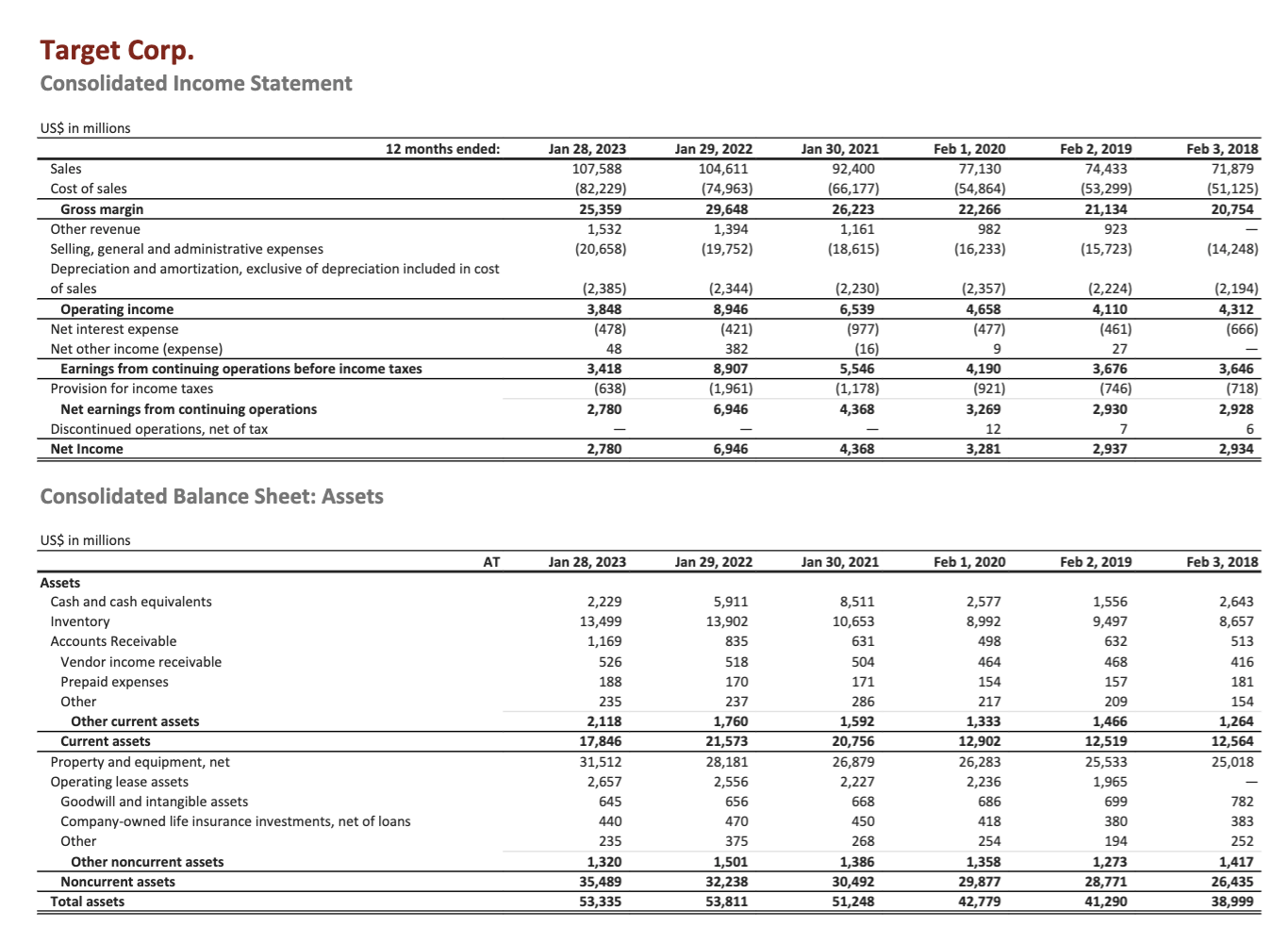

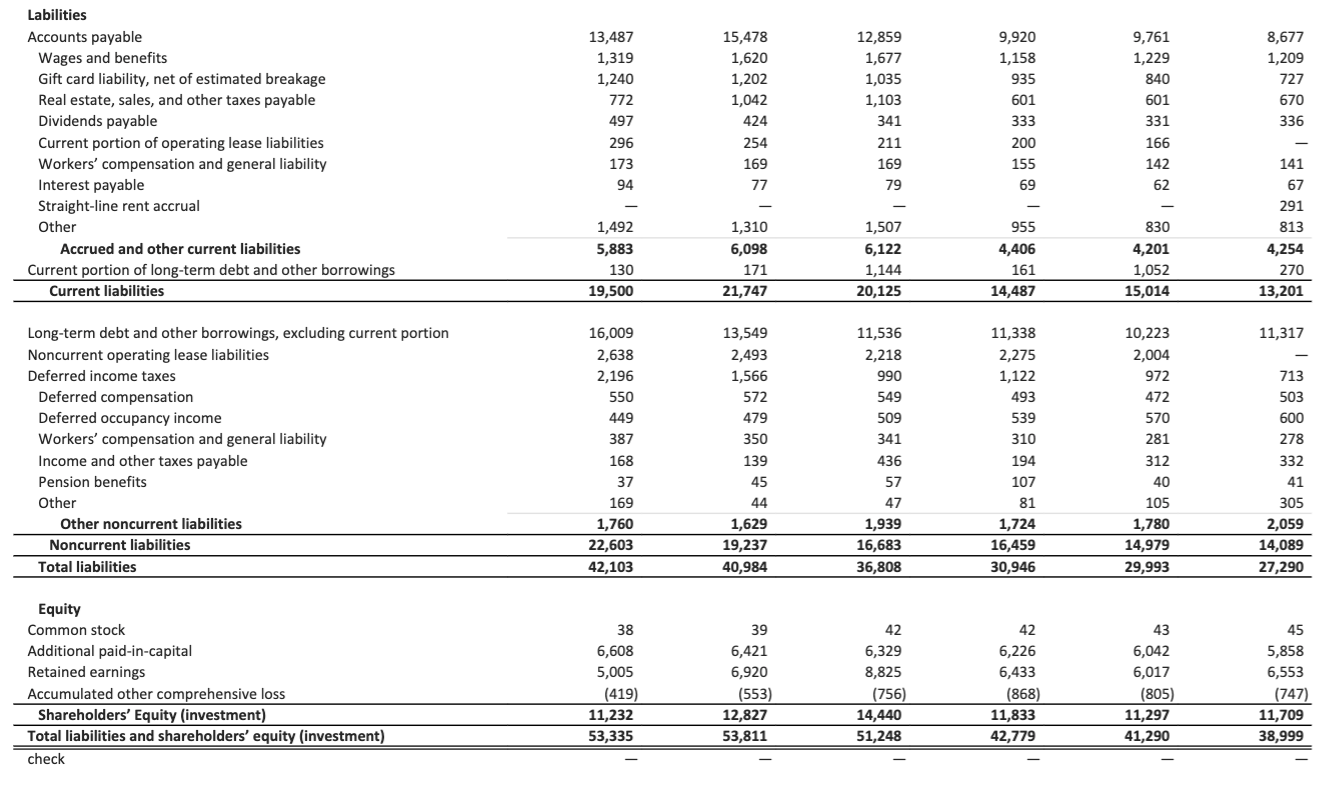

Question: Decomposing ROE involves expressing net income divided by shareholders equity as the product of component ratios (PM or profit margin x ATO or asset turnover

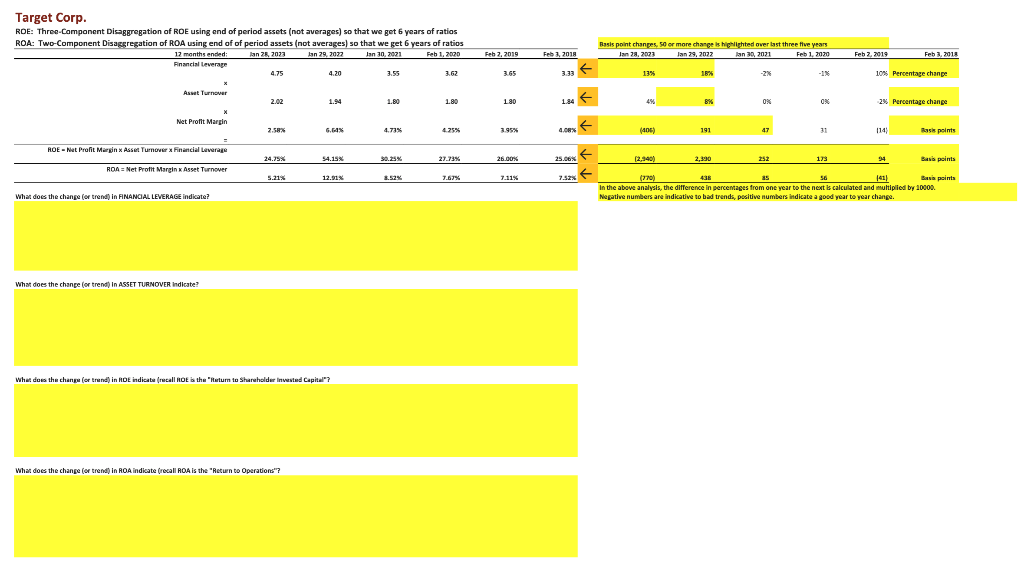

Decomposing ROE involves expressing net income divided by shareholders equity as the product of component ratios (PM or profit margin x ATO or asset turnover x LEV or Leverage).

ROE = PM x ATO x LEV

We do the calculations for you, so you only need to answer the questions. Study the results and give some depth to your analysis - that is, what did it change, not just it changed by x basis points.

ROA = PM x ATO

We do the calculations for you, so you only need to answer the questions. Study the results and give some depth to your analysis - that is, what did it change, not just it changed by x basis points.

Target Corp. Labilities Equity Target Corp. ROE: Three-Component Disggregation of ROE using end of period assets (not averages) so that we get 6 years of ratios ROA: Two-Component Disaggregation of ROA using end of of period assets (not averages) so that we get 6 years of ratios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts