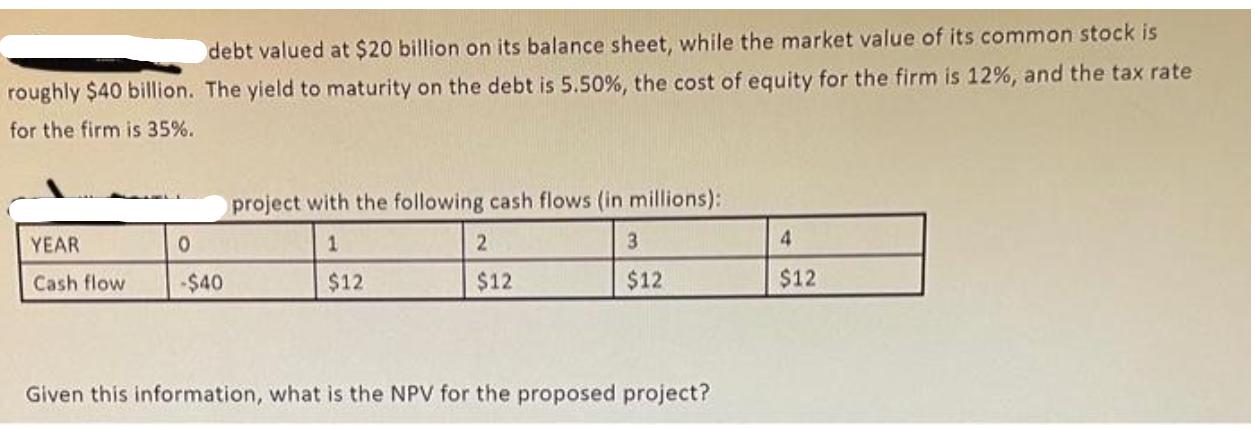

Question: debt valued at $20 billion on its balance sheet, while the market value of its common stock is roughly $40 billion. The yield to

debt valued at $20 billion on its balance sheet, while the market value of its common stock is roughly $40 billion. The yield to maturity on the debt is 5.50%, the cost of equity for the firm is 12%, and the tax rate for the firm is 35%. YEAR 0 Cash flow -$40 project with the following cash flows (in millions): 1 $12 2 3 $12 $12 Given this information, what is the NPV for the proposed project? 4 $12

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

To calculate the net present value NPV for the proposed project we need to discount the cash flows a... View full answer

Get step-by-step solutions from verified subject matter experts