Question: ( Dee Date April 9 , 2 0 2 5 ) A proposed new investmest has projected sales of $ 1 , 8 3 0

Dee Date April

A proposed new investmest has projected sales of $ Veriable costs are of sales, and fixed conts are $; depeeciation is $ Prepare a pro forma income statement aswming a tex rate of What is de operating cash flow? Please use both the most coemmon approach and the tax alirld approach to compute it

Dog Up Franks is looking at a new asaape syotes with an installed cost of This cost will be deprecisted straightline to rere over the project's fiveyear life, at the end of which the sausage syutem can be sold for $ in the market. The suasage system will ave the firm $ per year in pretar operating costs, and the system requires an initial investment in net working copital of If the tax rate is and the required rate of retum of the project is what is the NPV of this project?

Five Stars Inc, is considering a new fouryear expasion project that requires an initial fixed asset investment of million. The fixed asset will be depreciated straightline so zero over is fouryear tax life. However, the fird asset mill have a market value of $ at the end of the project. The project is evtimated to sell the new product for units a year and the price per unit is $ The variable cost is $ per unit and the fixed cost is $ a year. Suppose the project requires an initial investenest in oet working capital of $ and the net werking capien! will be fllty recovered at the end of the project. If the tax rate is and the required rate of return oe the project is k what is the project's NPV

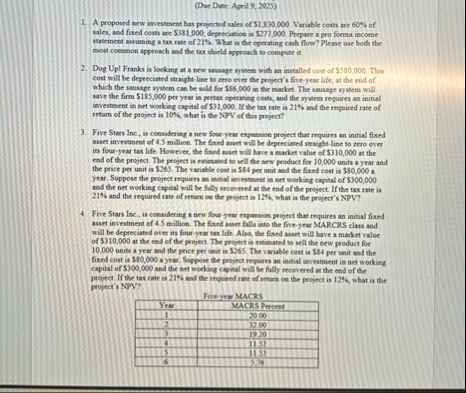

Five Stars Inc, is coesidering a new fouryear eqpansion peoject that requires an initial fixed asset investment of million. The fivd asset falls ieto the fiveyear MARCRS clas and will be deprecined ever its fouryear tra life. Aho, the fived awet will lave a market value of $ at the end of the project. The project is eitiesated to sell the new product for units a year and the price per unit is The variable cost is $ per unit and the fixed cost is $$ a year. Suppose the peopect reyeres an initial ievestment in net working capital of and the eet woeking cepinal will he folly recovered at the end of the propet. If the tas rate is and the required rite of ntturn on the project is what is the project's NPV

Fiveyem MACRS

tableYearMACRS Percent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock