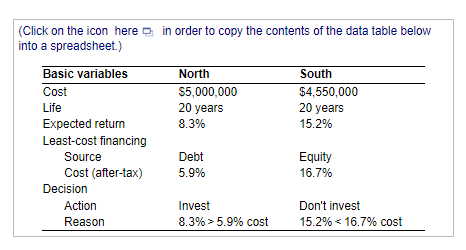

Question: decision actions are summarized in the following table c. Explain why the decisions in parts a and b may not be in the best interest

decision actions are summarized in the following table c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors d. If the firm maintains a capital structure containing 40% debt and 60% equity, find its weighted average cost using the data in the table e. If both analysts had used the weighted average cost calculated in part d, what recommendations would they have made regarding the North and South facilities? f. Compare and contrast the analysts' initial recommendations with your findings in part e. Which decision method seems more appropriate? Explain why. c. Explain why the decisions in parts a and b may not be in the best interest of the firm's investors. (Select the best answer below.) d. If the firm maintains a capital structure containing 40% debt and 60% equity, its weighted average cost is 6 . (Round to two decimal places.) A. Both the North facility and the South facility would be accepted. B. The North facility would be rejected and the South facility would be accepted. C. Both the North facility and the South facility would be rejected. D. The North facility would be accepted and the South facility would be rejected. Activar Windows CClick on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts