Question: Decide which information goes on which documents for Individual Tax return Your clients, Ross and Rachel Geller, both age 5 4 , are married and

Decide which information goes on which documents for Individual Tax return Your clients, Ross and Rachel Geller, both age are married and live in New York City, NY You are the tax accountant for the Gellers, and they have requested that you complete their federal income tax return, including Form darr, Schedule darr, Schedule darr,

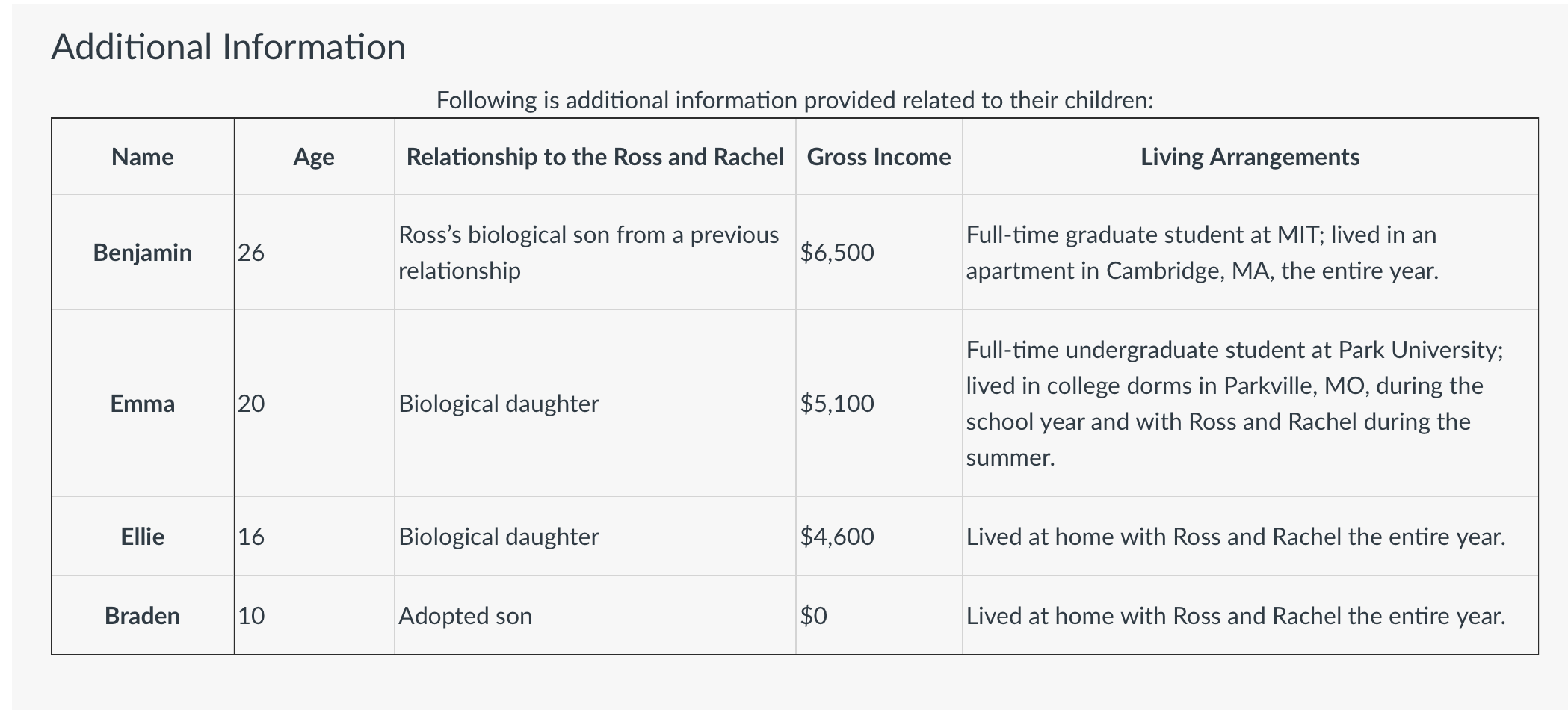

The Gellers have four children, none of whom are married or disabled, that they provided more than support for in

Additional Information

schedule schedule schedule Aandor form

Additional Information

Following is additional information provide In the Gellers paid the tuition for both Benjamin and Emma. Following is a summary of the information compiled on the Forms T

they received from MIT and Park University: Both Ross and Rachel had fulltime jobs in Following is a summary of the information compiled on the Forms W

Income Information Both Ross and Rachel had fulltime jobs in Following is a summary of the information compiled on the Fo

The Gellers also received the following other types of income during the year:

Proceeds received by Rachel as a result of a lawsuit for damages sustained in a car accident:Expense Information

The Gellers paid or incurred the following expenses in :d related to their children:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock