Question: Decision and Risk Analysis Decision and Risk Analysis Question 2 (30 pts) An investment firm is thinking of investing in a new fuel cell development.

Decision and Risk Analysis

Decision and Risk Analysis

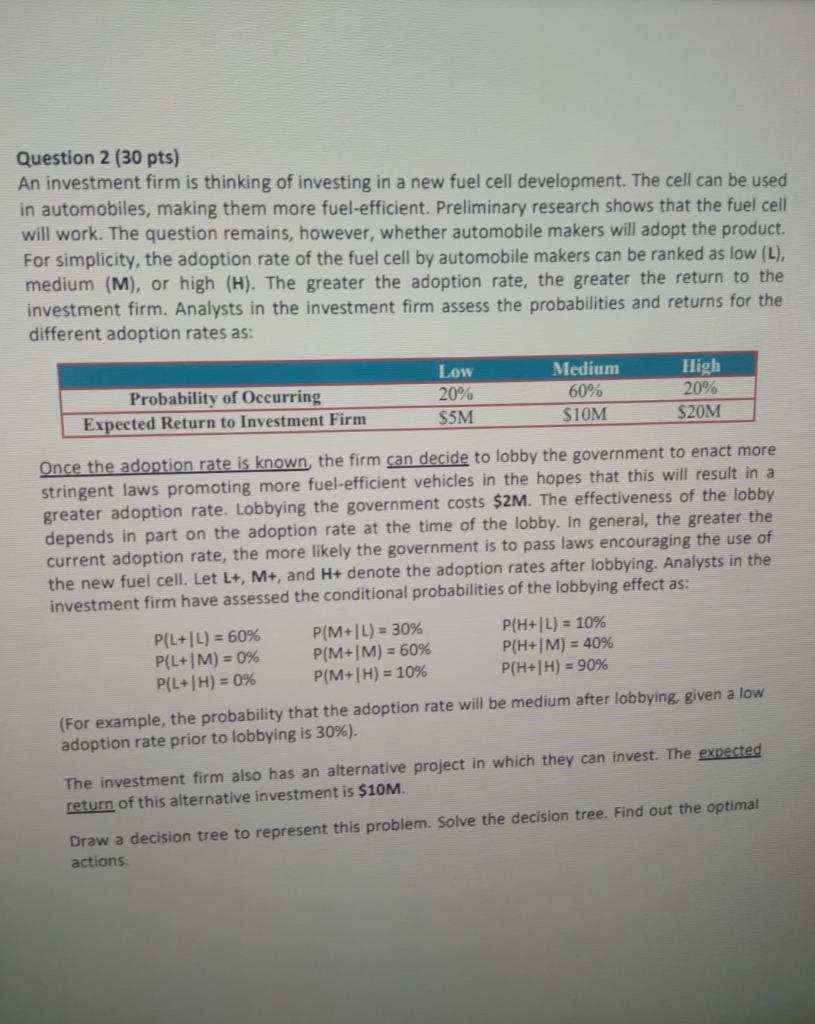

Question 2 (30 pts) An investment firm is thinking of investing in a new fuel cell development. The cell can be used in automobiles, making them more fuel-efficient. Preliminary research shows that the fuel cell will work. The question remains, however, whether automobile makers will adopt the product. For simplicity, the adoption rate of the fuel cell by automobile makers can be ranked as low (L), medium (M), or high (H). The greater the adoption rate, the greater the return to the investment firm. Analysts in the investment firm assess the probabilities and returns for the different adoption rates as: Low 20% $5M Probability of Occurring Expected Return to Investment Firm Medium 60% SIOM High 20% $20M Once the adoption rate is known the firm can decide to lobby the government to enact more stringent laws promoting more fuel-efficient vehicles in the hopes that this will result in a greater adoption rate. Lobbying the government costs $2M. The effectiveness of the lobby depends in part on the adoption rate at the time of the lobby. In general, the greater the current adoption rate, the more likely the government is to pass laws encouraging the use of the new fuel cell. Let L+, M+, and H+ denote the adoption rates after lobbying. Analysts in the investment firm have assessed the conditional probabilities of the lobbying effect as: P(L+IL) = 60% P(M+IL) = 30% P(H+|L) = 10% P(L+ M) = 0% P(M+IM) = 60% P(H+ M) = 40% P(L+1H) = 0% P(M+1H) = 10% P(H+ H) = 90% (For example, the probability that the adoption rate will be medium after lobbying, given a low adoption rate prior to lobbying is 30%). The investment firm also has an alternative project in which they can invest. The expected return of this alternative investment is $10M. Draw a decision tree to represent this problem. Solve the decision tree. Find out the optimal actions Question 2 (30 pts) An investment firm is thinking of investing in a new fuel cell development. The cell can be used in automobiles, making them more fuel-efficient. Preliminary research shows that the fuel cell will work. The question remains, however, whether automobile makers will adopt the product. For simplicity, the adoption rate of the fuel cell by automobile makers can be ranked as low (L), medium (M), or high (H). The greater the adoption rate, the greater the return to the investment firm. Analysts in the investment firm assess the probabilities and returns for the different adoption rates as: Low 20% $5M Probability of Occurring Expected Return to Investment Firm Medium 60% SIOM High 20% $20M Once the adoption rate is known the firm can decide to lobby the government to enact more stringent laws promoting more fuel-efficient vehicles in the hopes that this will result in a greater adoption rate. Lobbying the government costs $2M. The effectiveness of the lobby depends in part on the adoption rate at the time of the lobby. In general, the greater the current adoption rate, the more likely the government is to pass laws encouraging the use of the new fuel cell. Let L+, M+, and H+ denote the adoption rates after lobbying. Analysts in the investment firm have assessed the conditional probabilities of the lobbying effect as: P(L+IL) = 60% P(M+IL) = 30% P(H+|L) = 10% P(L+ M) = 0% P(M+IM) = 60% P(H+ M) = 40% P(L+1H) = 0% P(M+1H) = 10% P(H+ H) = 90% (For example, the probability that the adoption rate will be medium after lobbying, given a low adoption rate prior to lobbying is 30%). The investment firm also has an alternative project in which they can invest. The expected return of this alternative investment is $10M. Draw a decision tree to represent this problem. Solve the decision tree. Find out the optimal actionsStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock