Question: December 16, 2019 ce 101 - Fall 2019 18. The following factors reduce the cost of insurance, EXCEPT a) Deductibles b) Coinsurance c) Hazard reduction

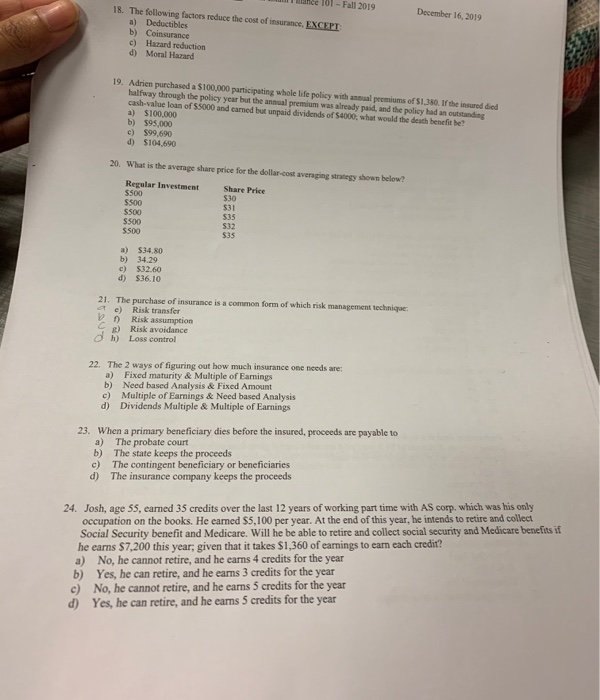

December 16, 2019 ce 101 - Fall 2019 18. The following factors reduce the cost of insurance, EXCEPT a) Deductibles b) Coinsurance c) Hazard reduction d) Moral Hazard 19. Adrien purchased a $100,000 participating whole life policy with annual premiums of S1380. If the insured died halfway through the policy year but the annual premium was already paid, and the policy had an outstanding cash-value loan of SS000 and earned but unpaid dividends of $4000, what would the death benefit be? a) S100.000 b) $95.000 e) $99.690 d) $104,690 20. What is the average share price for the dollar-cost averaging strategy shown below? Regular Investment S500 S500 Share Price 535 S500 5500 $35 a) b) c) d) S34.80 34.29 3260 36.10 21. The purchase of insurance is a common form of which risk management technique e) Risk transfer Risk assumption 2) Risk avoidance h) Loss control 22. The 2 ways of figuring out how much insurance one needs are: a) Fixed maturity & Multiple of Earnings b) Need based Analysis & Fixed Amount c) Multiple of Earnings & Need based Analysis d) Dividends Multiple & Multiple of Earnings 23. When a primary beneficiary dies before the insured, proceeds are payable to a) The probate court b) The state keeps the proceeds c) The contingent beneficiary or beneficiaries d) The insurance company keeps the proceeds 24. Josh, age 55, carned 35 credits over the last 12 years of working part time with AS corp, which was his only occupation on the books. He earned $5,100 per year. At the end of this year, he intends to retire and collect Social Security benefit and Medicare. Will he be able to retire and collect social security and Medicare benefits if he earns $7,200 this year, given that it takes $1.360 of earnings to earn each credit? a) No, he cannot retire, and he earns 4 credits for the year b) Yes, he can retire, and he earns 3 credits for the year c) No, he cannot retire, and he earns 5 credits for the year d) Yes, he can retire, and he earns 5 credits for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts