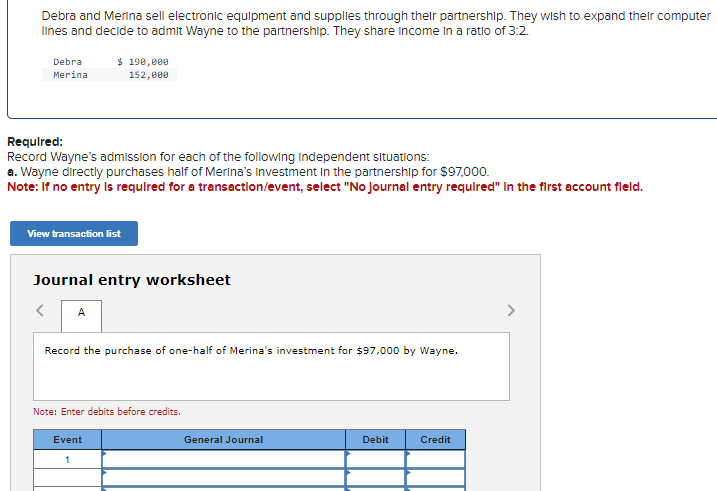

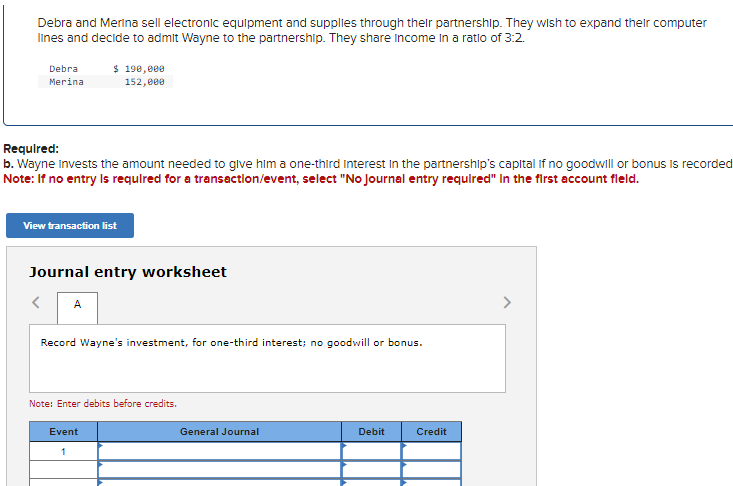

Debra and Merina sell electronic equipment and supplies through their partnership. They wish to expand their computer Ines and decide to admit Wayne to the partnership. They share income in a ratio of 3:2. equlred: lecord Wayne's admission for each of the following Independent situations: - Wayne directly purchases half of Merina's investment in the partnership for $97,000. lote: If no entry Is requlred for a transaction/event, select "No Journal entry required" In the first account fleld. Journal entry worksheet Record the purchase of one-half of Merina's investment for $97,000 by Wayne. Note: Enter debits before credits. Debra and Merina sell electronic equipment and supplies through thelr partnership. They wish to expand their computer Ines and decide to admit Wayne to the partnership. They share income in a ratio of 3:2. equlred: Wayne Invests the amount needed to glve him a one-third Interest in the partnership's capltal If no goodwill or bonus is recorder ote: If no entry Is requlred for a transaction/event, select "No Journal entry required" In the flrst account fleld. Journal entry worksheet Record Wayne's investment, for one-third interest; no goodwill or bonus. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts