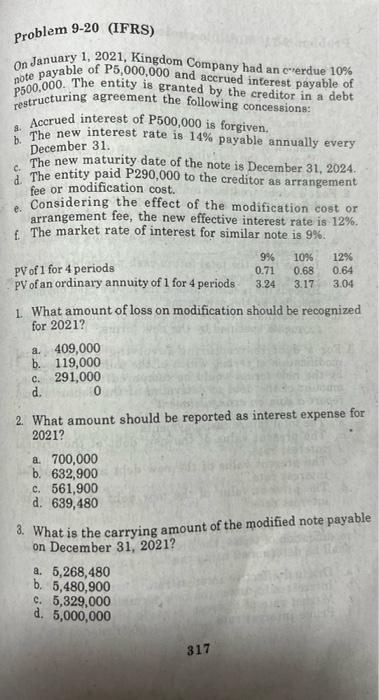

Question: December 31. c. Problem 9-20 (IFRS) note payable of P5,000,000 and accrued interest payable of On January 1, 2021, Kingdom Company had an cerdue 10%

December 31. c. Problem 9-20 (IFRS) note payable of P5,000,000 and accrued interest payable of On January 1, 2021, Kingdom Company had an cerdue 10% P500,000. The entity is granted by the creditor in a debt restructuring agreement the following concessions: Accrued interest of P500,000 is forgiven. The new interest rate is 14% payable annually every The new maturity date of the note is December 31, 2024. The entity paid P290,000 to the creditor as arrangement fee or modification cost. e Considering the effect of the modification cost or arrangement fee, the new effective interest rate is 12%. The market rate of interest for similar note is 9% 9% 10% 12% PV of 1 for 4 periods 0.71 0.68 0.64 PV of an ordinary annuity of 1 for 4 periods 3.24 3.17 3.04 1 What amount of loss on modification should be recognized for 2021? a. 409,000 b. 119,000 c. 291,000 d. 0 2. What amount should be reported as interest expense for 2021? a. 700,000 b. 632,900 C. 561,900 d. 639,480 2. What is the carrying amount of the modified note payable on December 31, 2021? a. 5,268,480 b. 5,480,900 c. 5,329,000 d. 5,000,000 317

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts