Question: Decrease in Accounts Payable Net Cash Provided by Operating Activities Additional data (ignoring taxes): 1. Net income for the year was $42,400. 2. Cash dividends

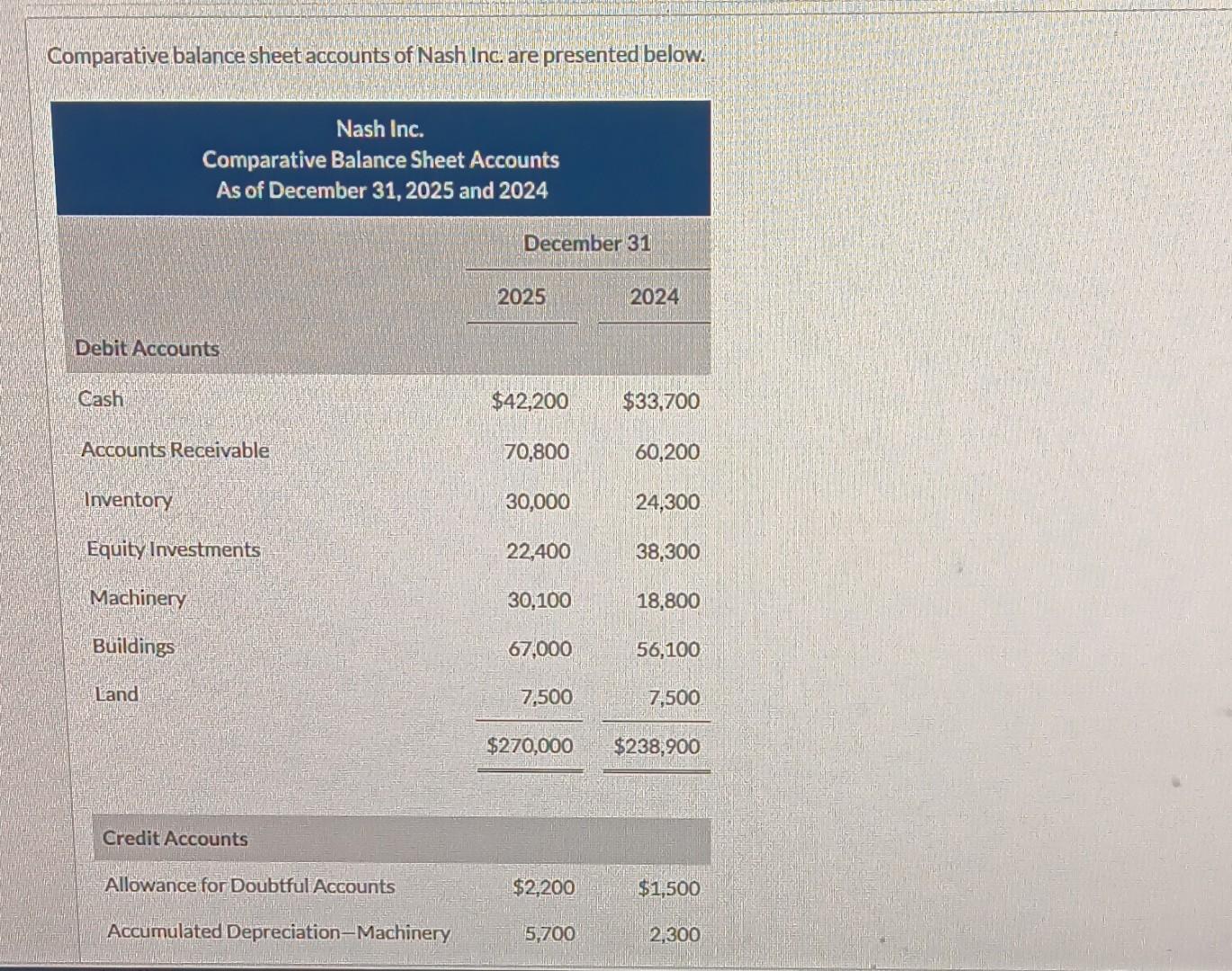

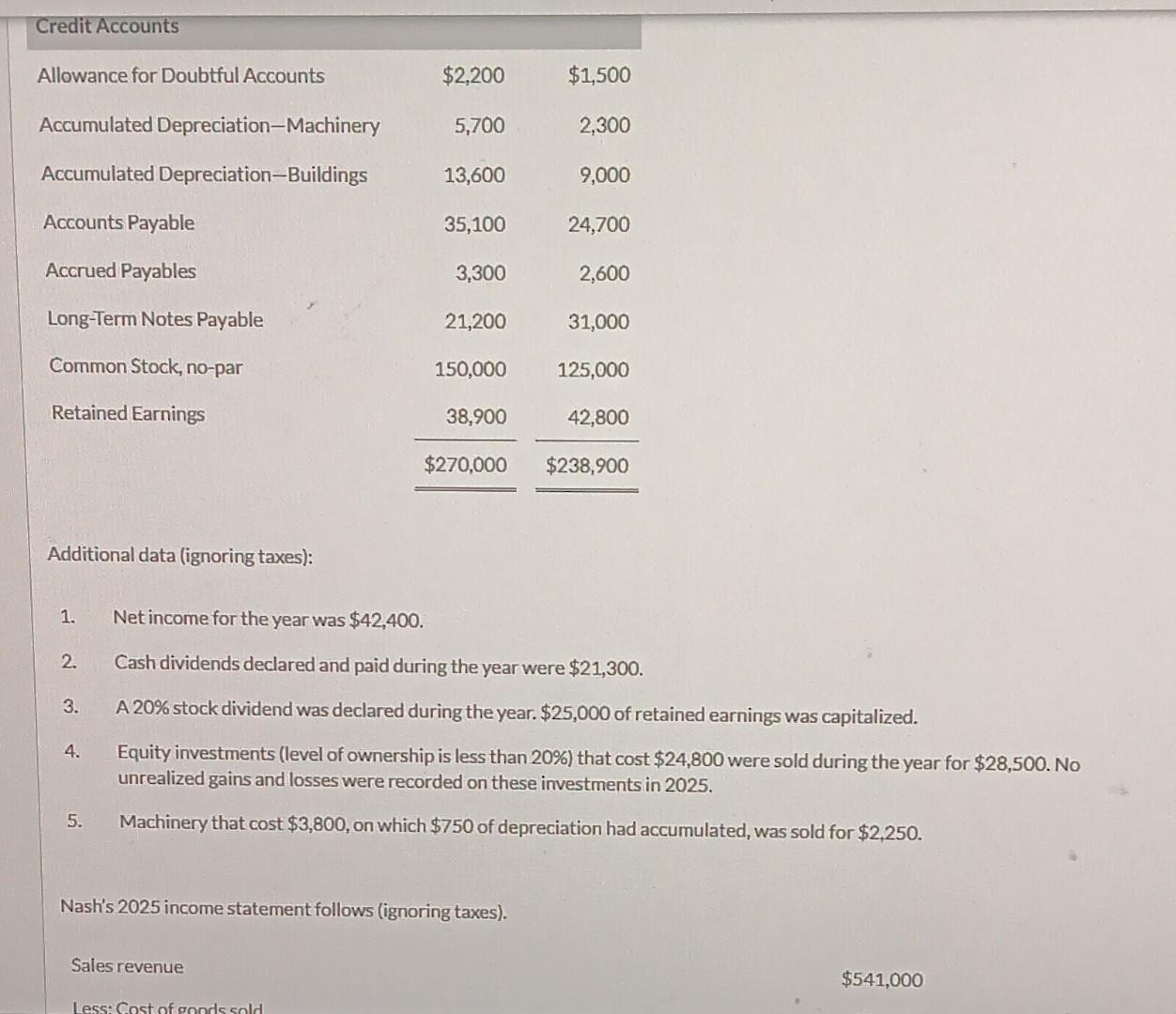

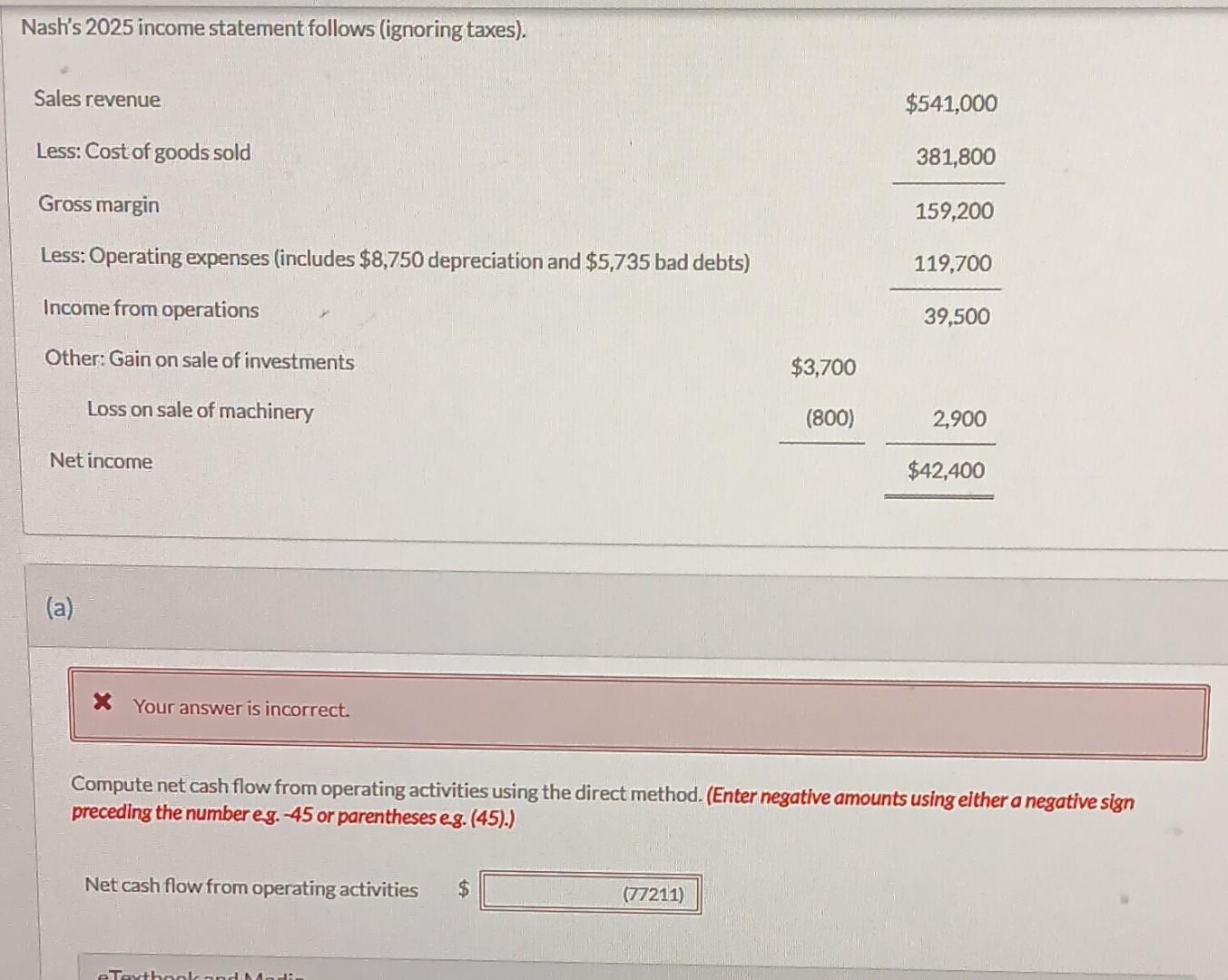

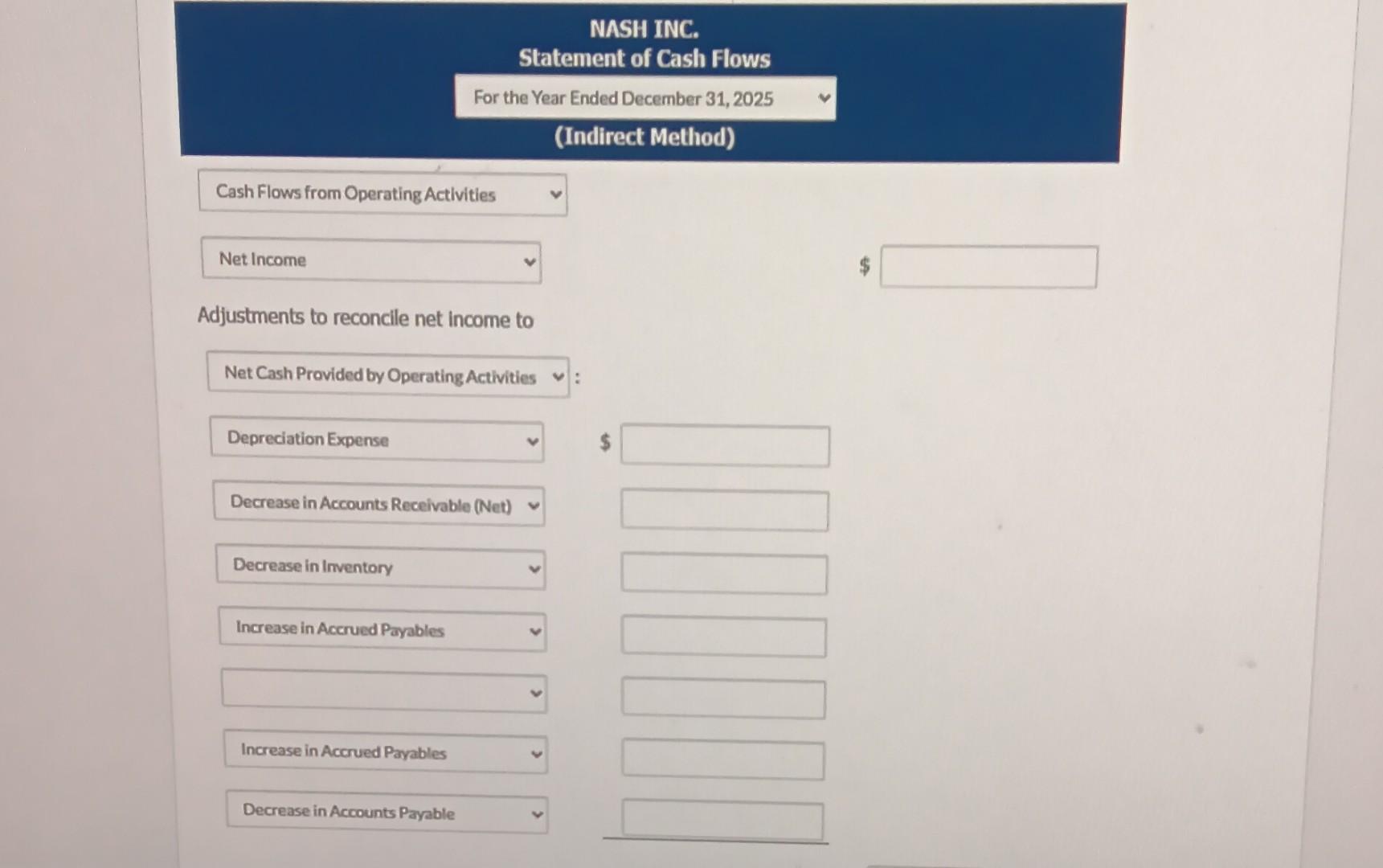

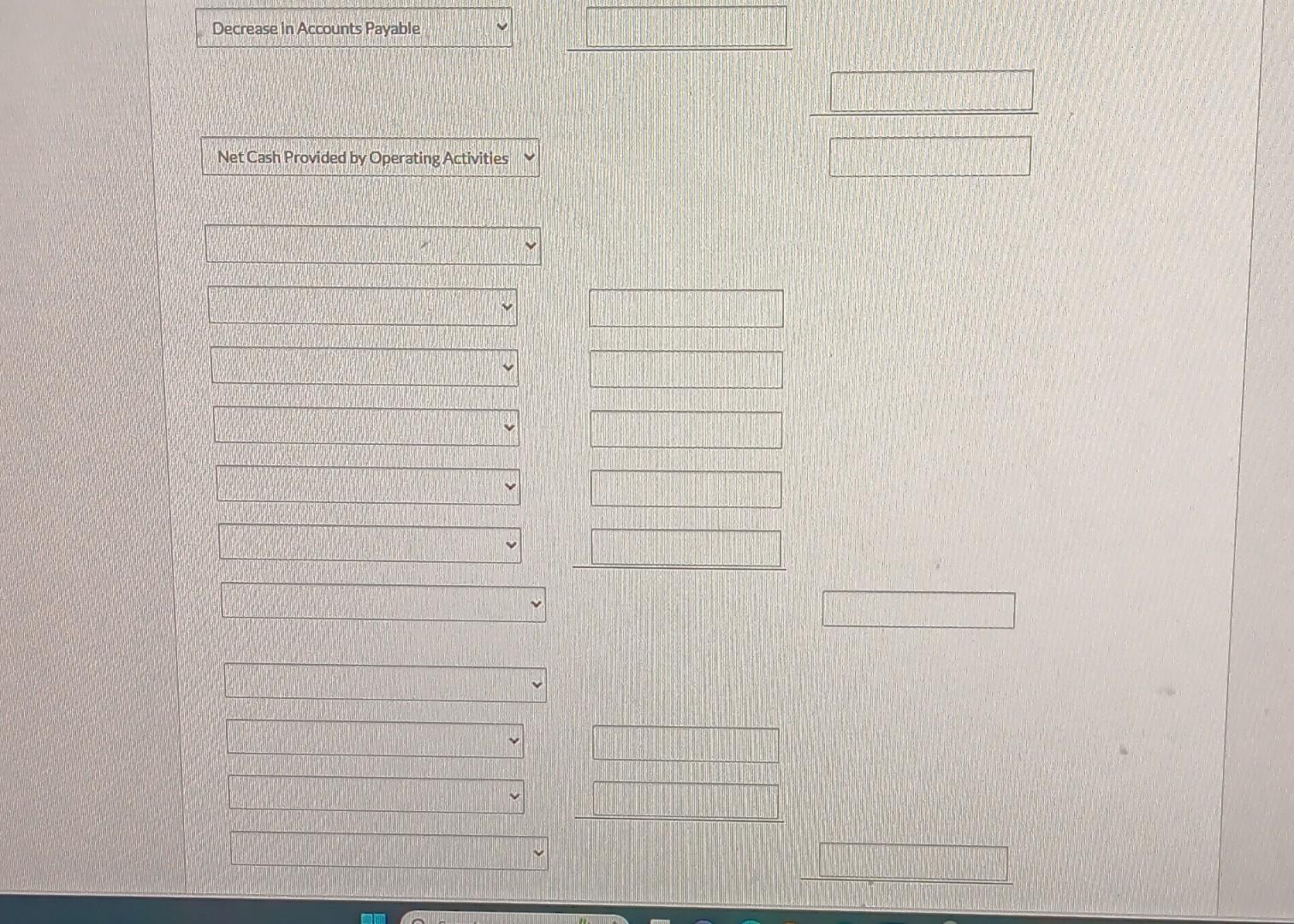

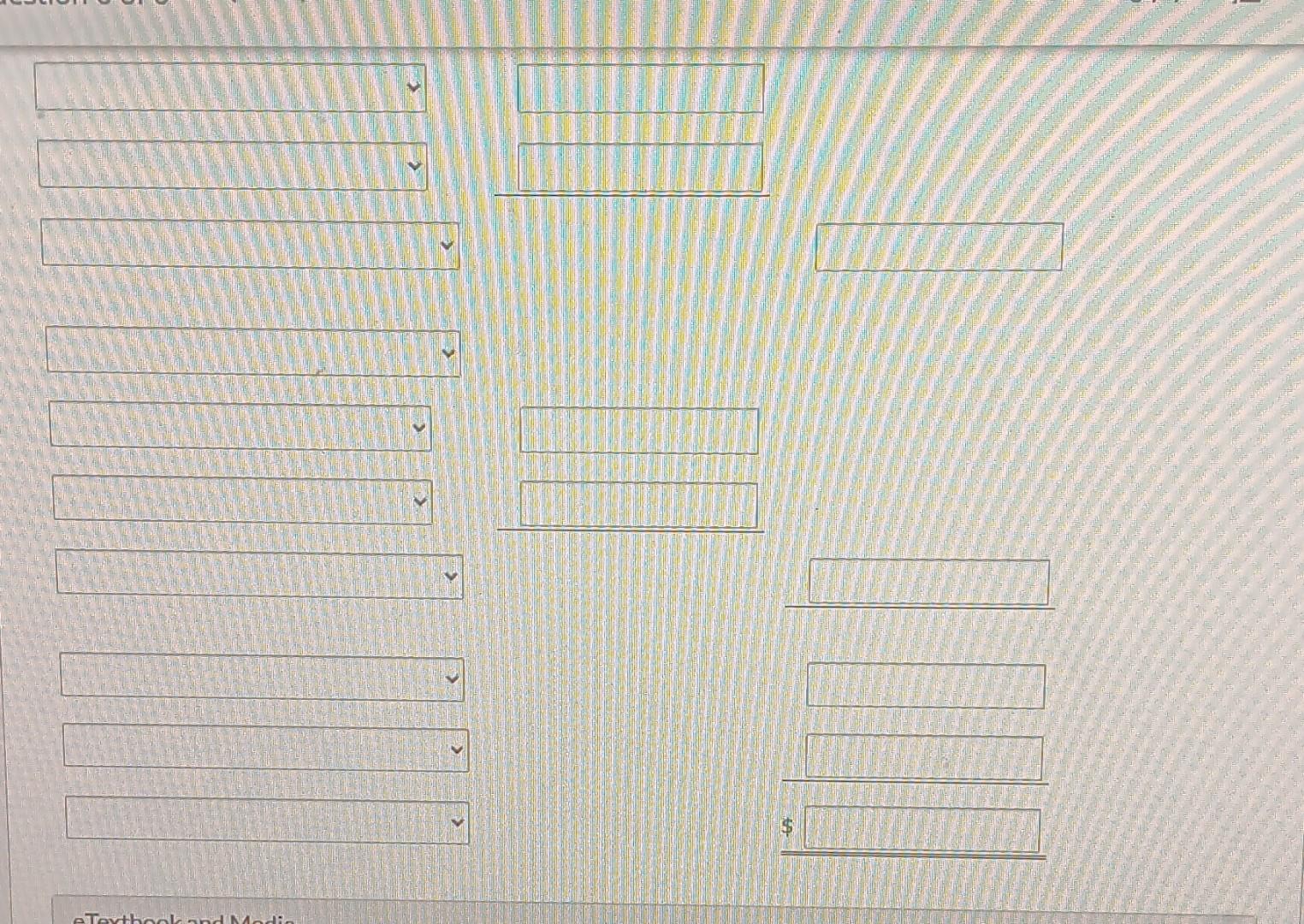

Decrease in Accounts Payable Net Cash Provided by Operating Activities Additional data (ignoring taxes): 1. Net income for the year was $42,400. 2. Cash dividends declared and paid during the year were $21,300. 3. A 20% stock dividend was declared during the year. $25,000 of retained earnings was capitalized. 4. Equity investments (level of ownership is less than 20% ) that cost $24,800 were sold during the year for $28,500. No unrealized gains and losses were recorded on these investments in 2025. 5. Machinery that cost $3,800, on which $750 of depreciation had accumulated, was sold for $2,250. Nash's 2025 income statement follows (ignoring taxes). Sales revenue $541,000 Comparative balance sheet accounts of Nash Inc. are presented below. Compute net cash flow from operating activities using the direct method. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e.g. (45).) Net cash flow from operating activities $ NASH INC. Statement of Cash Flows For the Year Ended December 31, 2025 (Indirect Method) Cash Flows from Operating Activities Net Income $ Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense $ Decrease in Accounts Receivable (Net) Decrease in Inventory Increase in Accrued Payables Increase in Accrued Payables Decrease in Accounts Payable Decrease in Accounts Payable Net Cash Provided by Operating Activities Additional data (ignoring taxes): 1. Net income for the year was $42,400. 2. Cash dividends declared and paid during the year were $21,300. 3. A 20% stock dividend was declared during the year. $25,000 of retained earnings was capitalized. 4. Equity investments (level of ownership is less than 20% ) that cost $24,800 were sold during the year for $28,500. No unrealized gains and losses were recorded on these investments in 2025. 5. Machinery that cost $3,800, on which $750 of depreciation had accumulated, was sold for $2,250. Nash's 2025 income statement follows (ignoring taxes). Sales revenue $541,000 Comparative balance sheet accounts of Nash Inc. are presented below. Compute net cash flow from operating activities using the direct method. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheses e.g. (45).) Net cash flow from operating activities $ NASH INC. Statement of Cash Flows For the Year Ended December 31, 2025 (Indirect Method) Cash Flows from Operating Activities Net Income $ Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense $ Decrease in Accounts Receivable (Net) Decrease in Inventory Increase in Accrued Payables Increase in Accrued Payables Decrease in Accounts Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts