Question: . Decrease sales volume. d. Increase the annual depreciation amounts of long-lived assets. O. ith (0):pect to asset utilization, which of the following is not

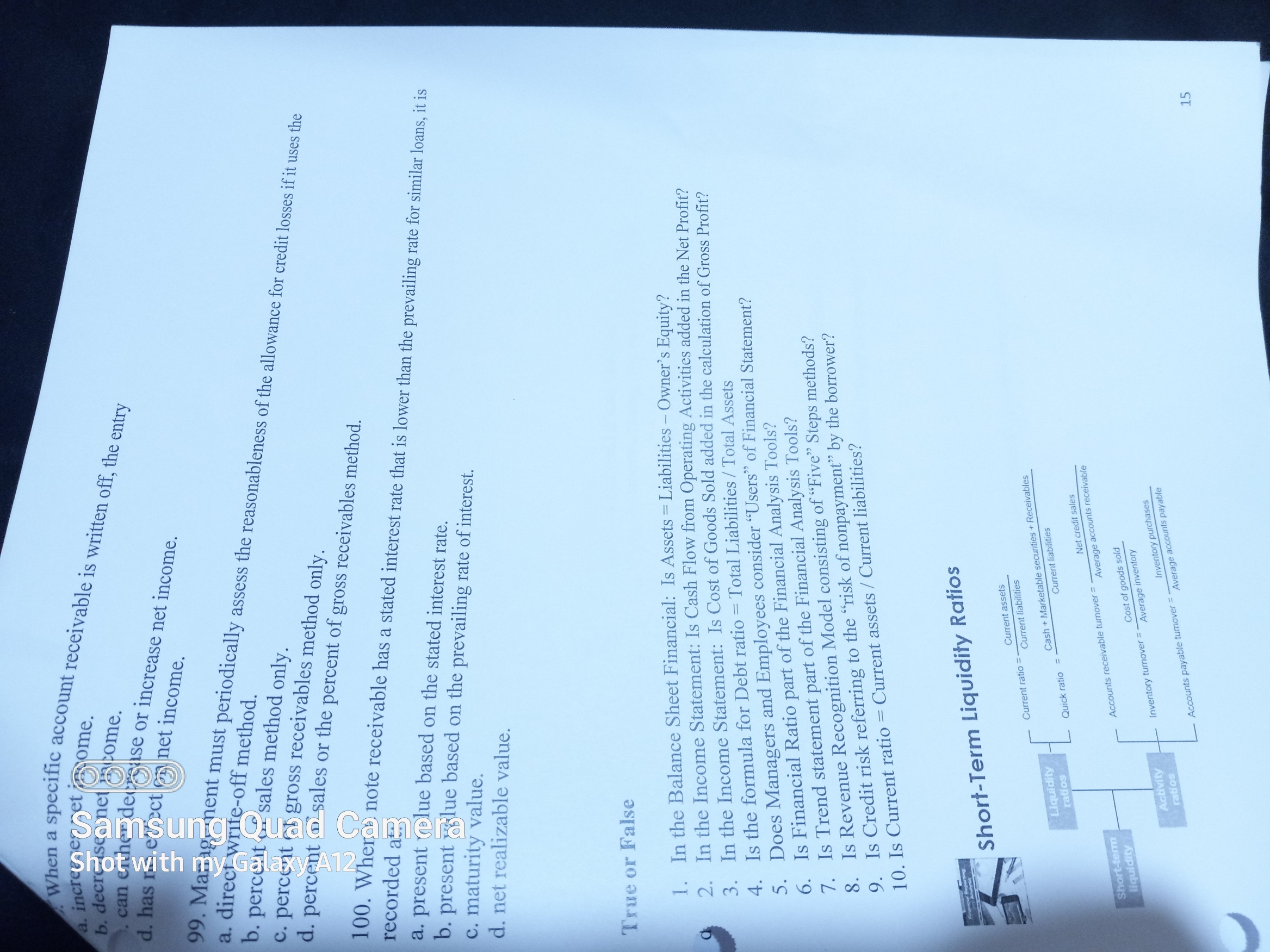

. Decrease sales volume. d. Increase the annual depreciation amounts of long-lived assets. O. ith (0):pect to asset utilization, which of the following is not correct? iurnoyer ratio. RQet turnover is only one part of the ROA caterte plant, and equipment is reflected in the long-term asset AIODes with inventory obsolescence will be evidenced in the current asset turnover ratio. 71. a. dent to equity ratio. b. irin rest coverage ratio. c. Ions -term debt to asset ratio. d. long-term debt to tangible assets ratio. 72. The fundamental valuation approach to business valuation uses basic accounting measures to assess the amount, timing and: a. certainty of a firm's past operating cash flows or earnings. b. certainty of a fimm's future non-operating cash flows or earnings. c. uncertainty of a frm's future operating cash flows or earnings. a.j. uncertainty of a fime's future nok-operating cash flows or earnings. 73. Cash flow assessment plays a central role in analyzing: a. the credit risk of a company. b. management's effectiveness. c. the future earnings potential of a company. d. the firm's investment potential. 74. Valuing an entire company, an operating division of that company or its ownership shares involves three basic steps. These steps include all of the following except: a. Forecasting future amounts of a value-relevant attribute. b. Determining the risk or uncertainty associated with the forecasted future amounts. b. Determining the discounted present value of the expected future amounts using an appropriate discount rate. c. Determining the discounted the company will pay in the future based on the company's dividend policy and expected future earnings. 75. To apply the discounted free cash flow model, the analyst needs to estimate: a. net cash flows from operations for each future period, starting one period from now. b. free cash flows for each future period, starting one period from now. c. free cash flows for approximately ten years as the pir ten years as the present value of cash flows occurring d. net cash flows from operations fo insignificant. 76. The FAAp stresses that the primary objective of financial reporting is to provide information useful, irresing int irores tor curmation about current cash flows. b-intormation uscis pay attention to managemeceipts and payments is the best indicator for this task. c. Uscis pay attentionto managements' estimates of free cash flows because this information improves their acili(io forecast future cash flows. cacu cash flows outperform current earnings in predicting future cash flows. 71. Bv using accruals and deferrals, accrual accounting: a. prifuces a cash flow number that reflects only cash earnings. b. profuces information about current cash receipts and payments. c. erioles management to estimate future free cash flows. d. prefuces an earnings number that depicts the effects of economic events on cash flows. 78. To obtain a better current price, the net present value of future growth opportunities (NPVGO) can be calculated and: a. added to the price per share calculated from the P/E ratio. b. subtracted from the price per share calculated from the P/E ratio. c. multiplied by the price per share calculated from the P/E ratio. d. divided into the price per share calculated from the P/E ratio. 79. The net present value of future growth opportunities (NPVGO) will contribute to an above average P/E multiple when the additional share value created is: a. positive and the return on new investment is lower than the cost of equity capital. b. positive and the return on new investment is greater than the cost of equity capital. c. negative and the return on new investment is lower than the cost of equity capital. d. negative and the return on new investment is greater than he cost of equity capita the future is a: 80. A component that is valuation-r a. permanent earnings component. b. transitory earnings component. 81. Income from continuing operations, excluding special or nonrecurring items, is generally regarded as: c. noise component. d. quiet component. a. permanent earnings. b. transitory earnings. c. value-irrelevant earnings. 82. Income or loss from discontinued operations is regarded as: d. abnormal earnings. a. permanent earnings. b. transitory earnings. c. value-irrelevant earnings. d. abnormal earnings. 1.80@anditures for rement. *Q Fai ings from repeat cusing. dalian from corporate customers. SQ) corporate restructuring. 8. A company with a return on equity that consistently exceeds the industry average ROCE will generally have share that sell at a: a. maret-to-book ratio cqual to the iner market-to-book ratio than the industry average. c. higner market-to-book ratio than the industry average. d. higner market price than its competitors. 86. When determining the fair value of an asset using an exit price approach, a. fair value is determined by how the company uses the asset. b. management may choose to reduce the fair value of the asset by the approximate amount of expected transaction costs (i.e., costs to dispose of the asset) if such costs are deemed to be material. c. transaction costs do not reduce the asset's fair value. d. transaction costs reduce the asset's fair value. 987. A bond that is considered unsecured is referred to as a: a. debenture. b. sinking fund bond. c. senior bond. d. callable bond. 88. Financial statement forecasts are: a. one of the required note disclosures found in each company's annual report. b. filed annually with the SEC by all public companies. c. frequently used in determining management compensation. d. essential ingredients of business valuation and credit risk analysis. 89. Common value-relevant attributes for determining the value of a company include all the following except: a. Fair value of fixed assets. rty to a business relationship can make decisions that benefit him or her but harm another ionship: tom d. a of interest arises. gent liability arises. 92. \( \stackrel{\text { }}{\multirow{2}{x}{y}y} \) aical rate formula for a public utility includes: a. ren operating costs, and taxes. b. orating costs, depreciation, and taxes. c. adVer oing, depreciation, and taxes. d. opera 1g costs, bad debt provisions, and depreciation. 93. Mar: loan agreements have financial covenants that rely on: a. floating GAAP. b. fixed GAAP. c. flexible GAAP. d. regulatory accounting procedures (RAP). 94. What purpose is served by including covenants that place strict limits on new borrowing, prohibit stock repurchases and dividends without prior lender approval, or ensure that cash generated both from ongoing operations and from asset sales will not be diverted away from servicing debt? a. Signal b. Protection against credit-damaging events c. Preservation of repayment capital d. Trigger 95. Covenants that place direct restrictions on managerial decisions are called: a. affirmative restrictions. b. affirmative covenanti. 96. Firms must provide detailed disclosure of three broad executive pay categories. Which of the following is c. negative restrictions d. negative covenants. a. Retirement and other postemployment compensation not one of these categories? pen for the last fiscal year and the two preceding years b. Costs incurred by the corporation for executive tratel, a. annual report. c. proxy statement. d. form 10Q. When a specific account receivable is written off, the entry d. has ris. efrect (3) net income. 99. Ma=igenent must periodically assess the reasonableness of the allowance for credit losses if it uses the a. directwrite-off method. b. percent pingales method only. c. percent (ab gross receivables method only. dercent iosales or the percent of gross receivables method. recorded a a. present GiOlue based on the stated interest rate. b. present c. maturity value. d. net realizable value. True or False 1. In the Balance Sheet Financial: Is Assets = Liabilities - Owner's Equity? 2. In the Income Statement: Is Cash Flow from Operating Activities added in the Net Profit? 3. In the Income Statement: Is Cost of Goods Sold added in the calculation of Gross Profit? 4. Is the formula for Debt ratio = Total Liabilities / Total Assets 5. Does Managers and Employees consider "Users" of Financial Statement? 6. Is Financial Ratio part of the Financial Analysis Tools? 7. Is Trend statement part of the Financial Analysis Tools? 8. Is Revenue Recognition Model consisting of "Five" Steps methods? 9. Is Credit risk referring to the "risk of nonpayment" by the borrower? 10. Is Current ratio = Current assets / Current liabilities? Short-Term Liquidity Ratios . Decrease sales volume. d. Increase the annual depreciation amounts of long-lived assets. O. ith (0):pect to asset utilization, which of the following is not correct? iurnoyer ratio. RQet turnover is only one part of the ROA caterte plant, and equipment is reflected in the long-term asset AIODes with inventory obsolescence will be evidenced in the current asset turnover ratio. 71. a. dent to equity ratio. b. irin rest coverage ratio. c. Ions -term debt to asset ratio. d. long-term debt to tangible assets ratio. 72. The fundamental valuation approach to business valuation uses basic accounting measures to assess the amount, timing and: a. certainty of a firm's past operating cash flows or earnings. b. certainty of a fimm's future non-operating cash flows or earnings. c. uncertainty of a frm's future operating cash flows or earnings. a.j. uncertainty of a fime's future nok-operating cash flows or earnings. 73. Cash flow assessment plays a central role in analyzing: a. the credit risk of a company. b. management's effectiveness. c. the future earnings potential of a company. d. the firm's investment potential. 74. Valuing an entire company, an operating division of that company or its ownership shares involves three basic steps. These steps include all of the following except: a. Forecasting future amounts of a value-relevant attribute. b. Determining the risk or uncertainty associated with the forecasted future amounts. b. Determining the discounted present value of the expected future amounts using an appropriate discount rate. c. Determining the discounted the company will pay in the future based on the company's dividend policy and expected future earnings. 75. To apply the discounted free cash flow model, the analyst needs to estimate: a. net cash flows from operations for each future period, starting one period from now. b. free cash flows for each future period, starting one period from now. c. free cash flows for approximately ten years as the pir ten years as the present value of cash flows occurring d. net cash flows from operations fo insignificant. 76. The FAAp stresses that the primary objective of financial reporting is to provide information useful, irresing int irores tor curmation about current cash flows. b-intormation uscis pay attention to managemeceipts and payments is the best indicator for this task. c. Uscis pay attentionto managements' estimates of free cash flows because this information improves their acili(io forecast future cash flows. cacu cash flows outperform current earnings in predicting future cash flows. 71. Bv using accruals and deferrals, accrual accounting: a. prifuces a cash flow number that reflects only cash earnings. b. profuces information about current cash receipts and payments. c. erioles management to estimate future free cash flows. d. prefuces an earnings number that depicts the effects of economic events on cash flows. 78. To obtain a better current price, the net present value of future growth opportunities (NPVGO) can be calculated and: a. added to the price per share calculated from the P/E ratio. b. subtracted from the price per share calculated from the P/E ratio. c. multiplied by the price per share calculated from the P/E ratio. d. divided into the price per share calculated from the P/E ratio. 79. The net present value of future growth opportunities (NPVGO) will contribute to an above average P/E multiple when the additional share value created is: a. positive and the return on new investment is lower than the cost of equity capital. b. positive and the return on new investment is greater than the cost of equity capital. c. negative and the return on new investment is lower than the cost of equity capital. d. negative and the return on new investment is greater than he cost of equity capita the future is a: 80. A component that is valuation-r a. permanent earnings component. b. transitory earnings component. 81. Income from continuing operations, excluding special or nonrecurring items, is generally regarded as: c. noise component. d. quiet component. a. permanent earnings. b. transitory earnings. c. value-irrelevant earnings. 82. Income or loss from discontinued operations is regarded as: d. abnormal earnings. a. permanent earnings. b. transitory earnings. c. value-irrelevant earnings. d. abnormal earnings. 1.80@anditures for rement. *Q Fai ings from repeat cusing. dalian from corporate customers. SQ) corporate restructuring. 8. A company with a return on equity that consistently exceeds the industry average ROCE will generally have share that sell at a: a. maret-to-book ratio cqual to the iner market-to-book ratio than the industry average. c. higner market-to-book ratio than the industry average. d. higner market price than its competitors. 86. When determining the fair value of an asset using an exit price approach, a. fair value is determined by how the company uses the asset. b. management may choose to reduce the fair value of the asset by the approximate amount of expected transaction costs (i.e., costs to dispose of the asset) if such costs are deemed to be material. c. transaction costs do not reduce the asset's fair value. d. transaction costs reduce the asset's fair value. 987. A bond that is considered unsecured is referred to as a: a. debenture. b. sinking fund bond. c. senior bond. d. callable bond. 88. Financial statement forecasts are: a. one of the required note disclosures found in each company's annual report. b. filed annually with the SEC by all public companies. c. frequently used in determining management compensation. d. essential ingredients of business valuation and credit risk analysis. 89. Common value-relevant attributes for determining the value of a company include all the following except: a. Fair value of fixed assets. rty to a business relationship can make decisions that benefit him or her but harm another ionship: tom d. a of interest arises. gent liability arises. 92. \( \stackrel{\text { }}{\multirow{2}{x}{y}y} \) aical rate formula for a public utility includes: a. ren operating costs, and taxes. b. orating costs, depreciation, and taxes. c. adVer oing, depreciation, and taxes. d. opera 1g costs, bad debt provisions, and depreciation. 93. Mar: loan agreements have financial covenants that rely on: a. floating GAAP. b. fixed GAAP. c. flexible GAAP. d. regulatory accounting procedures (RAP). 94. What purpose is served by including covenants that place strict limits on new borrowing, prohibit stock repurchases and dividends without prior lender approval, or ensure that cash generated both from ongoing operations and from asset sales will not be diverted away from servicing debt? a. Signal b. Protection against credit-damaging events c. Preservation of repayment capital d. Trigger 95. Covenants that place direct restrictions on managerial decisions are called: a. affirmative restrictions. b. affirmative covenanti. 96. Firms must provide detailed disclosure of three broad executive pay categories. Which of the following is c. negative restrictions d. negative covenants. a. Retirement and other postemployment compensation not one of these categories? pen for the last fiscal year and the two preceding years b. Costs incurred by the corporation for executive tratel, a. annual report. c. proxy statement. d. form 10Q. When a specific account receivable is written off, the entry d. has ris. efrect (3) net income. 99. Ma=igenent must periodically assess the reasonableness of the allowance for credit losses if it uses the a. directwrite-off method. b. percent pingales method only. c. percent (ab gross receivables method only. dercent iosales or the percent of gross receivables method. recorded a a. present GiOlue based on the stated interest rate. b. present c. maturity value. d. net realizable value. True or False 1. In the Balance Sheet Financial: Is Assets = Liabilities - Owner's Equity? 2. In the Income Statement: Is Cash Flow from Operating Activities added in the Net Profit? 3. In the Income Statement: Is Cost of Goods Sold added in the calculation of Gross Profit? 4. Is the formula for Debt ratio = Total Liabilities / Total Assets 5. Does Managers and Employees consider "Users" of Financial Statement? 6. Is Financial Ratio part of the Financial Analysis Tools? 7. Is Trend statement part of the Financial Analysis Tools? 8. Is Revenue Recognition Model consisting of "Five" Steps methods? 9. Is Credit risk referring to the "risk of nonpayment" by the borrower? 10. Is Current ratio = Current assets / Current liabilities? Short-Term Liquidity Ratios

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts