Question: Dee creates an irrevocable trust with three million dollars ($3,000,000 in stock). Under the trust terms, Mary (age 40) receives a life estate and her

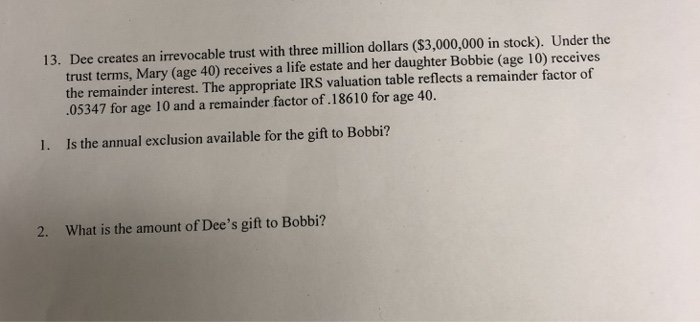

Dee creates an irrevocable trust with three million dollars ($3,000,000 in stock). Under the trust terms, Mary (age 40) receives a life estate and her daughter Bobbie (age 10) receives the remainder interest. The appropriate IRS valuation table reflects a remainder factor of .05347 for age 10 and a remainder factor of.18610 for age 40. 13. 1. Is the annual exclusion available for the gift to Bobbi? 2. What is the amount of Dee's gift to Bobbi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts