Question: Decision Tree from Risk management Problem 3 (30 points) Due to recent jump in the oil prices and people in Pennsylvania discovering oil on their

Decision Tree from Risk management

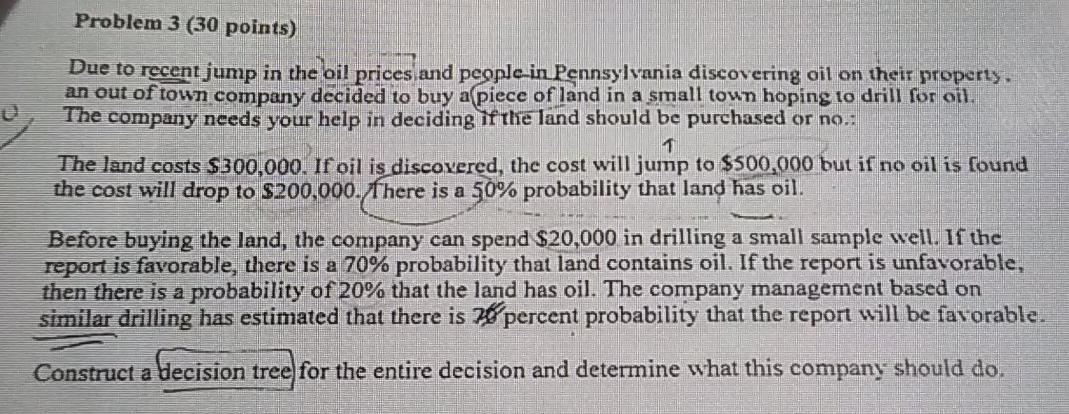

Problem 3 (30 points) Due to recent jump in the oil prices and people in Pennsylvania discovering oil on their property. an out of town company decided to buy a piece of land in a small town hoping to drill for oil. The company needs your help in deciding if the land should be purchased or no.: The land costs $300,000. If oil is discovered, the cost will jump to $500,000 but if no oil is found the cost will drop to $200,000. There is a 50% probability that land has oil. Before buying the land, the company can spend $20,000 in drilling a small sample well. If the report is favorable, there is a 70% probability that land contains oil. If the report is unfavorable, then there is a probability of 20% that the land has oil. The company management based on similar drilling has estimated that there is 76 percent probability that the report will be favorable. Construct a decision tree for the entire decision and determine what this company should doStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock