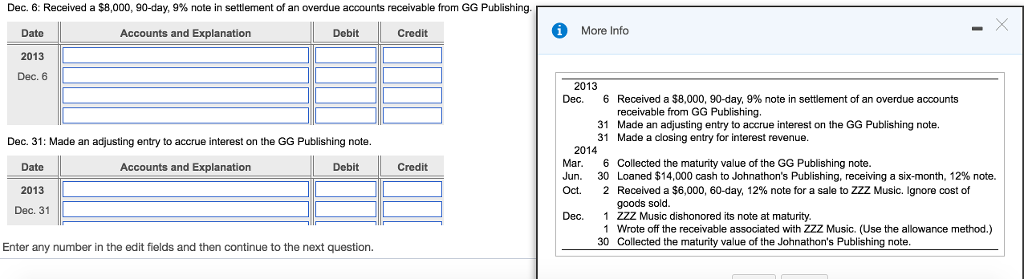

Question: Dec. 6: Received a $8,000, 90-day, 9% note in settlement of an overdue accounts receivable from GG Publishing. Credit Date Accounts and Explanation Debit 2013

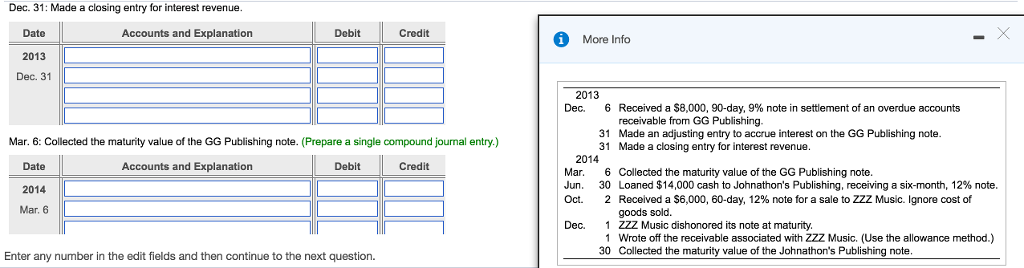

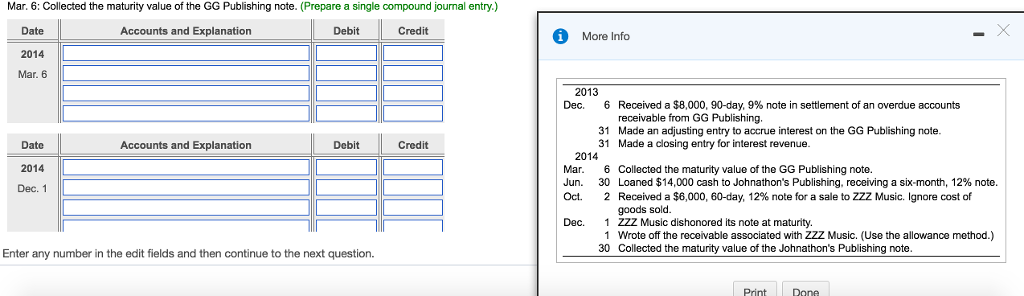

Dec. 6: Received a $8,000, 90-day, 9% note in settlement of an overdue accounts receivable from GG Publishing. Credit Date Accounts and Explanation Debit 2013 Dec. 6 Dec. 31: Made an adjusting entry to accrue interest on the GG Publishing note. Date Accounts and Explanation Debit Credit 2013 Dec. 31 Enter any number in the edit fields and then continue to the next question. More Info 2013 Dec. 6 Received a $8,000, 90-day, 9% n in settlement of an overdue accounts ote receivable from GG Publishing. 31 Made an adjusting entry to accrue interest on the GG Publishing note. 31 Made a closing entry for interest revenue. 2014 Mar. 6 Collected the maturity value of the GG Publishing note. Jun. 30 Loaned $14,000 cash to Johnathon's Publishing, receiving a six-month, 12% note. Oct. Received a $6,000, 60-day, 12% note for a sale to ZZZ Music. Ignore cost of goods sold. Dec. ZZZ Music dishonored its note at maturity. 1 Wrote off the receivable associated with ZZZ Music. (Use the allowance method. 30 Collected the maturity value of the Johnathon's Publishing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts