Question: Dec 2 Stock dividends e preparing financial statements for the current year, the chief accountant for Oriole Company discovered the following er counts. The declaration

Dec 2 Stock dividends

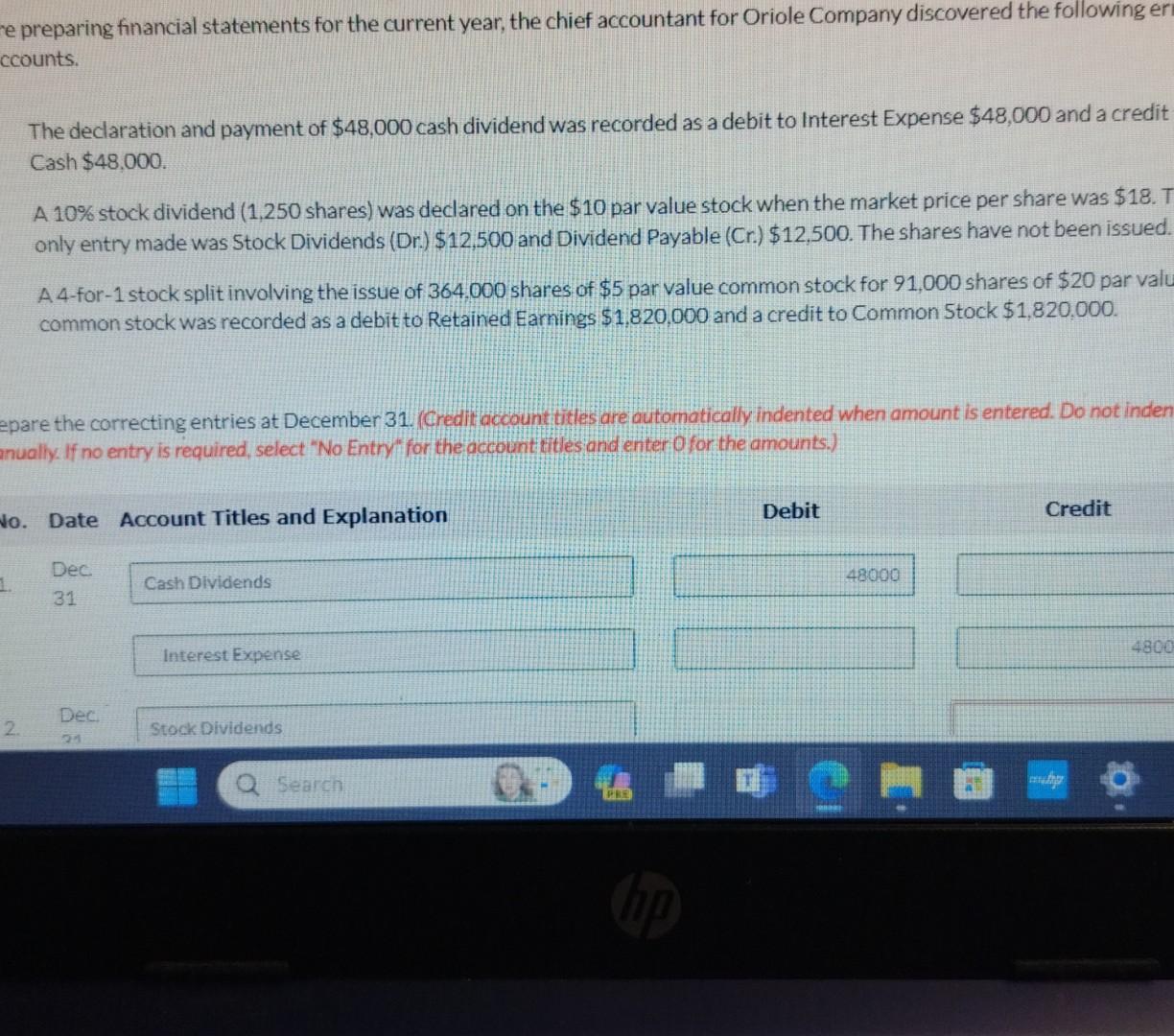

e preparing financial statements for the current year, the chief accountant for Oriole Company discovered the following er counts. The declaration and payment of $48,000 cash dividend was recorded as a debit to Interest Expense $48,000 and a credit Cash $48,000. A 10\% stock dividend (1,250 shares) was declared on the $10 par value stock when the market price per share was $18.7 only entry made was Stock Dividends (Dr.) $12,500 and Dividend Payable (Cr.) $12,500. The shares have not been issued A 4-for-1 stock split involving the issue of 364,000 shares of $5 par value common stock for 91,000 shares of $20 par valu common stock was recorded as a debit to Retained Earnings $1,820,000 and a credit to Common 5 tock $1,820,000. pare the correcting entries at December 31. (Credit account titles are automatically indented when amount is entered. Do not inder nually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts