Question: Debt A . On October 1 , 2 0 Y 9 , the company paid - off the note payable that was outstanding at the

Debt

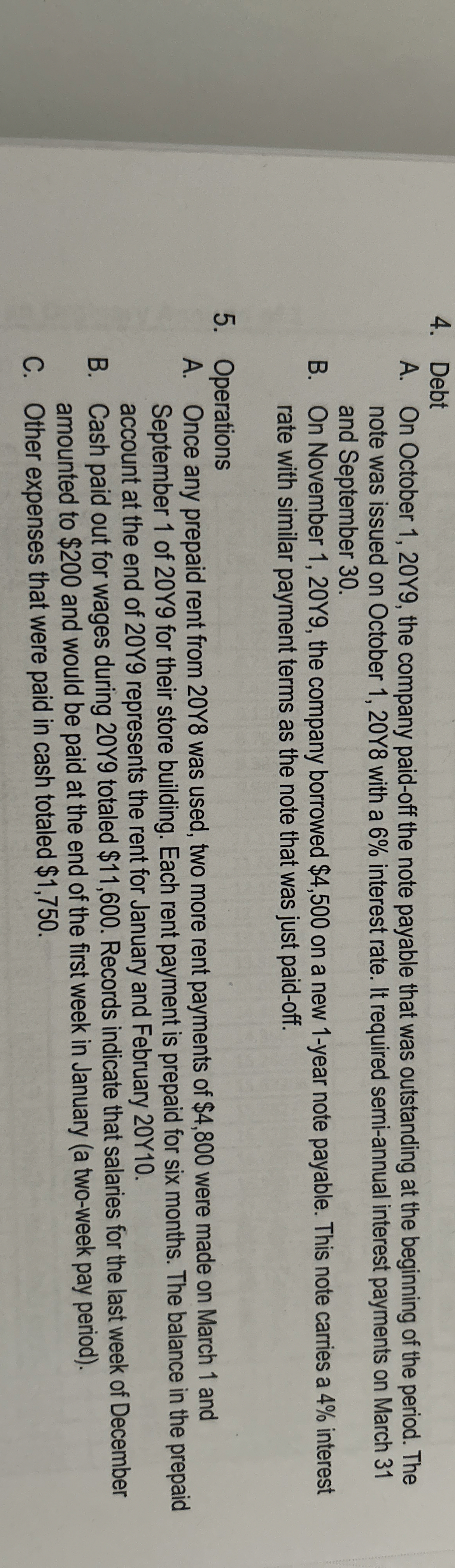

A On October the company paidoff the note payable that was outstanding at the beginning of the period. The note was issued on October Y with a interest rate. It required semiannual interest payments on March and September

B On November the company borrowed $ on a new year note payable. This note carries a interest rate with similar payment terms as the note that was just paidoff.

Operations

A Once any prepaid rent from Y was used, two more rent payments of $ were made on March and September of Yg for their store building. Each rent payment is prepaid for six months. The balance in the prepaid account at the end of Y represents the rent for January and February Y

B Cash paid out for wages during Yg totaled $ Records indicate that salaries for the last week of December amounted to $ and would be paid at the end of the first week in January a twoweek pay period

C Other expenses that were paid in cash totaled $Please record journal entries

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock