Question: DECEMBER 18 PAYDAY: (As you complete your work, answer the following questions.) What is the amount of FIT withheld for Joseph T. O'Neill? What is

DECEMBER 18 PAYDAY: (As you complete your work, answer the following questions.)

What is the amount of FIT withheld for Joseph T. O'Neill?

What is the total current net pay for all employees?

What is the total gross pay for all employees? What is the taxable amount of Joseph T. O'Neill's gross pay for OASDI?

What is the amount of the credit to cash for the deposit of FICA and FIT taxes on December 15?

What is the amount of the debit to Employees CIT Payable on December 15?

What is the balance in the Cash account?

What is the total amount of Plant Wages to date?

What is the total amount of Payroll Taxes to date?

What is the amount of the debit to Payroll Taxes?

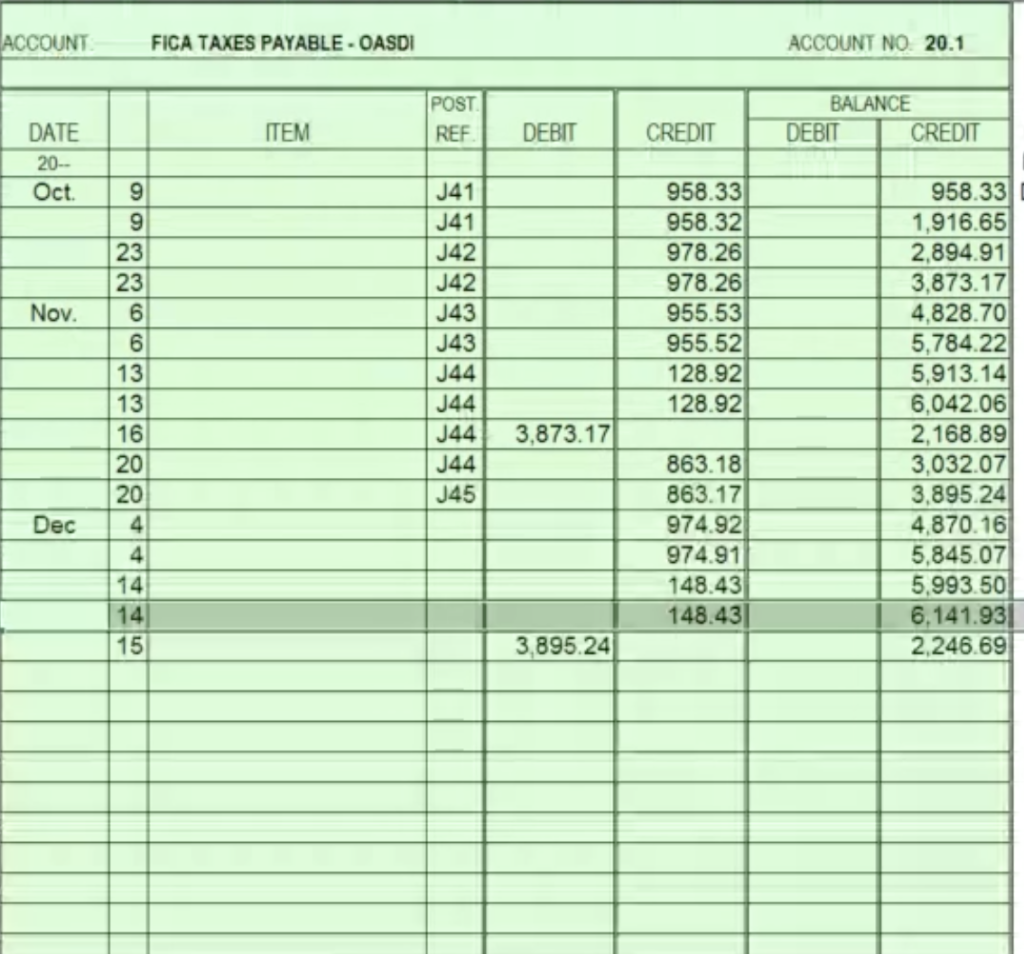

ACCOUNT FICA TAXES PAYABLE - OASDI ACCOUNT NO. 20.1 POST REF BALANCE DEBIT CREDIT ITEM DEBIT CREDIT DATE 20 - Oct. NIN 958.33 958.32 978.26 978.26 955.53 955.52 128.92 128.92 Nov. 9 9 23 23 6 6 13 13 16 20 20 4 4 14 14 15 J41 J41 J42 J42 J43 J43 J44 J44 J44 J44 J45 958.33 1,916.65 2.894.91 3,873.17 4,828.70 5,784.22 5,913.14 6,042.06 2.168.89 3,032.07 3.895.24 4,870.16 5,845.07 5.993.50 6,141.93 2.246.69 3,873.17 Dec 863.18 863.17 974.92 974.91 148.43 148.43 A 3,895.24 ACCOUNT FICA TAXES PAYABLE - OASDI ACCOUNT NO. 20.1 POST REF BALANCE DEBIT CREDIT ITEM DEBIT CREDIT DATE 20 - Oct. NIN 958.33 958.32 978.26 978.26 955.53 955.52 128.92 128.92 Nov. 9 9 23 23 6 6 13 13 16 20 20 4 4 14 14 15 J41 J41 J42 J42 J43 J43 J44 J44 J44 J44 J45 958.33 1,916.65 2.894.91 3,873.17 4,828.70 5,784.22 5,913.14 6,042.06 2.168.89 3,032.07 3.895.24 4,870.16 5,845.07 5.993.50 6,141.93 2.246.69 3,873.17 Dec 863.18 863.17 974.92 974.91 148.43 148.43 A 3,895.24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts