Question: Decision tree analysis shows a project to have several possible outcomes the best of which has an NPV of $10M calculated over a five year

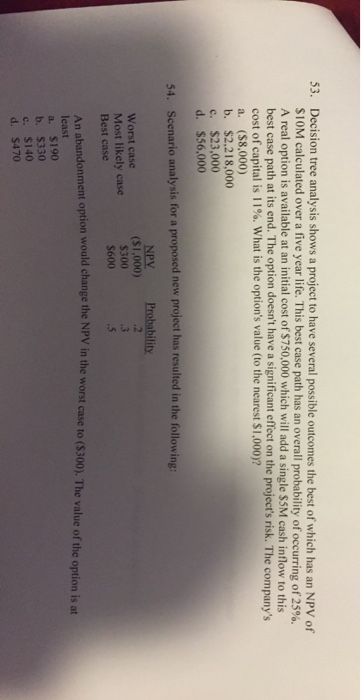

Decision tree analysis shows a project to have several possible outcomes the best of which has an NPV of $10M calculated over a five year life. This best case path has an overall probability of occurring of 25%. A real option is available at an initial cost of $750.000 which will add a single $5M cash inflow to this best ease path at its end. The option doesn't have a significant effect on the project's risk. The company's cost of capital is 11%. What is the option's value (to the nearest $1,000)? ($8,000) $2,218,000 $23,000 $56,000 Scenario analysis for a proposed new project has resulted in the following: An abandonment option would change the NPV in the worst case to ($300). The value of the option is at least $190 $330 $140 $470

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts