Question: Decision Analysis - Old vs. New Technology The next 20 questions refer to the following scenario: Consider a monopolist selling a product with inverse demand

Decision Analysis - Old vs. New Technology

The next 20 questions refer to the following scenario:

Consider a monopolist selling a product with inverse demand of PD=12?Q. The firm currently has production costs of C(q)=5+6Q. The firm has the option of attempting to develop a new technology that would lower production costs to C(q)=5+2Q. Research and development costs are $4 if undertaken and must be incurred regardless of whether or not the new technology is "successful" or a "failure." This means that in case of failure, the firm still needs to produce with C(q)=5+6Q but incurs $4 in sunk costs. If the firm attempts to develop the new technology, the innovation will be successful with probability p=3/8. Throughout your analysis, restrict attention to the profit/loss of the firm in only the current period (i.e., assume that the firm will not be operating in any future period).

The questions are submitted as screenshots for clarity--nothing is missing -- everything is here all information i was given

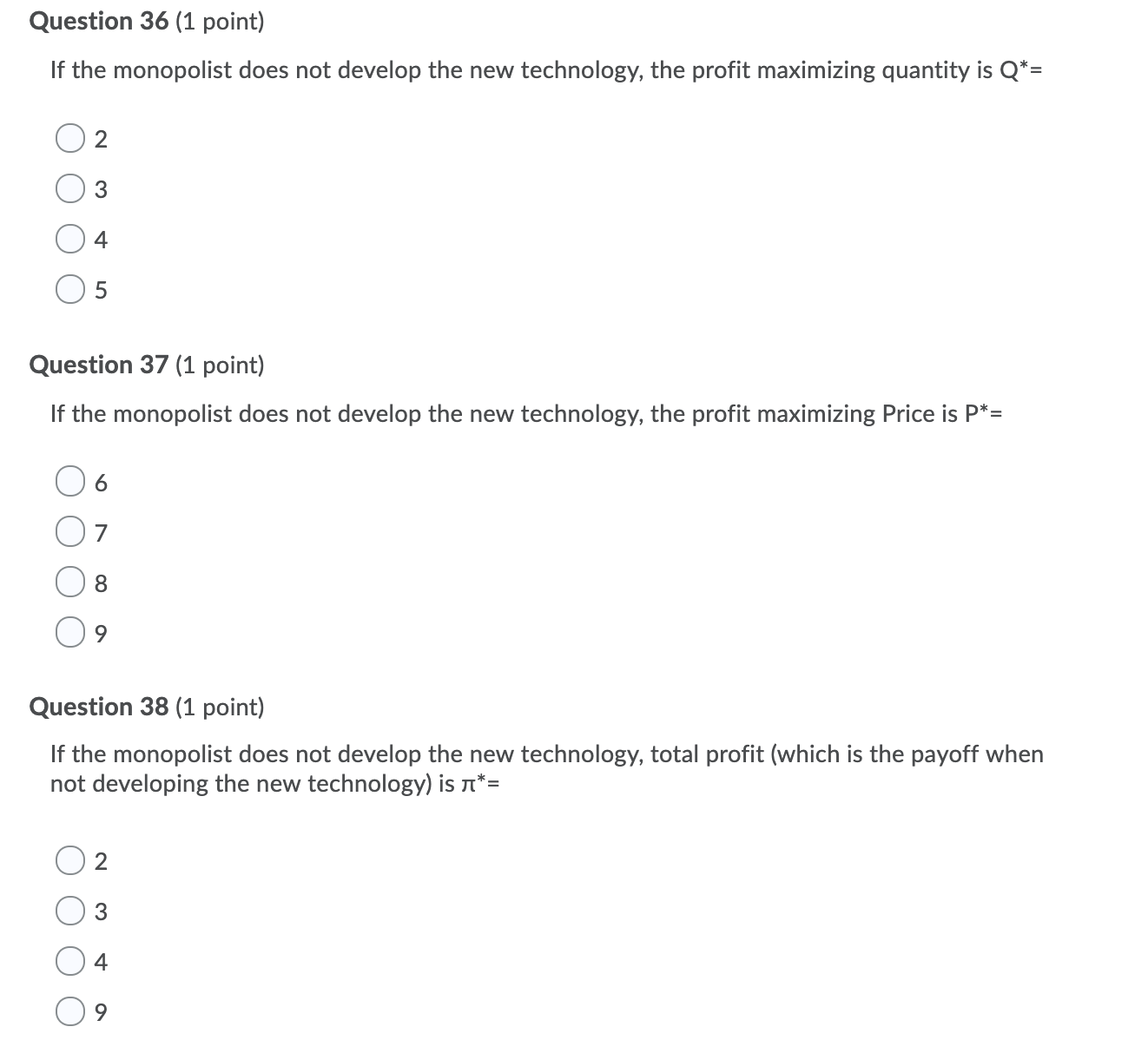

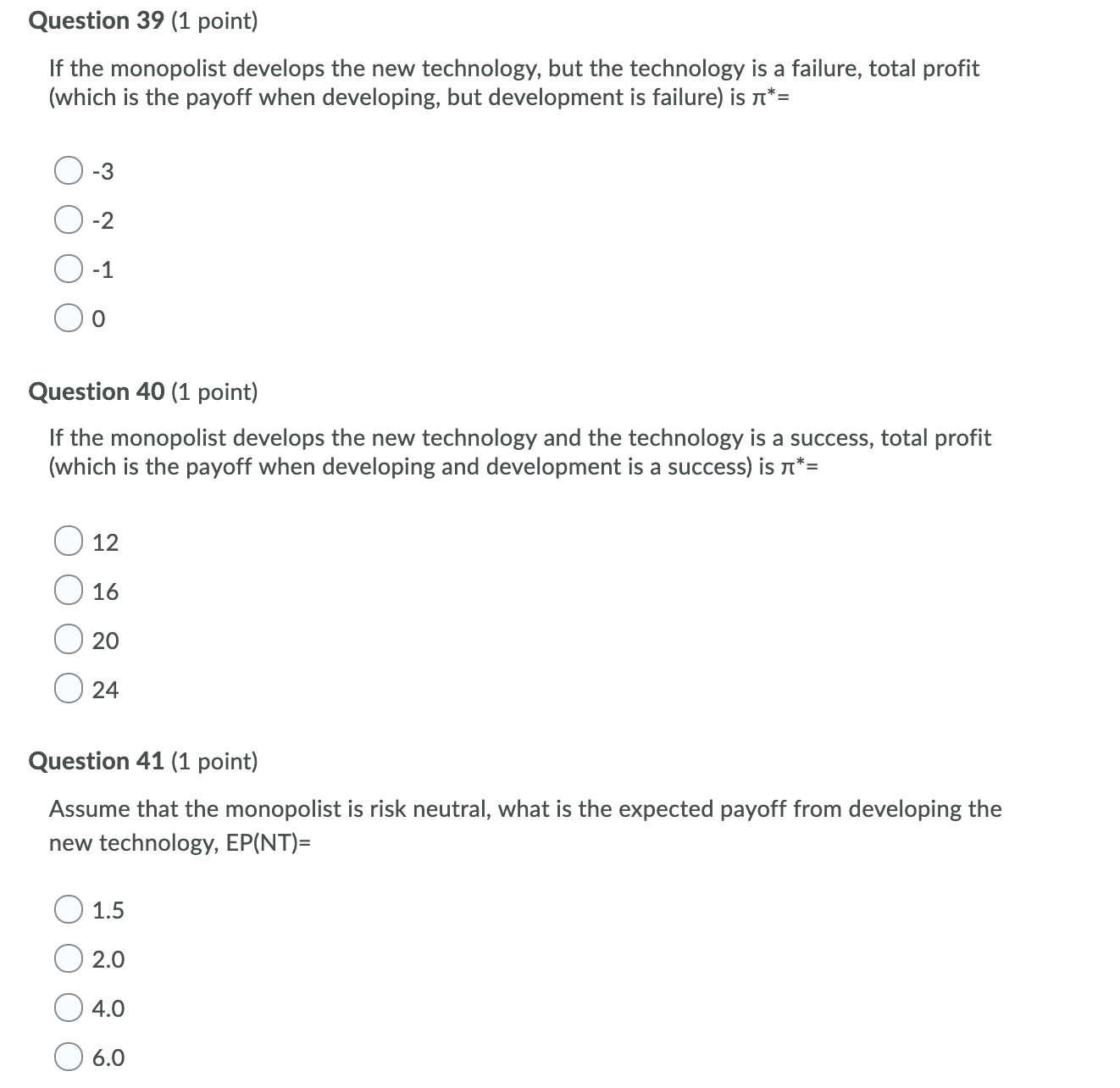

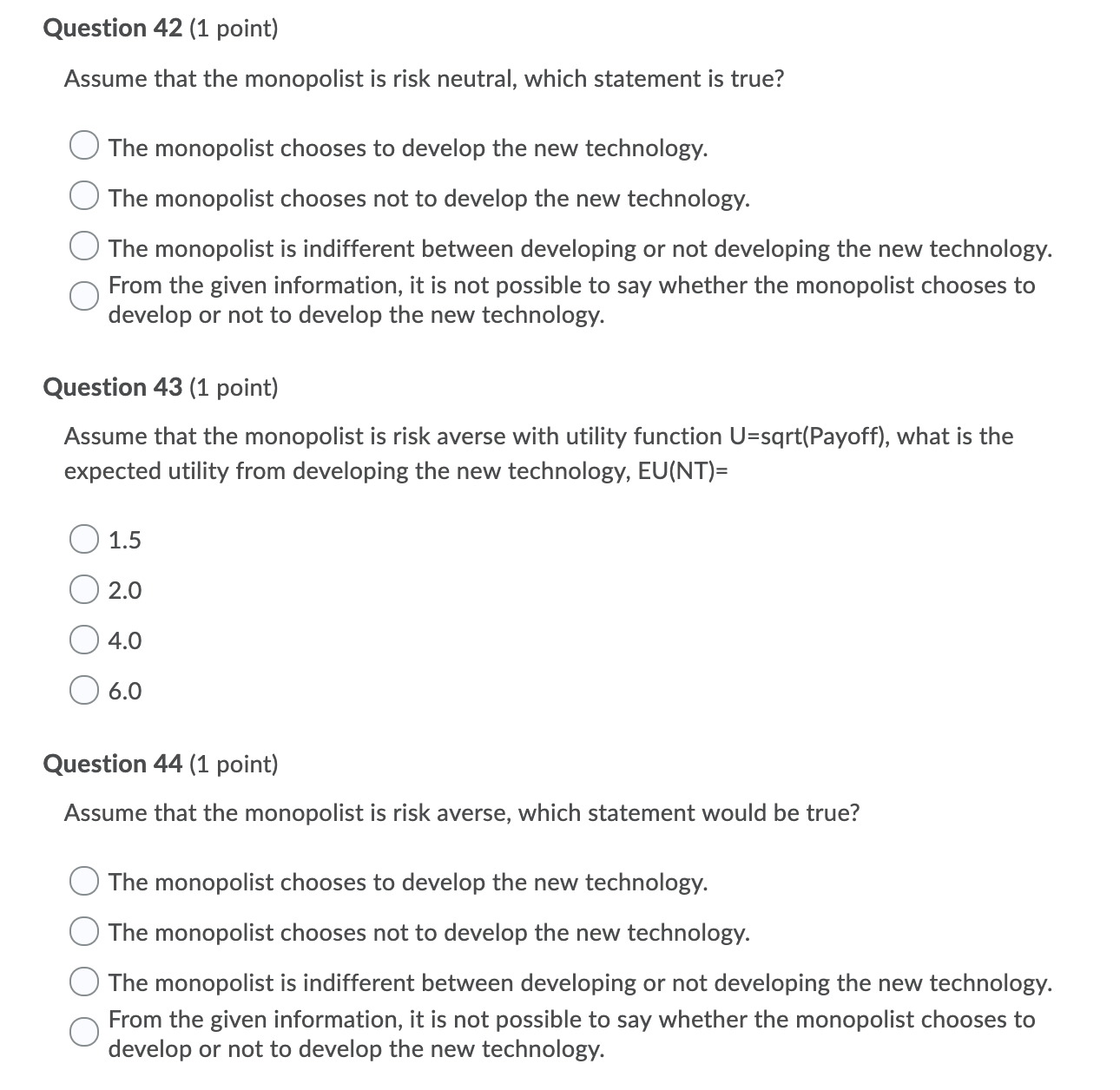

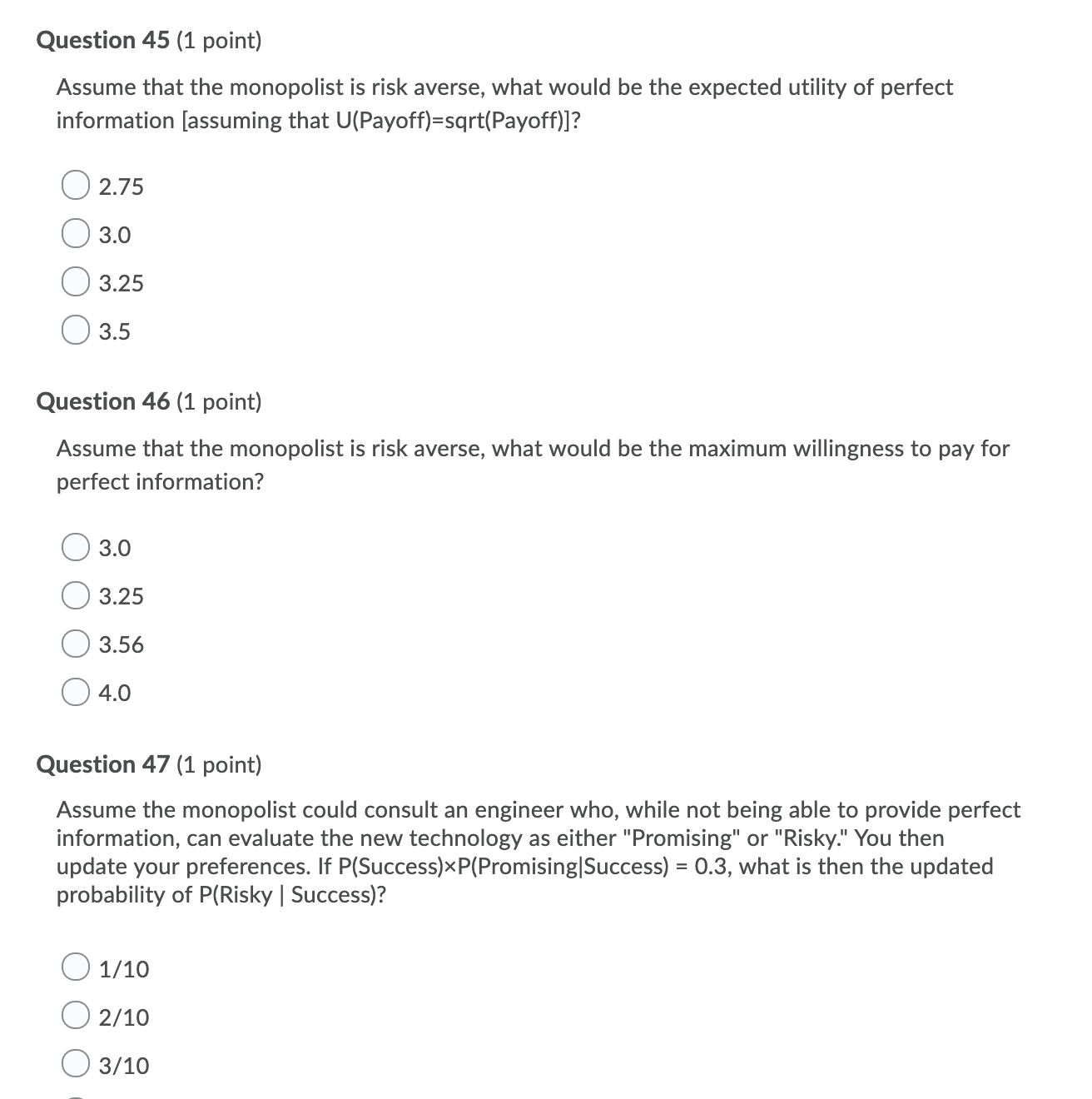

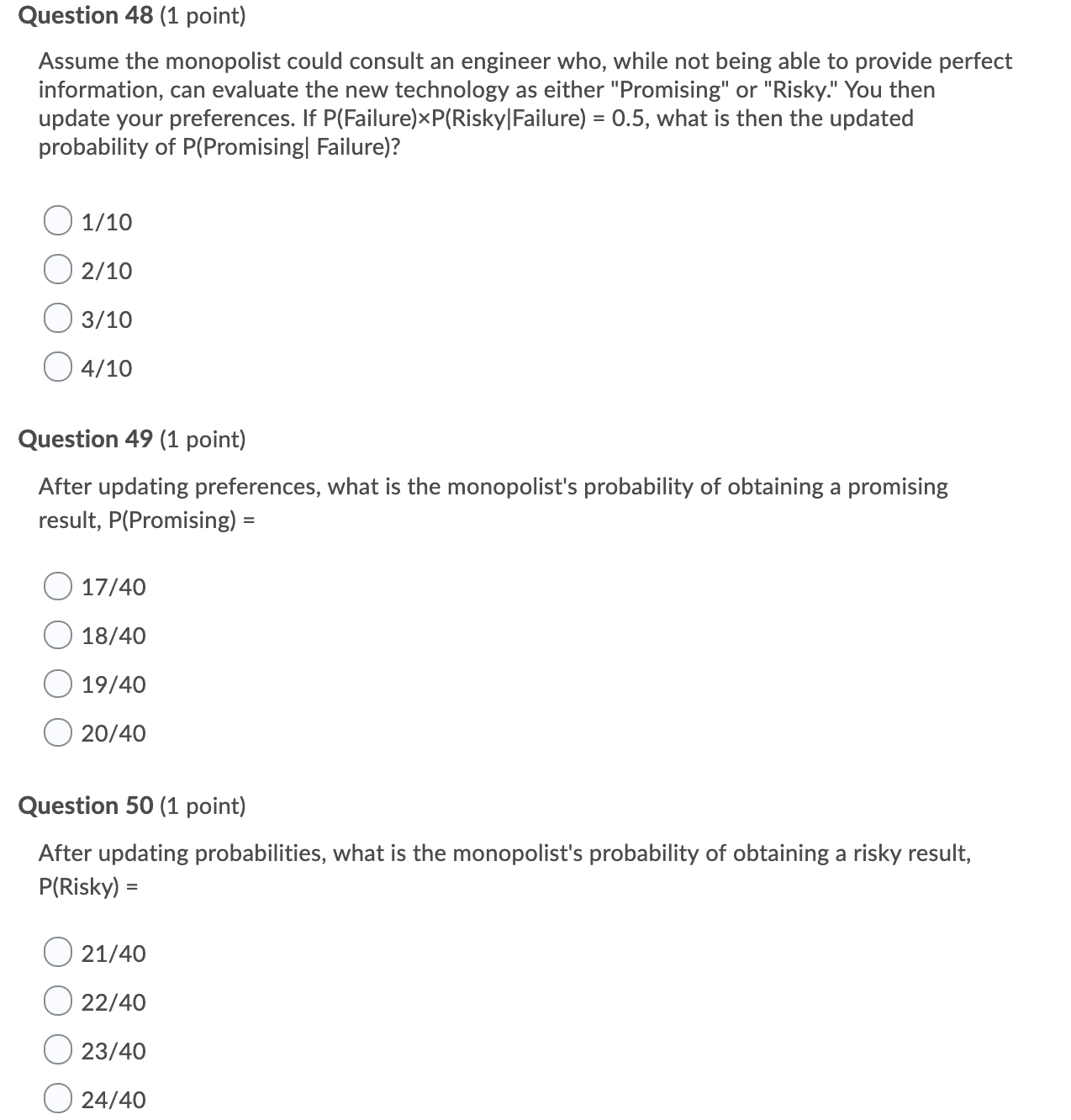

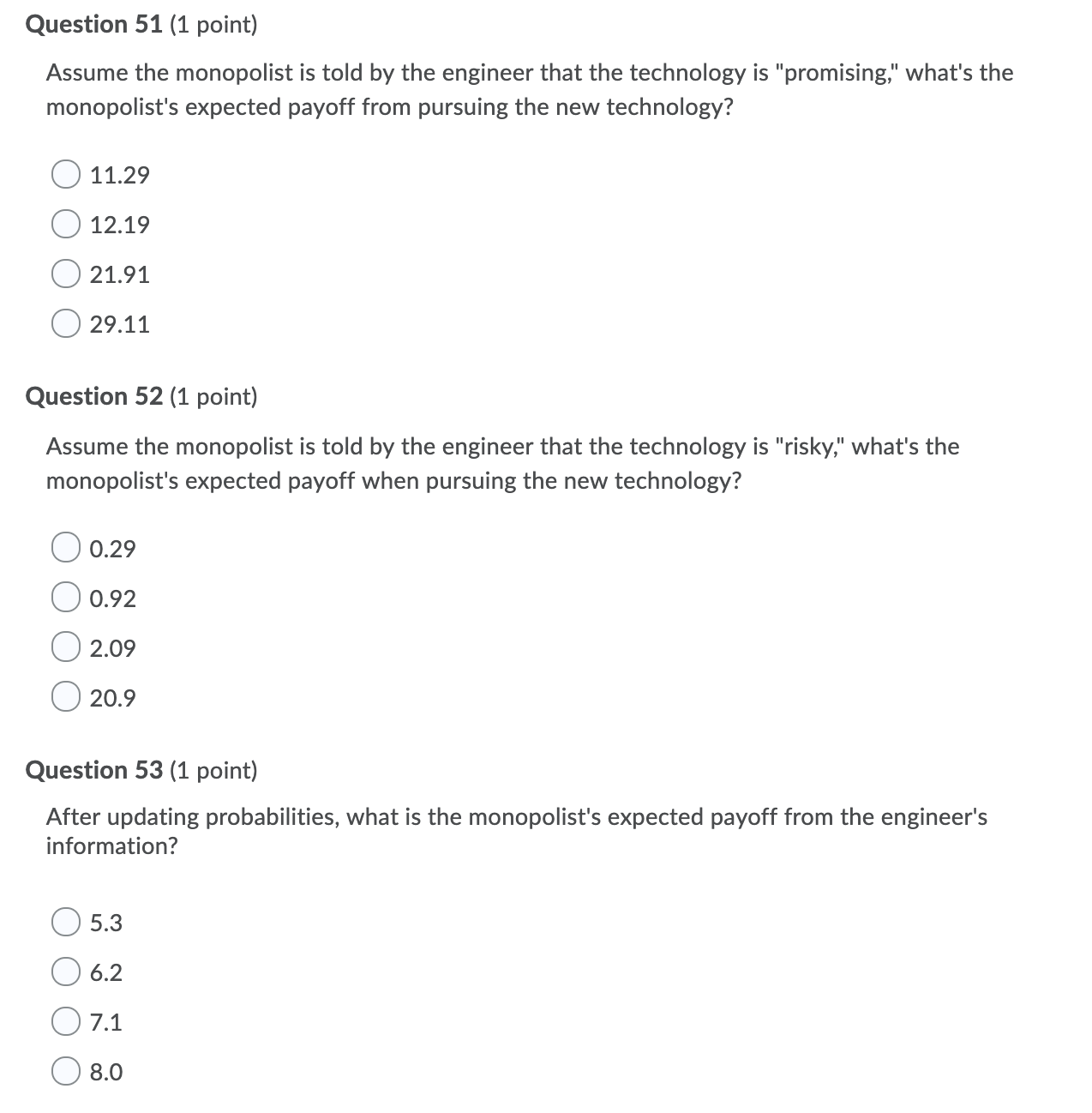

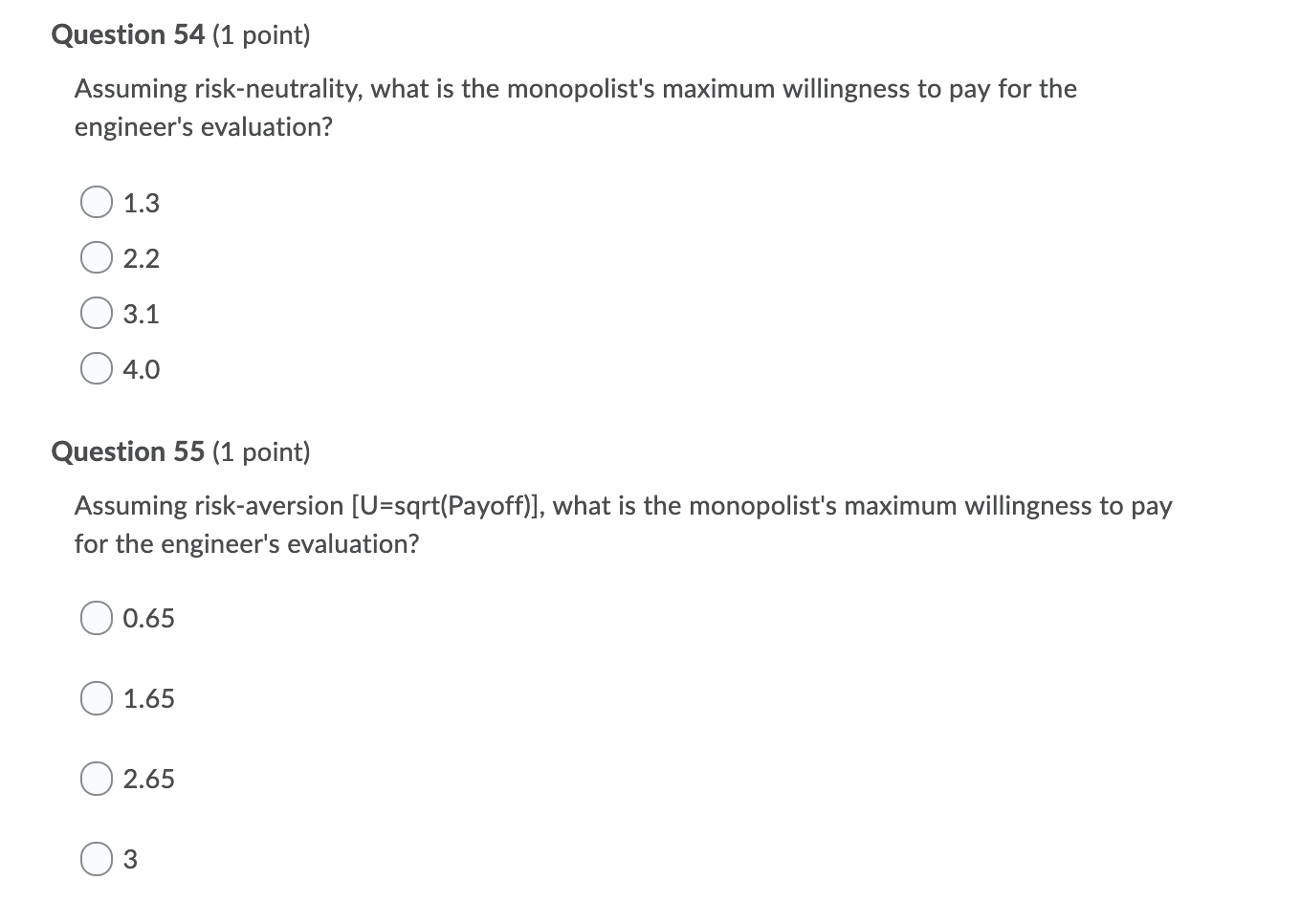

Question 36 (1 point) If the monopolist does not develop the new technology, the profit maximizing quantity is Q*= Question 37 (1 point) If the monopolist does not develop the new technology, the profit maximizing Price is P*= Question 38 (1 point) If the monopolist does not develop the new technology, total profit (which is the payoff when not developing the new technology) is n*= Question 39 (1 point) If the monopolist develops the new technology, but the technology is a failure, total profit (which is the payoff when developing, but development is failure) is n*= Question 40 (1 point) If the monopolist develops the new technology and the technology is a success, total profit (which is the payoff when developing and development is a success) is n*= Question 41 (1 point) Assume that the monopolist is risk neutral, what is the expected payoff from developing the new technology, EP(NT)= Question 42 (1 point) Assume that the monopolist is risk neutral, which statement is true? 0 The monopolist chooses to develop the new technology. 0 The monopolist chooses not to develop the new technology. 0 The monopolist is indifferent between developing or not developing the new technology. 0 From the given information, it is not possible to say whether the monopolist chooses to develop or not to develop the new technology. Question 43 (1 point) Assume that the monopolist is risk averse with utility function U=sqrt(Payoff), what is the expected utility from developing the new technology, EU(NT)= Question 44 (1 point) Assume that the monopolist is risk averse, which statement would be true? 0 The monopolist chooses to develop the new technology. 0 The monopolist chooses not to develop the new technology. 0 The monopolist is indifferent between developing or not developing the new technology. 0 From the given information, it is not possible to say whether the monopolist chooses to develop or not to develop the new technology. Question 45 (1 point) Assume that the monopolist is risk averse, what would be the expected utility of perfect information [assuming that U(Payoff)=sqrt(Payoff)]? Question 46 (1 point) Assume that the monopolist is risk averse, what would be the maximum willingness to pay for perfect information? Question 47 (1 point) Assume the monopolist could consult an engineer who, while not being able to provide perfect information, can evaluate the new technology as either "Promising" or "Risky." You then update your preferences. If P(Success)xP(Promising|Success) = 0.3, what is then the updated probability of P{Risky | Success)? Question 48 (1 point) Assume the monopolist could consult an engineer who, while not being able to provide perfect information, can evaluate the new technology as either "Promising" 0r "Risky." You then update your preferences. If P(Failure)XP(Risky|Failure) = 0.5, what is then the updated probability of P(Promisingl Failure)? Question 49 (1 point) After updating preferences, what is the monopolist's probability of obtaining a promising result, P(Promising) = C) 17/40 0 13/40 0 19/40 0 20/40 Question 50 (1 point) After updating probabilities, what is the monopolist's probability of obtaining a risky result, PlRisky) = C) 21/40 0 22/40 0 23/40 O 24/40 Question 51 (1 point) Assume the monopolist is told by the engineer that the technology is "promising," what's the monopolist's expected payoff from pursuing the new technology? Question 52 (1 point) Assume the monopolist is told by the engineer that the technology is "risky," what's the monopolist's expected payoff when pursuing the new technology? Question 53 (1 point) After updating probabilities, what is the monopolist's expected payoff from the engineer's information? Question 54 (1 point) Assuming risk-neutrality, what is the monopolist's maximum willingness to pay for the engineer's evaluation? Question 55 (1 point) Assuming risk-aversion [U=sqrt(Payoff)], what is the monopolist's maximum willingness to pay for the engineer's evaluation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts