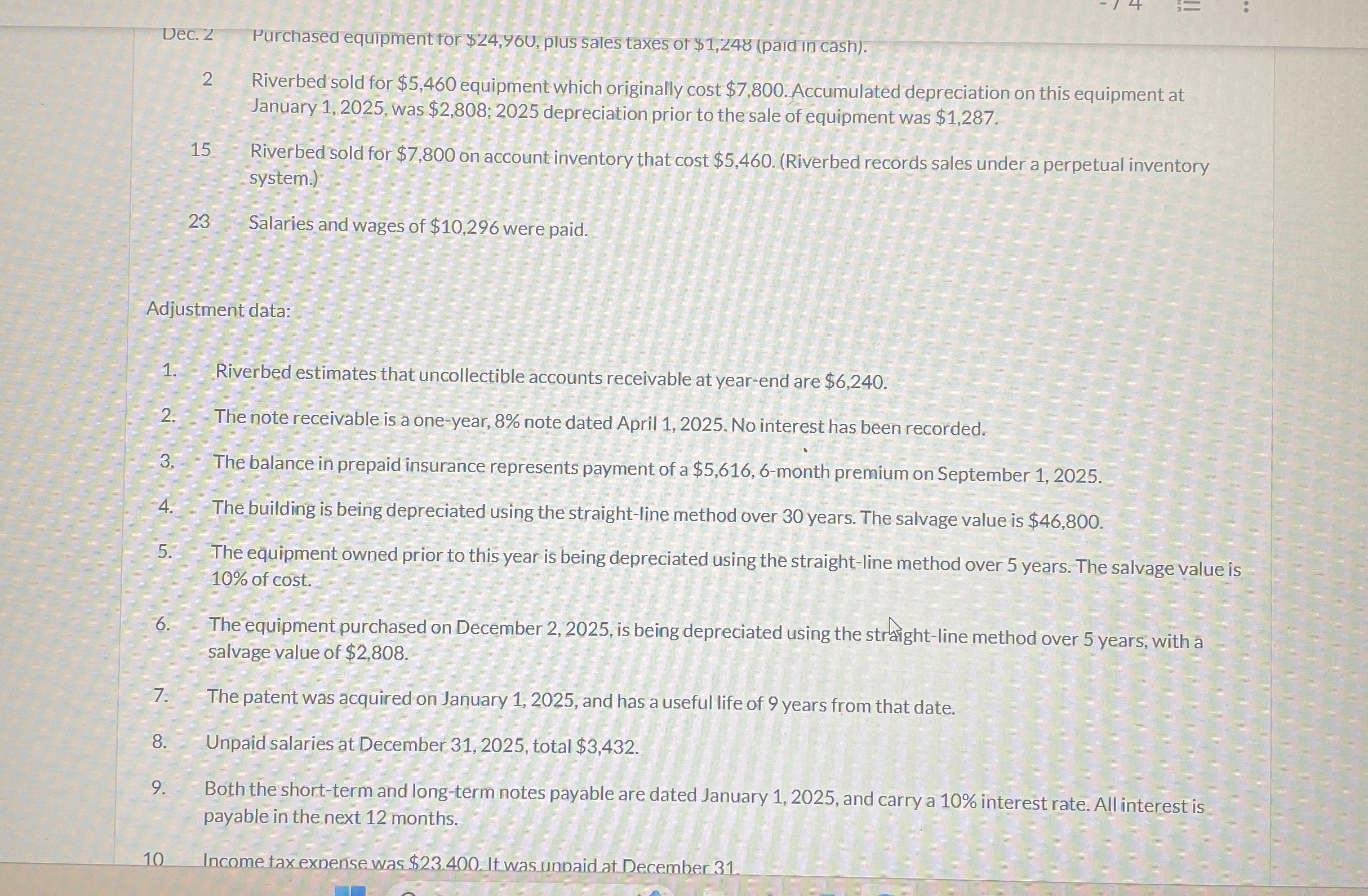

Question: Dec. 2 Purchased equipment for $ 2 4 , 9 6 0 , plus sales taxes of $ 1 , 2 4 8 ( paid

Dec. Purchased equipment for $ plus sales taxes of $paid in cash

Riverbed sold for $ equipment which originally cost $ Accumulated depreciation on this equipment at January was $; depreciation prior to the sale of equipment was $

Riverbed sold for $ on account inventory that cost $Riverbed records sales under a perpetual inventory system.

Salaries and wages of $ were paid.

Adjustment data:

Riverbed estimates that uncollectible accounts receivable at yearend are $

The note receivable is a oneyear, note dated April No interest has been recorded.

The balance in prepaid insurance represents payment of a $month premium on September

The building is being depreciated using the straightline method over years. The salvage value is $

The equipment owned prior to this year is being depreciated using the straightline method over years. The salvage value is of cost

The equipment purchased on December is being depreciated using the strayghtline method over years, with a salvage value of $

The patent was acquired on January and has a useful life of years from that date.

Unpaid salaries at December total $

Both the shortterm and longterm notes payable are dated January and carry a interest rate. All interest is payable in the next months.

Incometax exnense was $ It was unnaid at December

Prepare journal entries for the transactions listed above and adjusting entries

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock