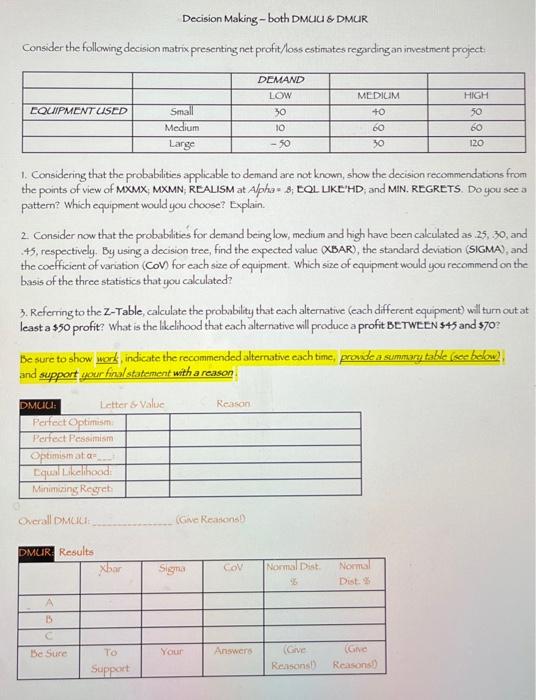

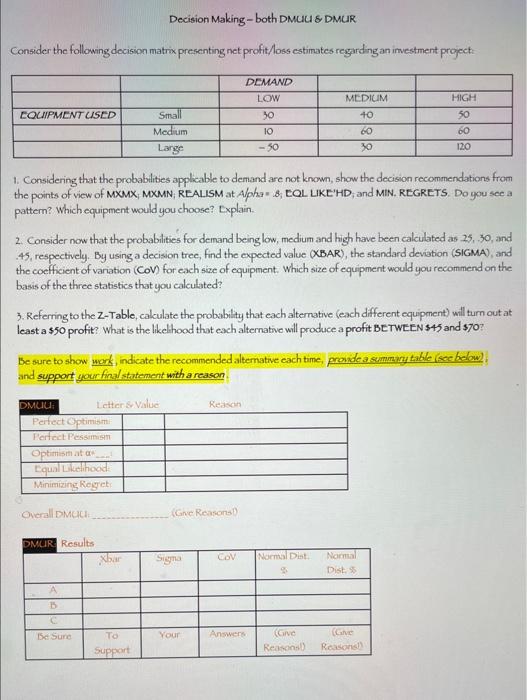

Question: decision mainh- both DMUU & DMUR Decision Making - both DMUU & DMUR Consider the following decision matrix presenting net profit/loss estimates regarding an investment

Decision Making - both DMUU \& DMUR Consider the following decision matrix presenting net profit/loss estimates regarding an investment project: 1. Considering that the probabilities applicable to demand are not known, show the decision recommendations from the points of view of MOMX MXMN; REALISM at A/pha = B; EOL LKE'HD; and MIN. REGRETS. Do you see a pattern? Which equipment would you choose? Explain. 2. Consider now that the probabilities for demand being low, medium and high have been calculated as 25,30 , and 45, respectively. By using a decision tree, find the expected value (XBAR), the standard deviation (SIGMA), and the coefficient of variation (COV) for each size of equipment. Which size of equipment would you recommend on the basis of the three statistics that you calculated? 3. Refering to the Z-Table, calculate the probability that each alternative (each different equipment) will turn out at least a $50 profit? What is the likelihood that each alternative will produce a profit BETWEEN $45 and $70 ? Be sure to show work, indicate the recommended alternative each time, pronde a summary table (see below)) and support your fina/statement with a reason: Overall DMCKi: (Give Realoins) Decision Making - both DMUU \& DMUR Consider the following decision matrix presenting net profit/loss estimates regarding an imvestment project: 1. Considering that the probablities applicable to demand are not known, show the decision recommendations from the points of view of MXMX; MXMN; REALISM at A/pha = s; EOL. LIKE'HD; and MIN. REGRETS. Do you sce a pattern? Which equipment would you choose? Explain. 2. Consider now that the probabilities for denand being low, medium and high have been calculated as 25,30 , and .45 , respectively. By using a decision tree, find the expected value (XBAR), the standard deviation (SIGMA), and the coefficient of variation ( COV ) for each sige of equipment. Which size of equipment would you recommend on the basis of the three statistics that you calculated? 3. Referring to the Z-Table, calculate the probability that each alternative (each different equipment) will turn out at least a $50 profit? What is the likelihood that each alternative will produce a profit BETWEEN $45 and $70 ? Be sure to show work, indicate the recommended altemative each time, pronde a summary table (see below); and support your finalstatement with a reasan. Overall DMGU: (Gne Reasons?) Decision Making - both DMUU \& DMUR Consider the following decision matrix presenting net profit/loss estimates regarding an investment project: 1. Considering that the probabilities applicable to demand are not known, show the decision recommendations from the points of view of MOMX MXMN; REALISM at A/pha = B; EOL LKE'HD; and MIN. REGRETS. Do you see a pattern? Which equipment would you choose? Explain. 2. Consider now that the probabilities for demand being low, medium and high have been calculated as 25,30 , and 45, respectively. By using a decision tree, find the expected value (XBAR), the standard deviation (SIGMA), and the coefficient of variation (COV) for each size of equipment. Which size of equipment would you recommend on the basis of the three statistics that you calculated? 3. Refering to the Z-Table, calculate the probability that each alternative (each different equipment) will turn out at least a $50 profit? What is the likelihood that each alternative will produce a profit BETWEEN $45 and $70 ? Be sure to show work, indicate the recommended alternative each time, pronde a summary table (see below)) and support your fina/statement with a reason: Overall DMCKi: (Give Realoins) Decision Making - both DMUU \& DMUR Consider the following decision matrix presenting net profit/loss estimates regarding an imvestment project: 1. Considering that the probablities applicable to demand are not known, show the decision recommendations from the points of view of MXMX; MXMN; REALISM at A/pha = s; EOL. LIKE'HD; and MIN. REGRETS. Do you sce a pattern? Which equipment would you choose? Explain. 2. Consider now that the probabilities for denand being low, medium and high have been calculated as 25,30 , and .45 , respectively. By using a decision tree, find the expected value (XBAR), the standard deviation (SIGMA), and the coefficient of variation ( COV ) for each sige of equipment. Which size of equipment would you recommend on the basis of the three statistics that you calculated? 3. Referring to the Z-Table, calculate the probability that each alternative (each different equipment) will turn out at least a $50 profit? What is the likelihood that each alternative will produce a profit BETWEEN $45 and $70 ? Be sure to show work, indicate the recommended altemative each time, pronde a summary table (see below); and support your finalstatement with a reasan. Overall DMGU: (Gne Reasons?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts