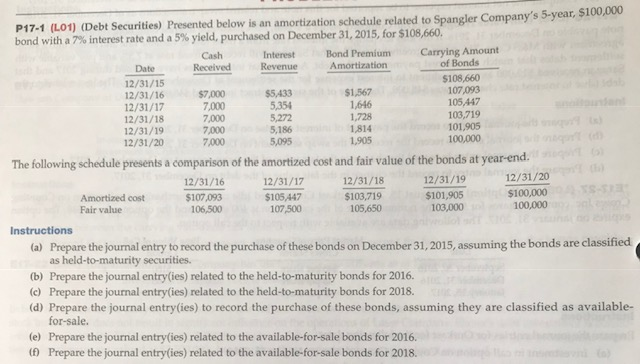

Question: ) (Debt Securities) Presented below is an amortization schedule related to Spangler Company's 5-year, $100,000 bond with a 7% interest rate and a 5% yield,

) (Debt Securities) Presented below is an amortization schedule related to Spangler Company's 5-year, $100,000 bond with a 7% interest rate and a 5% yield, purchased on December 31, 201 5, for $108,660. Cash InterestBond Premium Carrying Amount of Bonds $108,660 107,093 105,447 103,719 101,905 100,000 Date Amortization ReceivedRevenue 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 $7,000 7,000 7,000 7,000 7,000 5,354 5,272 5,186 5,095 $1,567 1,646 1,728 1,814 1,905 The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end. 12/31/16 Amortized cost Fair value $107,093 106,500 2/31/17 $105,447 107 500 12/31/18 $103,719 105,650 12/31/19 $101,905 103,000 12/31/20 $100,000 100,000 Instructions (a) Prepare the journal entry to record the purchase of these bonds on December 31, 2015, assuming the bonds are classified as held-to-maturity securities. (b) Prepare the journal entry (ies) related to the held-to-maturity bonds for 2016. (c) Prepare the journal entry(ies) related to the held-to-maturity bonds for 2018. (d) Prepare the journal entry(ies) to record the purchase of these bonds, assuming they are classified as available- for-sale. (e) Prepare the journal entry(ies) related to the available-for-sale bonds for 2016 (D Prepare the journal entry(ies) related to the available-for-sale bonds for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts