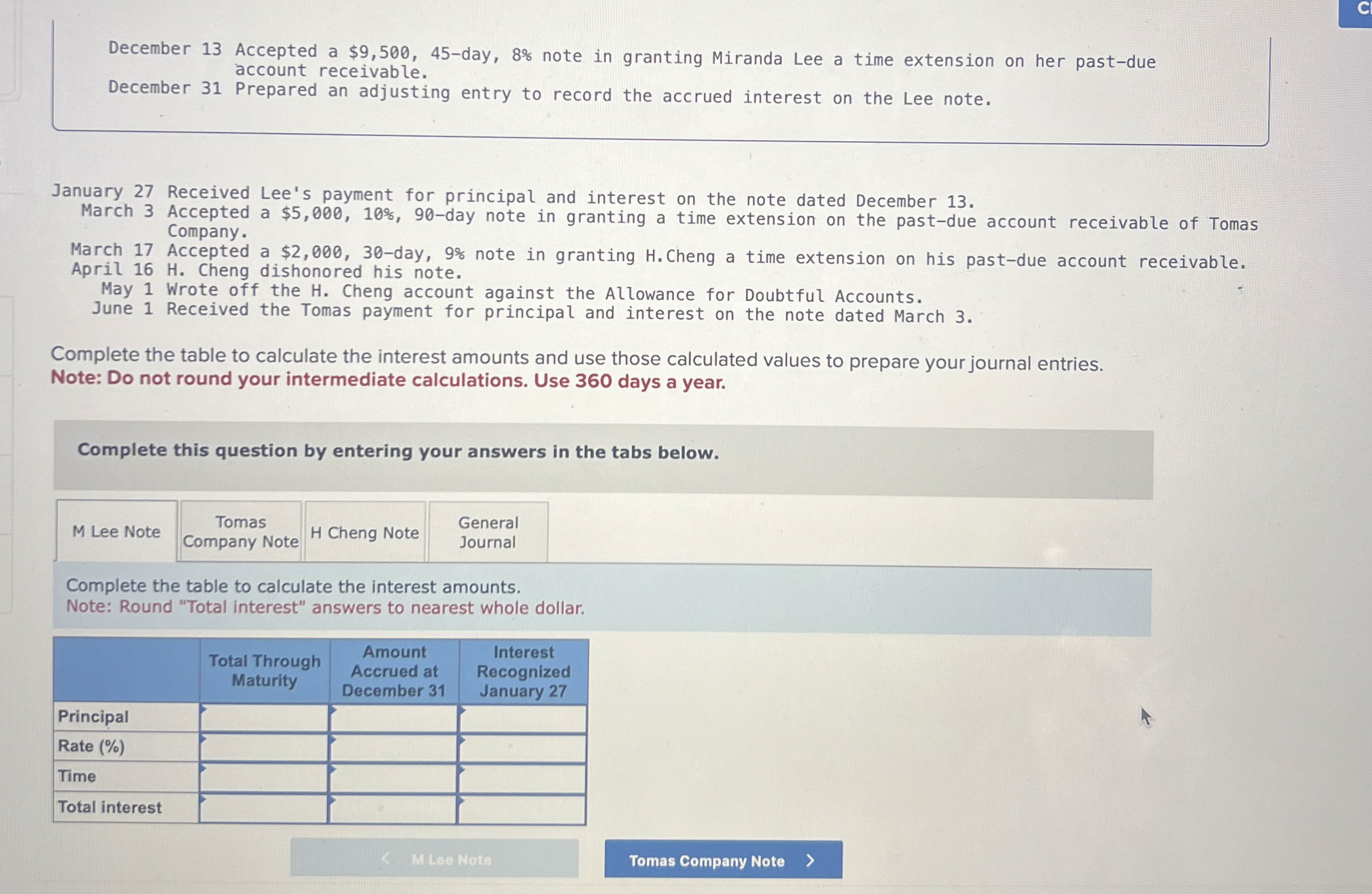

Question: December 1 3 Accepted a $ 9 , 5 0 0 , 4 5 - day, 8 % note in granting Miranda Lee a time

December Accepted a $day, note in granting Miranda Lee a time extension on her pastdue account receivable.

December Prepared an adjusting entry to record the accrued interest on the Lee note.

January Received Lee's payment for principal and interest on the note dated December

March Accepted a $day note in granting a time extension on the pastdue account receivable of Tomas Company.

March Accepted a $day, note in granting HCheng a time extension on his pastdue account receivable.

April H Cheng dishonored his note.

May Wrote off the H Cheng account against the Allowance for Doubtful Accounts.

June Received the Tomas payment for principal and interest on the note dated March

Complete the table to calculate the interest amounts and use those calculated values to prepare your journal entries.

Note: Do not round your intermediate calculations. Use days a year.

Complete this question by entering your answers in the tabs below.

tableM Lee Note,tableTomasCompany NoteH Cheng Note,tableGeneralJournaltableComplete the table to calculate the interest amounts.Note: Round "Total interest" answers to nearest whole dollar.tableTotal ThroughMaturitytableAmountAccrued atDecember tableInterestRecognizedJanuary PrincipalRate TimeTotal interest,,,

M Lee Note

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock