Question: ded Homework - Chapter 9 eBook Show Me How 08.02. ALGO 2.09.OSA BLANKSHEETA... 08.06A BLANKSHEETA.... Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on

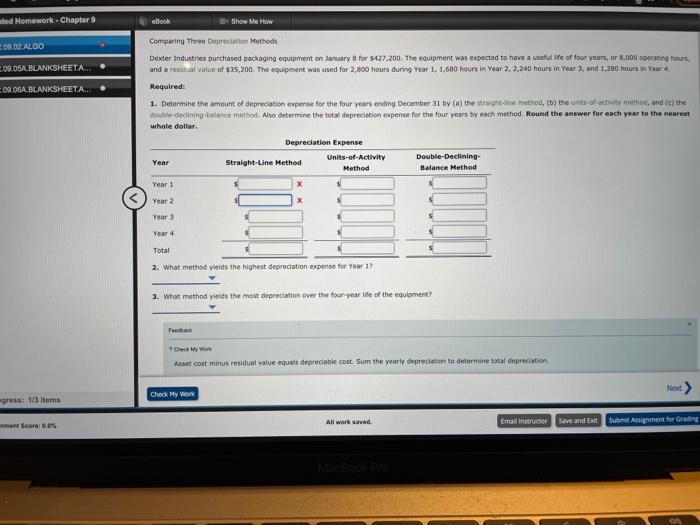

ded Homework - Chapter 9 eBook Show Me How 08.02. ALGO 2.09.OSA BLANKSHEETA... 08.06A BLANKSHEETA.... Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 3 for $427.200. The equipment was expected to have a useful life of four years, or B,000 operating hours, and a residual value of 535,200. The equipment was used for 2,800 hours during Year 1. 1.680 hours in Year 2, 2,240 hours in Year 3 and 1.280 hours in Year Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the themethod, (b) the sts-of-activity method, and the Godeining balance method. Also determine the total depreciation expense for the four years by each method, Round the answer for each year to the nearest whole dollar Depreciation Expense Year Straight-Line Method Units-of-Activity Double-Declining Method Balance Method Year 1 Year 2 Year 3 Year 4 Total 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the four year ide of the equipment? Feedback Asset cost minus residual value equais depreciable cost Sum the yearly depreciation to determine total depreciation Check My Work egress: 1/3 items All work surved Email Instructor Save and Exit mant Score 0.0% Submit Assement for Gradis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts