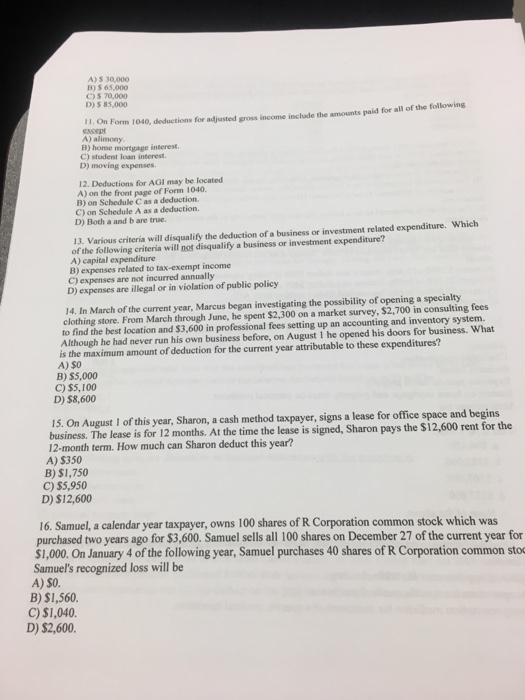

Question: Deductions for AGI may he located on the front page of Form1040. on Schedule C as a deduction on Schedule A as a deduction. Both

Deductions for AGI may he located on the front page of Form1040. on Schedule C as a deduction on Schedule A as a deduction. Both a and b are True. Various criteria will disqualify (he deduction of a business or investment related expenditure. Which of the following criteria will net disqualify a business or investment expenditure? capital expenditure expenses related to tax-exempt income expenses are not incurred annually expenses are illegal or in violation of public policy In March of the current year. Marcus began investigating the possibility of opening a specialty clothing store. From March through June, he spent $2, 300 on a market survey. $2, 700 in consulting fees to find the best location and $3, 600 in professional fees setting up an accounting and inventory system. Although he had never run his own business before, on August 1 he opened his doors for business. What is the maximum amount of deduction for the current year attributable to these expenditures? $0 $5, 00 $5, 100 $8, 600 On August 1of this year. Sharon, a cash method taxpayer, signs a lease for office space and begins business. The lease is for 12 months. At the time the lease is signed. Sharon pays the $12, 600 rent for the 12-month term. How much can Sharon deduct this year? $350 $1, 750 $5, 950 $12, 600 Samuel, a calendar y ear taxpayer, owns 100 shares of R Corporation common stock which was purchased two years ago for S3.600. Samuel sells all 100 shares on December 27 of the current year for $1, 000 On January 4 of the following year. Samuel purchases 40 shares of R Corporation common slot Samuels recognized loss will be $0. $1, 560. $1, 040. $2, 600

Step by Step Solution

There are 3 Steps involved in it

Lets address each question one by one Question 12 Which of the following deductions for AGI may be located on the front page of Form 1040 A Schedule C ... View full answer

Get step-by-step solutions from verified subject matter experts