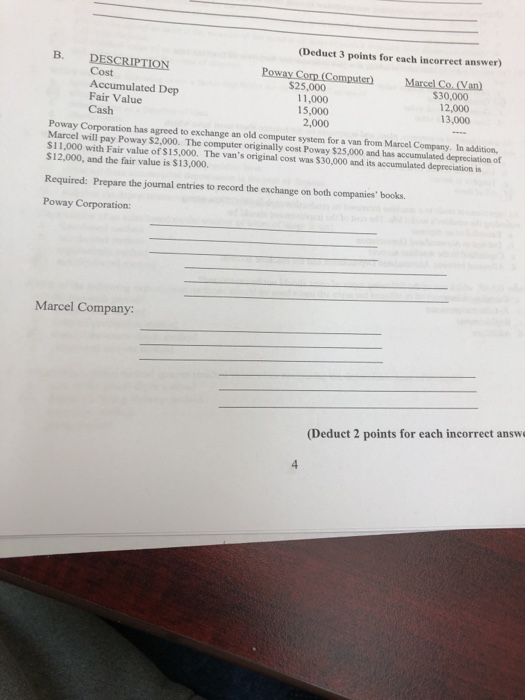

Question: (Deduct 3 points for each incorrect answer) Poway Corp (Computer) Marcel Co.(Van) Cost Accumulated Dep Fair Value Cash $25,000 11,000 15,000 2,000 $30,000 12,000 13,000

(Deduct 3 points for each incorrect answer) Poway Corp (Computer) Marcel Co.(Van) Cost Accumulated Dep Fair Value Cash $25,000 11,000 15,000 2,000 $30,000 12,000 13,000 Corporation has agreed to exchange an old computer system for a van from Marcel Company. In addition, $11,000 with Fair value of $15,000. The van's original cost was $30,000 and its accumulated depreciation is S12,000, and the fair value is $13,000 Required: Prepare the journal entries to record the exchange on both companies' books. Poway Corporation: Marcel Company: Deduct 2 points for each incorrect answe 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts